Metromile, an insurance startup that charges drivers per mile using a free tracking device, will be among the first companies to meet the unique insurance needs of ridehail drivers when the company integrates its platform with Uber in February.

With the integrated platform, Uber drivers will be able to track and distinguish the miles they drive on Uber trips (which is defined as from the point a driver accepts the trip to when the passenger gets out of the car) from the miles driven between trips. According to Uber, while on a trip drivers are covered primarily by the company's $ 1 million commercial auto liability policy. However, when Uber drivers are not on a trip, as defined by the company, they have to turn to their personal policy for coverage.

With the Metromile tracking device, drivers will be able to subtract the miles they were on a trip and covered by Uber's insurance from the total miles they were driving and simply pay for the difference. According to Metromile CEO Dan Preston, existing customers (generally drivers that drive less than 12,000 miles a year) pay approximately $500 less a year because they only pay for what they use.

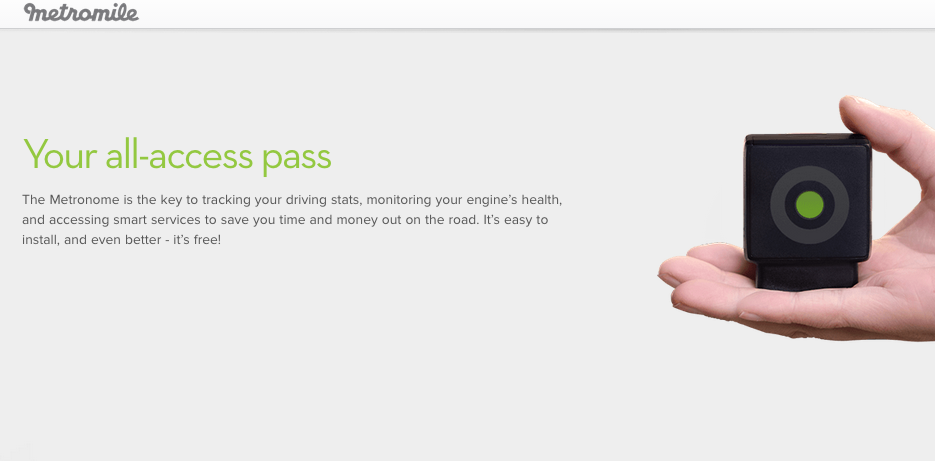

"Uber driver-partners will plug Metromile's Metronome device into the OBD-II port of the car, located under the dash," the release reads. "Driver-partners will enjoy the variety of services and features Metromile provides to all of its users including commute optimization, fuel insights, engine diagnostics, and access to on-staff Metromile mechanics."

The new platform will be available to Uber drivers in California, Illinois, and Washington in February. The company has yet to open it up to drivers of other services like Lyft, Sidecar, or Flywheel and though technologically applying this same idea to the other services should be easy enough, Metromile CEO Dan Preston told BuzzFeed News that expanding this sort of integrated service beyond Uber is not yet on their radar.

For that reason, the partnership is not as advantageous for drivers who drive for more than one platform as Metromile will only be integrated with the Uber platform.

Though an early mover, Metromile isn't the first entrant into the ridehail insurance market. Farmers Insurance in Colorado will also be offering coverage for drivers of all rideshare companies before and after a trip beginning in February.

"With Farmers you're buying supplemental insurance," Preston said. "You will need to have two different policies. Second, you're paying an extra 25% or so with a policy like that. With Metromile, you're saving money because those driving for that platform drive much less personal miles than commercial miles. We won't charge for drivers when they're not using their car for personal use. We will only charge the per mile rate when the car is used for personal purposes. Users driving less than 12,000 miles per year in personal mileage will save with Metromile."

There has been a bit of confusion among regulators, ridehail companies, as well as drivers about whether a vehicle used for ridehail services needs to be registered as commercial or personal vehicles, which in turn would determine whether those vehicles required personal or commercial insurance. As BuzzFeed News reported, the California DMV issued a public memo earlier this month reminding the public that any driver that carried passengers must register their vehicles as commercial pursuant to existing laws. Shortly after, however, the DMV retracted that statement and said that the matter needed to be reviewed further before any existing rules are enforced or new rules are implemented.

However, Preston said that he and the company worked with the California Department of Insurance to come up with a terms that would sufficiently cover ridehail drivers under the Assembly Bill 2293 which comes into effect in July. The bill requires a firewall between personal and company-provided commercial insurance so that personal policies will not cover commercial activities unless the policy allows for it.

"We're meeting the need before it's required in July," Preston said.

A previous version of this article stated that the California DMV required drivers of ridehail services to register their cars as commercial vehicles. However, the DMV has since revoked their original statement regarding that mandate. The story has been updated to reflect the development.

Earlier this morning, California Insurance Commissioner Dave Jones announced that he approved Metromile's filing with the commission. Now Uberx drivers can add an endorsement to their personal auto policy through Metromile that will cover them during the periods that they are not on a trip but are logged into the app. According to the announcement, Metromile is the first insurance provider to cover drivers during this time.

“This first TNC endorsement is a great start, but it does not cover drivers with multiple apps open during the pre-match period or who are signed on with TNCs in addition to UberX. Our door is open for automobile insurers to propose new products that provide drivers with additional choices,”