How can a bank get its customers to sign up for an expensive "overdraft protection" plan — essentially a very high-fee loan, automatically extended to customers trying to take out more money than they have? Strict rules require account holders to affirmatively opt in to these plans, which are very profitable for banks and often a terrible deal for customers.

The way one big global bank approached this challenge ended with a $10 million penalty on Thursday, with the Consumer Financial Protection Bureau ruling Santander Bank — a U.S. subsidiary of the Spanish banking giant, which acquired Boston-based Sovereign Bank in 2009 — had crossed the line.

Santander's U.S. telemarketers signed up customers for its expensive overdraft programs "without their consent," the CFPB found. In some cases, the telemarketers would give "a brief description of the product and then had the consumers verify the last four digits of their social security numbers," signing them up for the service without getting a "yes" at all.

The CFPB released transcripts of some such calls. In one, a telemarketer says the service is "free" and they would set it up for the customer's account.

"So, you know, basically it’s a free service and, uh, we would like to send you out Account Protector package for your account," they said. "Would that be OK?" The customer says "Sure," and the telemarketer asks for the last four digits of their social security number.

Later in the calls, the CFPB says, the fees would be mentioned as part of a "legal disclosure" after the customer had signed up. In other cases the caller would say "This is not a sales call," despite Santander's own internal documents calling the deals "sales." In addition to misidentifying the sales calls, the telemarketers would sometimes say that they were trying to "re-enroll" customers in the program even if they were not already using it.

“Santander tricked consumers into signing up for an overdraft service they didn’t want and charged them fees,” the CFPB's head Richard Cordray said in a statement. “Santander’s telemarketer used deceptive sales pitches to mislead customers into enrolling in overdraft service. We will put a stop to any such unlawful practices that harm consumers.”

Along with the $10 million payment, Santander will have to contact customers it sold the overdraft protection service to, and make sure they still want it. And the bank has been banned from using an outside contractor to sell overdraft protection products in the future.

Starting in 2010, the bank used a telemarketing vendor to sell the program, called Account Protector, which charged a $35 fee for each overdraft and additional fees if the account remained overdrawn for five days after the first transaction.

“We regret that the vendor we hired to promote this service may not have followed our instructions and we did not supervise them as closely as we should have," a Santander spokesperson said in a statement. "These actions, which occurred several years ago, do not reflect our values and fell short of the high expectations we have for ourselves and our vendors. We are terminating our relationship with the vendor and are continuing to implement additional controls to ensure more effective oversight of our vendors and our processes."

Very early into the relationship with the vendor, the CFPB says, Santander realized that its telemarketers "were being overly aggressive, making sales without the consumer’s consent, and not following the script" and complaints started to roll in from customers who incurred unauthorized overdraft fees. Santander would continue to work with the vendor, however, "over the next several years," until 2014 after the program was only paused "for a few days," for some more training.

In another call transcript released by the regulator, a bank customer says they aren't ready to sign up for the service, but asks if the telemarketer will just "send me the information."

Sale!

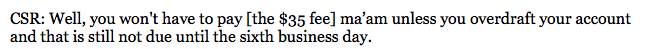

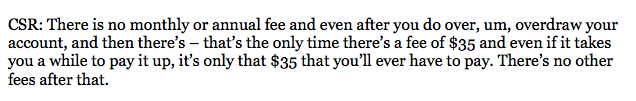

Sometimes the telemarketers would misdescribe the program, saying there were only fees if the account remained overdrawn for many days, even when the $35 dollar fee is charged immediately. "During numerous other calls, CSRs directly stated or implied that Santander would not charge any overdraft fees at all if consumers repaid the overdraft within five business days," the consent order says. Or they would say the opposite: that there was only a fee on the initial overdraft and not one that could be applied later.

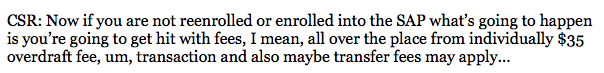

And they didn't stop by misrepresenting the cost of enrolling in the account protection program, but also what would happen if the customers didn't enroll, saying they could be charged with overdrafts instead of just having transactions declined. One salesperson told a Santander customer:

The consent order puts it bluntly: Santander's "representations...are false and misleading, and constitute deceptive acts or practices."