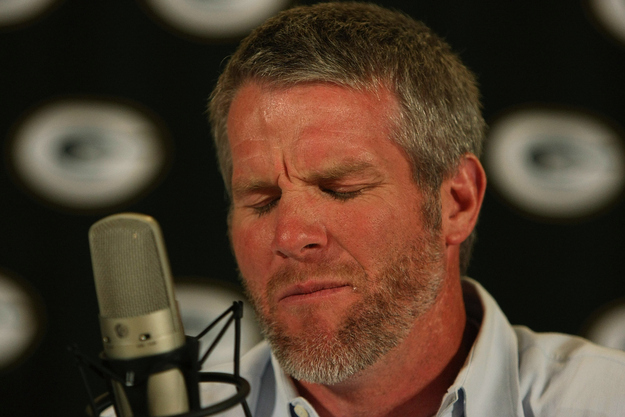

After 15 seasons in the NFL and a Super Bowl ring with the Green Bay Packers, veteran quarterback Brett Favre first says he's considering retirement during an interview with ESPN on Jan. 30, 2006.

"I wish I knew where I stood ... If I had to pick right now and make a decision, I would say I'm not coming back," Favre told ESPN's Chris Mortenson.

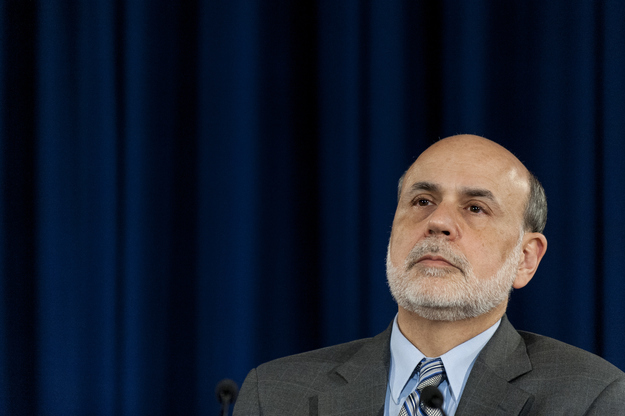

In a June 19 press conference, Federal Reserve chairman Ben Bernanke said that the Fed could begin to reduce its $85 billion a month of bond purchases by the end of the year if the economy continues to improve.

Financial markets promptly freaked out: Yields on 10-year treasury bonds spiked to 2.33%, the highest level in more than a year, and all major stock indices dropped. Some analysts even predicted that the reduction in bond purchases could come by the Fed's September meeting.

In April 2006, Favre told the Packers that he decided to play for Green Bay that season.

Packers fans rejoice, ESPN executives are giddy, and Aaron Rodgers, Favre's backup, curses his luck.

Following its policy-making meeting in September, when many analysts expected an announcement that bond purchasing would slow, the Fed instead said that it would continue bond purchases at its $85 billion-a-month pace.

Markets shoot up on the announcement that the Fed would not reduce its purchases, putting off the much anticipated "taper" to 2014 or at the very earliest, December. The S&P 500 would hit a record high by the end of the day. Treasury yields also dropped. In his press conference, Bernanke once again says that any decision to take down the bond purchases would be dependent on data about the health of the economy. But the rise in bond yields since the June Fed statement has had some of the effect that an actual taper would, and thus puts off the actual reduction in purchases for at least a few months.

Favre keeps his word, goes to training camp, and plays the entire 2006 season for the Packers. Green Bay finishes 8-8 and doesn't make the playoffs.

At the end of October, following another Fed meeting, Bernanke sticks with his September commitment not to reduce bond purchases, keeping the $85 billion-a-month spend up until at least December.

In February 2007, Favre commits to his 17th season in Green Bay: "I am so excited about coming back," Favre said.

In a Nov. 19 speech, Bernanke says that asset purchases will only slow and eventually stop “because the economy has progressed sufficiently,” reiterating again that the taper is not on any preset schedule.

Following the 2007 season, which ended with the Packers losing to the Giants in the NFC championship, Favre tearfully retires. He then unretires and demands a trade and is eventually shipped to the New York Jets. Favre would later retire in 2011.

Following a postive jobs report, The Wall Street Journal reports that the Fed is "closer to winding down their controversial $85 billion-a-month bond-purchase program, possibly as early as December."

We'll find out if that actually happens after the Fed's meeting tomorrow, when it will issue a statement announcing any changes in policy. Taper or no taper, let's hope the last policy statement of Bernanke's career doesn't include any pictures.

Many economic policy observers are already speculating that a decision to taper will again be put off to sometime between January and March of next year.

Correction:This post original misstated how many Super Bowls Brett Favre won with the Green Bay Packers. He won one, not two.