Growth at Starbucks has cooled dramatically in the US, suggesting a difficult path ahead for the coffee company.

As Starbucks reported disappointing sales on Thursday, it also announced a deal to sell its mass-market Tazo tea brand to Unilever for $384 million, pulling back again on its previous commitment to tea. The company said the move will allow it to focus on its premium Teavana brand instead, although it revealed this summer it will be closing all 379 Teavana mall stores by spring 2018.

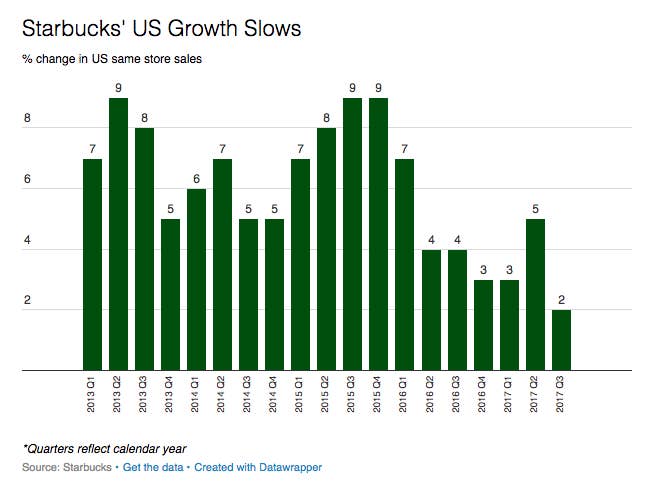

Sales at domestic Starbucks cafés increased by 2% in the three months ending in September, the company reported, half the rate as the same period in 2016 and far less than the 9% reported during the same months in 2015.

Even more concerning was that Starbucks lowered its long-term profit growth forecast, even as it adds more stores. For 2018, it expects global comparable store sales to increase 3% to 5% and will add 2,300 new stores globally, mainly in Asia. In the Americas region, Starbucks will add 900 new locations.

There are signs that the coffee boom may have peaked. Coffee competitor Dunkin' Donuts has also been struggling with declining traffic.

Addressing concerns that all the new Starbucks stores would only eat into sales at existing cafés, Chief Financial Officer Scott Maw said recent trends show that is not the case and there is still demand for more Starbucks outlets.

CEO Kevin Johnson said the company has the "strongest quarterly traffic number in the U.S. since mid-2016 — despite a difficult operating environment," but investors were disappointed, sending shares down by more than 7% in after-hours trading before they rebounded.