In an updated filing with the Securities and Exchange Commission, Alibaba said it would raise the price of the shares it is offering in its initial public offering in the United States to between $66 and $68.

Raising the share price over the course of what is colloquially referred to as the "road show" — a series of meetings a company takes with bankers and prospective shareholders to convince them to invest — is actually common. It's especially common for a highly anticipated company like Alibaba, which is set to have one of the largest initial public offerings in the United States ever.

According to the new price range, the company is set to raise as much as $25 billion and values the company at roughly $168 billion at the top end of the price range. The company is issuing roughly 320 million shares, not including an additional 47 million potential shares for underwriters depending on interest.

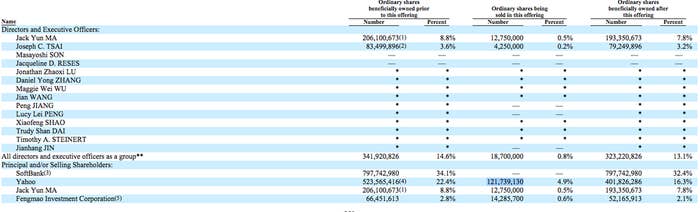

While Alibaba has built an e-commerce giant in China, a lot of interest in the U.S. is the result of a 21% stake that Yahoo has in the company thanks to a savvy investment led by Yahoo founder Jerry Yang. In the amended filing, the company said Yahoo intends to sell roughly 122 million shares. At the top end of the pricing, that would reap a windfall of more than $8 billion to Yahoo, which would continue to hold on to more than 400 million shares. Alibaba founder Jack Ma will reap himself a large initial reward of nearly $1 billion at the top end of the company's target share price range.

Yahoo so far has been able to sate shareholders by returning capital from parts of its Alibaba investment in the form of dividends and share buybacks, and also negotiated better terms ahead of Alibaba's initial public offering that allow it to keep additional shares. New Yahoo CEO Marissa Mayer has already made clear to investors that Yahoo intends to return half of its windfall from Alibaba's U.S. IPO — already valued at more than $35 billion, at the top end of the range — to Yahoo shareholders.