Total outstanding student debt has now crossed the $1 trillion mark. According to data from the New York Federal Reserve Bank that tracks total consumer debt, America's total student debt balance is $1.27 trillion, up $33 billion from the second quarter of this year. Broadly, consumer debt has risen $127 billion in this third quarter to $11.28 trillion.

So, while increasing student debt is less than ten percent of the total debt held by individuals, it's growing as a share of all consumer debt and is now the second largest type of consumer debt, greater than home equity lines, auto debt, or credit card debt. The lion's share of consumer debt is, as always, mortgages, with $7.9 billion outstanding.

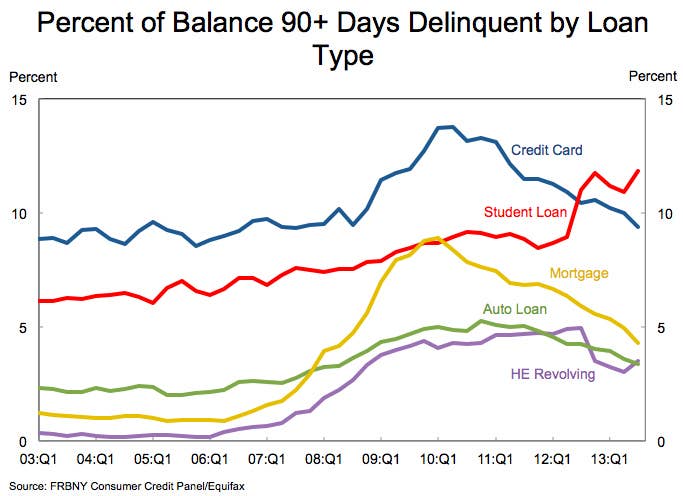

The serious delinquency rate for student debt, which the Fed defines as 90 or more days without payment, is peaking up too, faster than overall consumer debt. The Fed reported that the delinquency rate is now 11.8%, up from 10.9% last quarter. In comparison, the delinquency rate for credit cards fell to 9.4% from 10%. The 90 day delinquency rate for all consumer debt is 5.3%, down from 5.7% last quarter—the only other category of consumer debt to see its seriously delinquent rate go up was home equity lines of credit.

And the real delinquency rate for student debt might be twice as high: an earlier New York Fed report said that the delinquency rates for student loans it reports "likely understate the actual delinquency rate" because about half of seriously delinquent student loans don't have to be repaid immediately because the borrowers are in a grace period, have deferred repayment, or have gotten forbearance from their lender.

Last year, Federal Reserve chair Ben Bernanke said "I don't think student loans are a financial stability issue to the same extent that, say, mortgage debt was in the last crisis because most of it is held not by financial institutions but by the federal government."

While the risks to the national economy may not be large, the growing delinquency rate has been showing up on the balance sheet of some banks and student lenders, about 85% of student debt is government-backed.