Letting a credit agency onto your Facebook page seems like a disaster. But at least one company is betting that under the right circumstances, it won't be so bad.

It works like this: instead of going to a bank for a loan, you'll install a Facebook app that judges your credit worthiness based on who your friends are. If you've got a strong enough network, you'll get a loan straight from the app, no banking required.

Sure, the idea's a non-starter in America — we're too well-banked and squeamish about privacy — but a company called Lenddo is betting it will work with micro-finance style loans in countries with more developed Facebook networks than banks. The site launched in the Phillipines in March 2011 and spread their reach to Colombia this past April. So far, most of the loans focus on education or disaster relief in typhoon season, the kind of thing you'd usually expect from a microloan company like Kiva, which connects borrowers in impoverished countries with users willing to lend their disposable income. But instead of partnering with local agencies like Kiva, Lenddo uses Facebook to build up its referral network. As CEO Jeff Stewart told us, "We created an environment where people can vouch for each other."

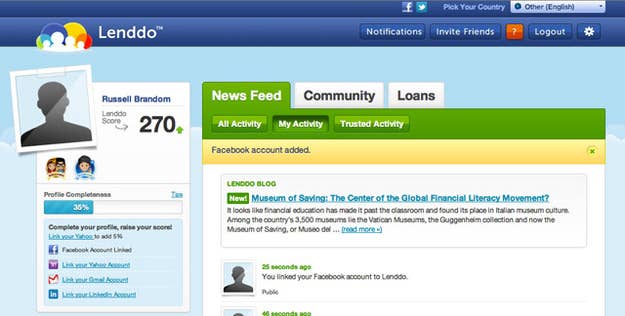

If it works, Stewart envisions a shift to a kinder, gentler style of banking, based on social reputation instead of standing assets. It's banking by community — even if that community happens to be online. In practice, it looks a lot like the Bank of Zynga. Instead of a credit score, you've got a Lenddo score, which has to clear 400 before the site will cough up anything at all. Eventually, you'll be able to drive it up by connecting with other Lenddo users, but at the moment the main way to raise your credit score is by inviting friends onto the site — which means dipping into the same contact-scouring as every other social app on your newsfeed. It's not pretty, but as long as the process ends with loans going to people who need them, it's hard to complain too loudly.

To the startup crowd, it looks like a social spin on Kiva (in fact, that was probably the elevator pitch), but there's a lot of develompental econ baked in as well. One inspiration is the the land titling movement, popularized in the 1990s, that looks to unlock wealth by assigning official titles to traditionally held plots of land. That gives the inhabitants property rights and something to borrow against, should they need to. Lenddo would do the same thing for social capital, giving it tangible value and setting up a system for borrowing against it.

The company has no plans to expand into America — presumably thanks to the already-massive banking sector and the intricate web of FDIC regulations that go into producing a credit score. It doesn't help that, so far, the local response to banking-by-social-media has fallen somewhere between vague anxiety and blind panic — but as long as there are emerging markets to serve, Lenddo doesn't need to worry about stateside predictions.

As for how it's doing in Colombia and the Philippines, it's hard to say. Stewart declined to share user numbers, but said the site was growing at a half to one percent each day — solid numbers, if not quite as explosive as the usual Facebook boost. Only time will tell if Colombians are as squeamish about social banking as we are.

But if your 2022 credit report has a Twitter section, you'll know who to blame.