With a website claiming more than 200 employees and an office in a business complex in the middle of Singapore, Ask Trading — “a trading and investment company focusing on the Russia/CIS market” — might appear to be a thriving midsize business.

But actually it’s a mirage. Under even the slightest scrutiny, it starts to disappear.

That office, BuzzFeed News discovered during a visit, is just a few sparsely populated cubicles. The company’s current website is only one page, and photographs on it were lifted from published materials about other firms. And public records show Ask was not doing what it claimed to do.

Yet between 2001 and 2016, it managed to move at least $671 million in transactions through Deutsche Bank, JPMorgan Chase, and Bank of New York Mellon, from sources no one at those banks ascertained, for purposes it never revealed.

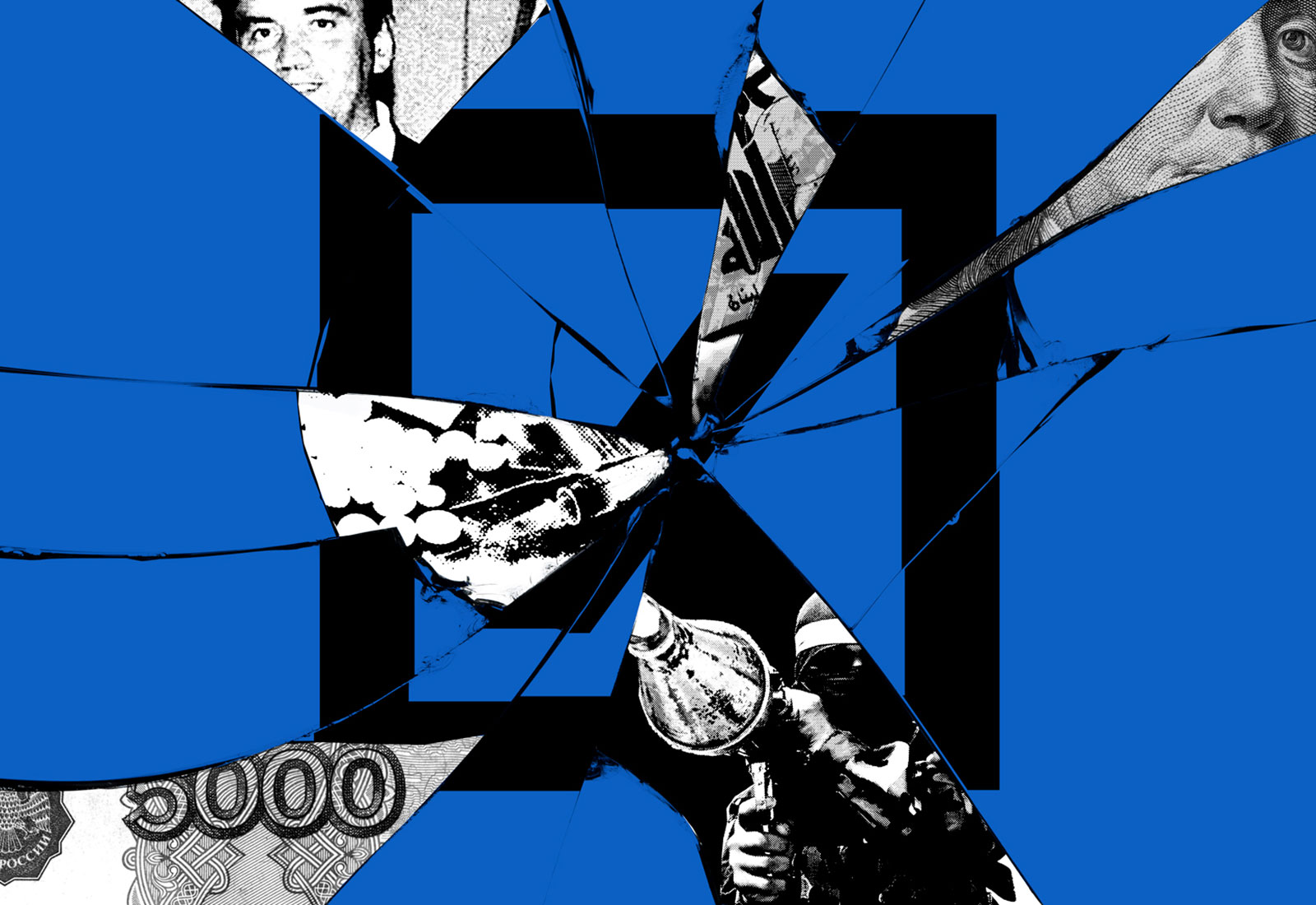

Shell companies like Ask Trading keep a low profile, but they play an outsize role in the dark economy, the trillions of dollars of dirty money that course through Western banks in full view of government regulators.

As documented in the FinCEN Files, thousands of secret government documents that BuzzFeed News shared with the International Consortium of Investigative Journalists and more than 100 news organizations around the globe, these so-called shell companies can be a conduit for terrorist networks, narcotraffickers, and crime syndicates to launder the proceeds of their illegal activity. The money goes into an account at a prestigious international bank, and when it emerges, cleansed of any taint, just a few more clicks can move it from one country to another to fund more mayhem and misery.

By law, banks are supposed to be on the lookout for transactions that bear hallmarks of money laundering or other financial misconduct, then report their concerns to the Treasury Department's Financial Crimes Enforcement Network, or FinCEN. Such reports can support investigations and intelligence gathering — but by themselves they are not evidence of a crime. Banks have broad discretion to end their relationship with the customers whose accounts they find suspicious. But in the FinCEN Files they rarely do.

Dozens of banks around the globe opened their doors to Ask and the network of companies connected to it. Bankers documented their concerns, but still went on to process nearly a billion dollars’ worth of their transactions.

And not just any transactions. According to government documents, Ask used the banks to send $4 million to a United Arab Emirates–based company for what it said were construction materials. The US government later said the company was part of an organization financing drug cartels and terrorist organizations such as the Taliban. Ask received $17 million from a money laundering ring manipulating international stock trades.

The story of how a venture as elusive as Ask could gain access to some of the world’s most powerful financial institutions is the story of how the entire elaborate system of safeguards fails, over and over again.

It’s the story of banks that don’t ask too many questions about the money flowing through their accounts. And of a government oversight structure that lets banks profit off even the most suspicious transaction as long as they file the proper paperwork.

It’s also a detective story.

BuzzFeed News decided to see if we could do what was apparently too great a challenge for huge international banks: figure out what the Ask network is and who’s behind it. That could have been all the information needed to stop these suspicious transactions, if anyone were so inclined.

Quite a Lot of Lamps

Banks are supposed to make sure they know their customers. The requirements are a lot lower when a customer, like Ask, comes through what's known as a correspondent bank — a smaller, local bank that partners with a big institution in order to gain global reach.

The big institution may rely on outdated or shoddy information. That’s how Deutsche Bank came to believe that Ask Trading’s networks were run by a man named Yeo Tiam Chye, records show.

Anyone who checked the public database in which all Singapore’s corporations must register could have seen that in June 2014, the director of the company was changed to a man named Heng Boon Liang.

A little digging shows that Heng, who goes by Daniel, lives in Yishun — a residential area in the northeast of Singapore — and on LinkedIn says he works for a shipping logistics company. On his Facebook page, he has shared photos of his time spent golfing and umpiring softball games.

The internet has few traces of anyone else working at Ask Trading. The only person clearly associated with the company online is its original founder, a Russian-born entrepreneur named Maxim Glazov. On social media, he and Heng have shared photos of their activities together throughout the years, such as attending a mixed martial arts competition in 2016.

Glazov has tried to hype Ask Trading’s success to promote other ventures. On F6S, a website for startup founders, there’s a section titled Amazing Things Maxim’s Made: “A group of companies in logistics and trade finance in Singapore with $800M combined yearly turnover.”

It’s unclear exactly how bank officers conducted their due diligence. But if they had checked the various addresses they had on file for Ask, they would have found locations unlikely to be headquarters for a company moving hundreds of millions of dollars’ worth of goods around the globe. One address was Glazov’s apartment. Two others were offices registered to Yeo, who goes by Henry, and who turns out to be the person who filed the government paperwork for the companies.

Without digging even this deep, banks still were aware that something seemed fishy about Ask. Suspicious activity reports, or SARs, filed by BNY Mellon, flagged hundreds of millions of dollars in transactions — in particular, 50 payments totaling $27 million, from a Russian company called LLC Inter-Trade.

Every one of those 50 payments referenced a single invoice for fluorescent lamps and included improbably neat round-dollar amounts — amounts that would almost never show up in actual invoices for products that are valued down to the last penny. In addition, a SAR noted that the payments were “frequently sent on consecutive days or only a few days apart,” rather than on regularly scheduled billing intervals, or the kind of time frame in which a company might plausibly need to reorder huge numbers of lights.

One SAR also noted that “$27.1 million over a 3 month time span seems like an excessive amount to pay for fluorescent lamps.”

Further research led the analyst at BNY Mellon to remark that “Ask Trading is also [a] shell entity” — a company set up with no assets to speak of and no transparency about the business it is conducting — “whose website was created only to make it appear legitimate.”

In response to questions, the bank sent BuzzFeed News a statement that said, “As a trusted member of the international banking community, we fully comply with all applicable laws and regulations, and assist authorities in the important work they do. By law, we cannot comment on any alleged SAR.”

Analysts at other banks, including JPMorgan and Deutsche Bank, also flagged Ask’s transactions. An April 2017 SAR from JPMorgan said the bank filed at least 13 prior reports that included Ask between 2013 and 2015. Any of the three banks could have cut the company off and refused to conduct its business any longer. But as with so many other cases documented in the FinCEN Files, the banks kept accommodating their suspicious customer, and profiting off its transactions.

JPMorgan and Deutsche told BuzzFeed News that the banks have invested heavily in efforts to thwart money laundering. The Deutsche spokesperson said the bank could not comment on SAR-related information, but that it had “learnt from past mistakes.’’

About those fluorescent fixtures: The Center for Advanced Defense Studies, a nonprofit foundation that tracks transnational security issues, keeps a database of all public Russian customs data. In the time period that Ask told the bank it was shipping all those lamps, C4ADS has no records of Ask making any shipments, let alone $27.1 million worth. (They do appear to have made other shipments before and after, but nothing at that scale.)

So if it wasn’t shipping fluorescent lighting fixtures, what was Ask being paid all that money for? And what were they doing with it?

BuzzFeed News contacted Glazov, Ask’s founder. First reached by email in October 2019, he said it had been a while since he was involved in any of the Ask network companies, but that he would try his best to answer any questions sent to him in writing. A number of detailed questions were sent. Glazov never wrote back.

It was time to go to Singapore to ask him in person.

A Knock on the Door

Far from the glittering towers of Singapore’s downtown core, Ask Trading’s headquarters are located in a 30-story high-rise of stark white concrete. Offices are arranged in a ring facing in toward the open space at the center of the building. Ask Trading is registered to office #03-76.

None of the names next to the solid metal door belong to companies in the Ask network. Inside, there is just a receptionist desk, a tiny conference room, and a few cubicles. It is not the home of a busy global import-export conglomerate, but instead the offices of Yeo Tiam Chye — the man the banks once believed was Ask’s owner.

Yeo is not the owner of Ask. He is an accountant who helps companies file the registrations, annual reports, and other paperwork required by Singapore’s business regulations. That’s why his address is listed as the home to Ask Trading — and to more than 30 other companies. Yeo was fined nearly $60,000 by the Singapore government in June 2019 for helping a different client avoid paying taxes.

“Due to pressing family matters, I decided to plead guilty to the charges so that I can move on with my life,” Yeo said in a written response to BuzzFeed News. He said that he “did no wrong.”

Yeo initially declined to comment for this article, so the next stop was Heng, the current owner of Ask Trading. Answering the door at his sixth-floor apartment, his daughter took a business card and letter, but said her father was unavailable. He did not respond to multiple further inquiries.

US authorities were no more helpful.

A 2016 report from BNY Mellon had noted that the bank fielded “government inquiries” seeking information on Ask. Lots of government entities can make inquiries, but this seemed likely to involve one of the handful of agencies that investigate financial crimes.

The Office of Foreign Asset Control said it could neither confirm nor deny the existence of records. The Department of Justice said talk to the FBI. Finally, the FBI said it wouldn’t turn over any documents because doing so “would be expected to interfere with a pending or prospective law enforcement proceeding.”

That was interesting.

Ask Trading also turns up in the case of an epic Russian money laundering scheme, known as the mirror trades, conducted through Deutsche Bank accounts. During the bank’s internal investigation, in 2016, officials found that Ask had received $17 million as part of those trades.

Separately, a search of court records uncovered an FBI agent’s August 2016 affidavit — from a case about the illegal exportation of night vision goggles — that named two companies related to Ask as potential money launderers.

Robert Mazur, who spent 27 years investigating financial crimes with three different federal agencies, agreed to look through BuzzFeed News’ files about Ask and see what he could make of them.

Mazur’s career has been colorful enough that it led to a book and a movie. For the feds, he worked undercover as a money launderer. He knows how money launderers operate, and he knows how to read a SAR and glean insights.

His analysis wouldn’t be definitive, but it would — at long last — put enough of the puzzle pieces together for a picture to emerge.

Reviewing more than 200 pages of the suspicious activity reports from the FinCEN Files, he said that, in his opinion, the flags waved vivid red from almost every one of those pages.

“The transactions had no apparent economic, business or lawful purpose,” the report he compiled for BuzzFeed News noted.

“In nearly every instance, the reported transactions involved shell companies from many corners of the tax haven world.”

He continued, “The addresses of the company that maintained the account used the same address as hundreds of other shell-like companies.”

And on and on he went, 13 bullet points in all, leading to what he said was one clear conclusion: Ask’s transactions had all the hallmarks of a classic money laundering operation.

“In my opinion, the U.S. dollar transactions reported in the 14 SARs appear to have been conducted for the purpose of moving funds connected to illicit activity from Russia, or on behalf of Russian or Ukrainian residents, to places outside of Russia,” Mazur wrote in his report to BuzzFeed News.

Mazur’s conclusions called to mind the Russian national who was Ask Trading’s original founder, Maxim Glazov. The guy who wanted a list of questions and then didn’t respond.

A balding entrepreneur, Glazov lives in a third-floor walk-up apartment — the address that banks had listed as one of Ask’s corporate offices — at the end of a quiet street in an affluent Singapore neighborhood.

While in Singapore, BuzzFeed News visited his doorstep three times before he finally opened the door.

Standing a bit under 6 feet tall, with a toned build and a red shirt, Glazov declined to answer any questions about Ask Trading’s business, about the FBI investigation, about how a company can get three powerful banks to conduct its financial transactions when they had been repeatedly flagged as suspicious, about why Ask wired millions of dollars to accused terror financiers.

He said, simply and definitively, “I don’t want to talk.”

He confirmed he had received our questions and politely closed the door.

Months later, Glazov responded by email to some of the questions asked by BuzzFeed News about Ask Trading’s activity.

“I have not been involved in ASK for a few years, and do not have records of the so-called transactions that you describe in your email,” Glazov wrote. “Regardless, when I was involved with ASK, none of its transactions involved any criminal wrongdoing to the best of my knowledge.”

Glazov said that it was not uncommon in Singapore for businesses to be registered at personal addresses for the sake of correspondence. Despite internet records saying that he registered the website that claimed Ask Trading had more than 200 employees, Glazov said he didn’t know who created the website or why.

The research on Glazov turned up something else about him. He had been trying to start a new company, SafeChats, that provides “military-grade security” for business and private communications. Glazov said that SafeChats is no longer in operation.

The tagline of its website reads: “No one needs to know.” ●