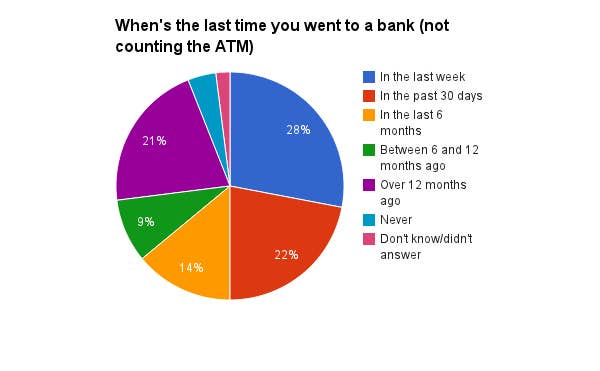

Over a third of Americans haven't done any banking in a bank branch, not counting ATM use, in the last six months. That's according to a new survey done by Bankrate, which also says that 21% of people last visited a bank branch over a year ago, while 9% visited in the last six months to a year.

Those with higher incomes and more education visited banks more often, with 35% of survey respondents with "at least some college experience" having visited a bank in the last week, compared to 21% with a high school education or less.

The figures are not surprising, considering the consolidation of the banking industry and the end to growth in bank branches. Retail branches are some of the most headcount-intensive parts of a megabank's operations and are one of the first places banks have looked at to reduce costs.

Young people especially are some of the most allergic to traditional banking. The Bankrate survey reported that 38% of young people surveyed hadn't visited a bank in the last six months, compared to 36% of the overall population. The age split was most stark in who visited in the last week: 28% of the total population last visited in the past seven days, while only 19% of young people had.

According to a survey done by Scratch, a division of Viacom, a third of people between 14 and 33 are open to switching banks in the next three months. Three quarters of those surveyed are looking forward to tech companies taking over more and more of the banking industry.

But in the meantime, more and more simple banking transactions can be done through ATMs, like check and cash deposits, while more and more banking migrates online. At Chase, there's been 28% growth in log-ins to its online banking products and 3% and 4% declines respectively in calls with real people and transactions with tellers.

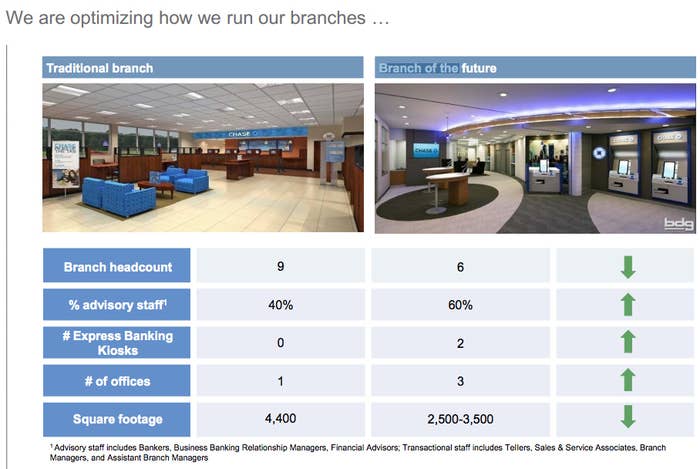

The "branch of the future" — fewer people, more kiosks

According to data collected by the Federal Deposit Insurance Corporation, the number of bank branches has been shrinking since 2009, down to 96,339. From 2004 to 2008, by contrast, the number of commercial bank branches grew by about 12,000.

JPMorgan Chase, for example, is planning to halt the expansion of its bank network and has already reduced its total branch staff by 7,000 in the last two years, while its customers who regularly use the bank's online services has grown by over 2.5 million from 2012 to 2013.

At a recent investor's conference, Gordon Smith, JPMorgan's head of community and consumer banking, said to expect zero growth in branches. In a presentation, the bank said that total staff in consumer banking would fall off about 20% from 2011 levels, "that will all be done through automation and it will not be done through running large lines in the branches," Smith said.

The company's "branch of the future" will have a third fewer employees on average, from nine to six, while more of the remaining workers will be "advisory staff" — employees who advise customers and do actual banking. Branches will have fewer "transactional staff," like tellers and branch managers.