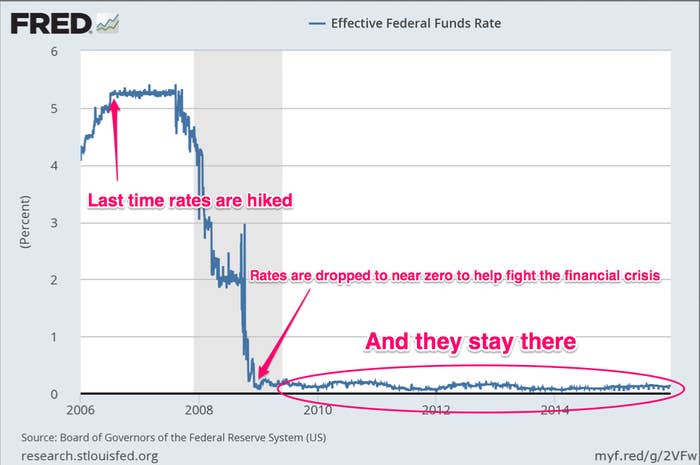

The Federal Reserve is moving to raise the short-term interest rate it controls, breaking its seven-year effort to pump up the economic growth by keeping the rate close to zero.

The Fed said it would bump up the range of the rate it controls from between zero and .25% to between .25% and .5%. The Fed said in a statement that its projection of future inflation and unemployment "will warrant only gradual increases in the federal funds rate," likely meaning slow and very gradual future hikes. "Even after this increase monetary policy remains accommodative,” Federal Reserve chair Janet Yellen said in a press conference following the release of the Fed's decision.

Financial markets largely expected the rate hike. Yellen said in a speech earlier this month that "we all are looking forward to" to seeing rates start to rise again. U.S. stocks however were up slightly in response to the news.

The Fed hasn't raised the federal funds rate since 2006 — when Shakira's Hips Don't Lie was the number one song on the charts. The economy was also much different then. It was incredibly easy to get a mortgage and a huge run-up in home prices was finally cresting.

The largest company in the world by market capitalization back then was ExxonMobil, and three of the world's ten largest companies were banks. Apple, now by far the largest business in the world, was the 131st largest back then. Inflation back then was running above 2%, which the Fed now targets, at 2.4%. But in some ways it was similar — unemployment was quite low (4.6% then, 5% now.)

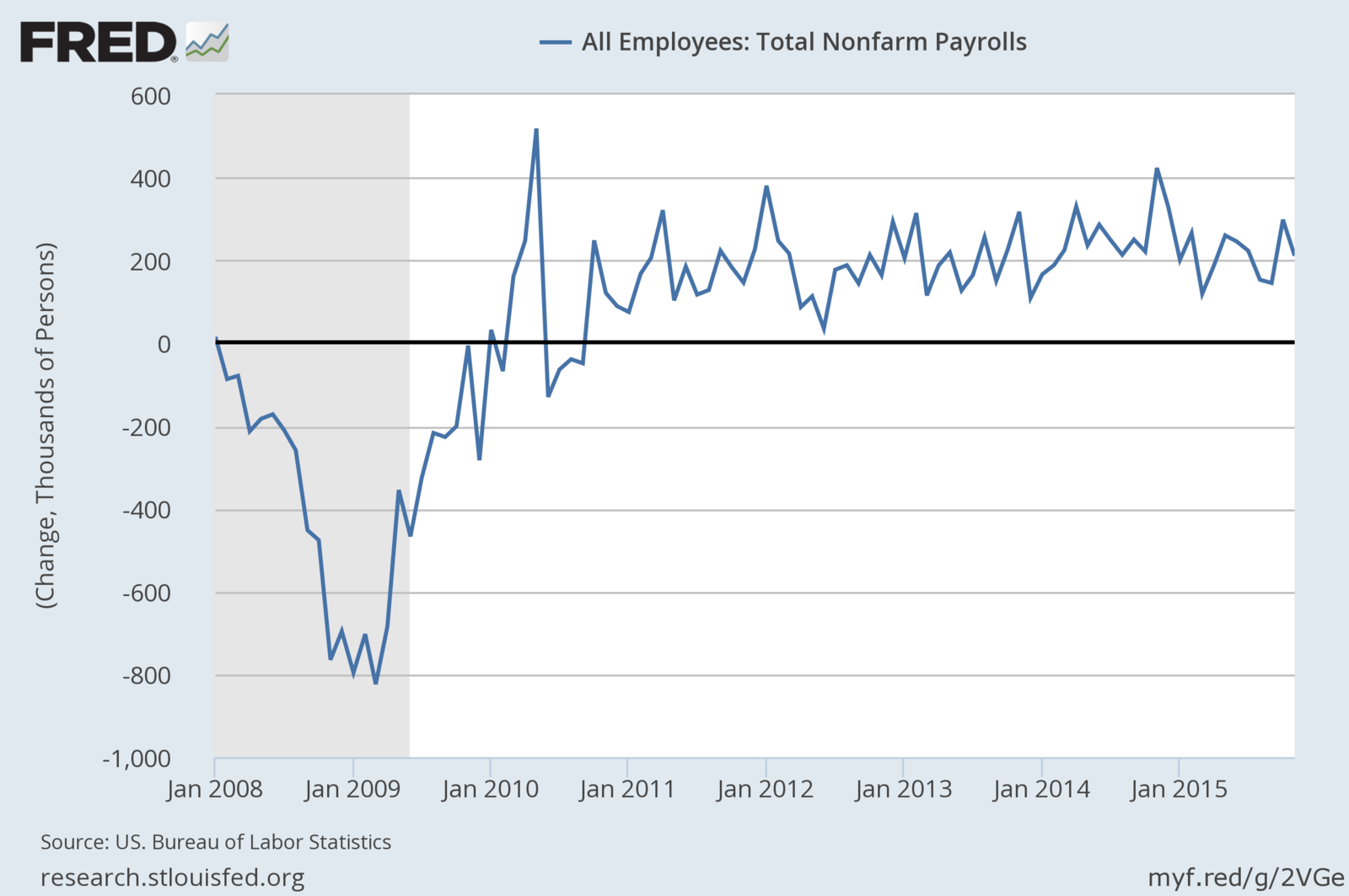

One reason the Federal Reserve felt comfortable raising interest rates was solid jobs growth. "The Committee judges that there has been considerable improvement in labor market conditions this year, and it is reasonably confident that inflation will rise, over the medium term, to its 2 percent objective," the Fed said today.

In the last three months, jobs growth has averaged over 218,000 new jobs per month, and in the last year, monthly jobs growth has averaged 210,000 new jobs per month. "The labor market has clearly shown significant improvement,” Yellen said in the press conference.

And while the economy hasn't exactly been roaring — its been growing at about 2% according to the latest data — Nomura analysts said Friday that "consumer activity has been solid this year and will likely continue to be the main source of growth in the near term."

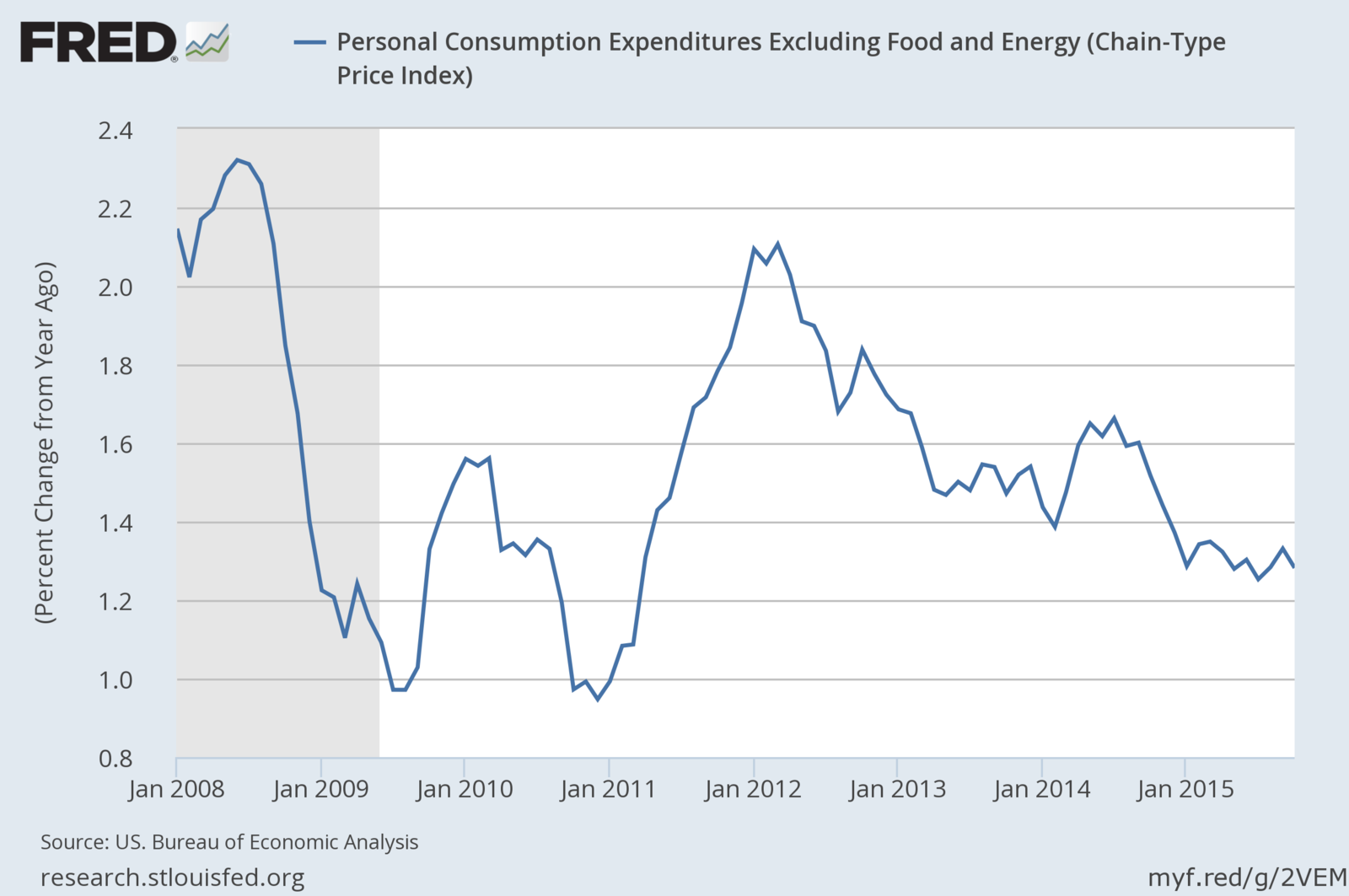

The Federal Reserve's mandate is to encourage jobs growth and keep inflation — the change in prices over time — from accelerating. And inflation has been quite low since the financial crisis, despite years of very low interest rates.

One measure of inflation, which measures what consumers pay for things excluding food and energy, has only grown 1.3% in the last year, well below the Fed's target of 2%. Wages

And investors aren't expecting inflation to accelerate. Going into the meeting, one measure of expectations of future inflation has been shrinking since last summer, and is now at 1.7%. The Fed said it projected the inflation rate wouldn't hit 2% until 2018, and would only be at 1.6% in 2016. 12 of the 17 members of the Fed policymaking committee that makes interest rate decisions said that the appropriate level for the federal funds rate in 2016 would between 1% and 2%.

An expected change in Federal Reserve policy wouldn't mean anything without some gyrations in financial markets. In August, in anticipation of what many thought would be a rate hike in September, stocks in emerging markets dragged down world markets and U.S. stocks fell over 11%.

And those concerns delayed the hike to December. The Washington Post reported that a "slim majority" of the Fed's top staff wanted to hike rates in September but Yellen feared that "wild swings in global financial markets" in August could damage the U.S. economy and she was able to get them to stand pat.

A full cycle of interest rate hikes also brings more expensive credit for everyday people on things like car loans, credit cards, and mortgages, but also higher payouts on things like money market funds.

Several banks announced today that they had raised their so-called "prime" rate, an interest rate used as a reference for other loans. Wells Fargo was the first out of the gate, and announced they raised their prime rate form 3.25% to 3.5%.

According to data from Bankrate.com, in the year following the last rate rising cycle which started in 2004, rates for new car loans jumped about .4%, the rate on a 30 year fixed mortgage declined .69%, while the rate paid on money market accounts went up only .23%. Right now, rates on savings and money markets account are a mere .47%, while a 1-year CD pays 1.1%. May the rates ever be in your favor.