In a cruel season for retailers, Banana Republic is in an especially bad place.

Its owner Gap Inc. said today that Banana Republic's comparable sales, a measure that excludes the impact of new stores, fell 12% in the third quarter compared to the same period last year, following declines of 4% in the second quarter and 8% in the first quarter. The company, which lowered its profit forecast for the year, also saw a drop at the Gap brand for a seventh straight quarter, making Old Navy its only real hot performer.

Banana Republic has "been a real disappointment to me and a bit of a surprise," CEO Art Peck said on an earnings call today. "I expected Banana to be in a better spot in the back half of the year...I was really hoping we would get more traction with the new design direction. Obviously, we've made some changes in design and we made that really quickly when we felt like we weren't where we needed to be."

Peck appeared to be alluding to last month's exit of designer Marissa Webb, who was hired as Banana Republic's creative director and executive vice president of design in April 2014. Webb is now a creative adviser to the brand and is spending more time on her own label, which Gap invested in when it hired her.

Gap hoped that Webb, who spent more than a decade at J.Crew and also worked at Polo and Club Monaco, would reenergize Banana Republic and give it more authority in the fashion world. She didn't design clothes but was "responsible for everything customers buy and see, including advertisements and the design of the stores," the New York Times said in a feature about her New York loft last year.

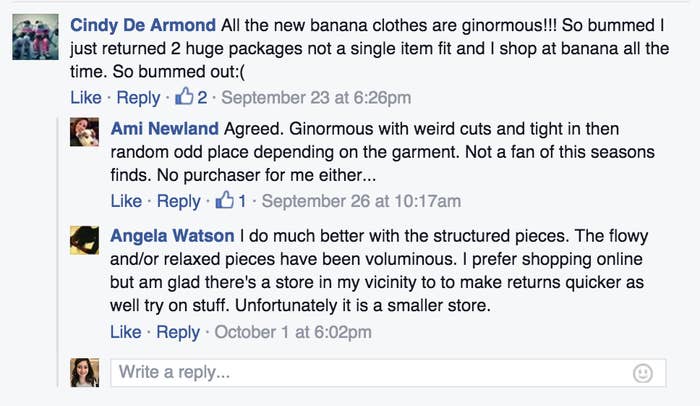

When Webb's position was eliminated last month, Peck told Bloomberg News that customers had been "clear" that Banana's women's clothing "doesn't fit well." He added: "It's not as versatile or flattering as it should be given the price point."

Customer comments on Banana Republic's Facebook page

On Banana Republic's homepage, the company is selling $80 sweaters, $128 faux-shearling vests and $90 cashmere-blend cardigans.

The chain has typically been a go-to for stylish workwear, but has joined J.Crew among one successful brandsthat are struggling to appeal to women this year. Their struggles come as shoppers enjoy an ever-wider array of alternatives, and have developed higher expectations of retailers charging premium prices.

"The problem Banana Republic appears to be having is one of remaining relevant in the face of a changing consumer and a more competitive environment," Liz Dunn, founder and CEO of consulting firm Talmage Advisors, told BuzzFeed News. "The product has been inconsistent in terms of styling and fit. Meanwhile the consumer now has more options for fashion discovery. She is following fashion bloggers, shopping European imports and online boutiques. She is looking for fashion curation and brands with personality and a strong point of view. It is no longer enough to look passably put together for work."

Banana made up 18% of Gap Inc.'s $16.4 billion in annual sales last year, making it less than half the size of the Old Navy and Gap brands. Banana Republic's comparable sales were unchanged last year and fell 1% the year before.

Peck said that products at Gap and Banana will show "material improvement" by spring of next year.

"We know what the issues are with our product and we're addressing those pretty systematically," he said. "I spend a lot of time reading reviews of our product online, and our customers are really clear in telling us what we're doing well and what we're not doing well."