Is it still worth it to buy a house, or are you better off renting? After a housing bubble, a housing crash, a financial crisis, and a Great Recession, plenty of people have turned away from the American dream, helped along by impossibly high prices in some big cities, stagnant wages in others, and mortgages that remain tough to get.

But across most of the country, buying is still a much better deal than renting, according to a new study by real estate site Trulia. In all 100 of the country's biggest metro areas, owning comes out cheaper than renting — 35% cheaper, on average.

To calculate the advantage of buying over renting (and vice versa), Ralph McLaughlin, Trulia's housing economist, assumed buyers would make a 20% down payment on their home and take out a 30-year fixed-rate mortgage at 3.87%. Alongside mortgage payments, he factored in things like maintenance, insurance, and taxes; one-off costs were also considered — closing costs for owners, security deposits for renters, and so on (you can see the detailed methodology here).

Once all that, and more, is strung together, the report tried to answer a simple question: Should you use all that money to buy a house, or just invest it somewhere else and rent a place instead?

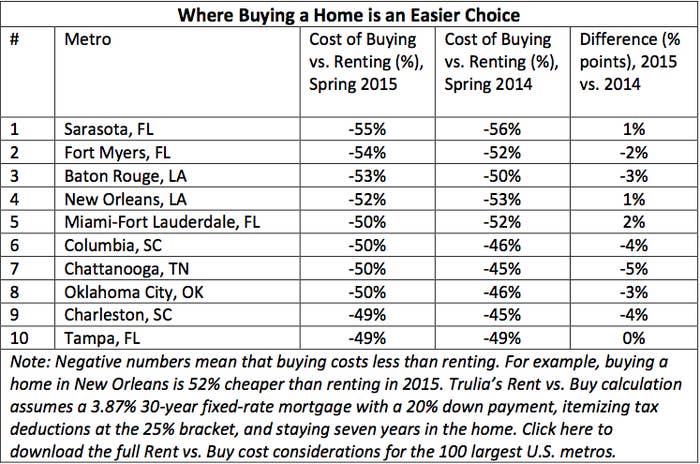

In some cities, buying looks like a no-brainer:

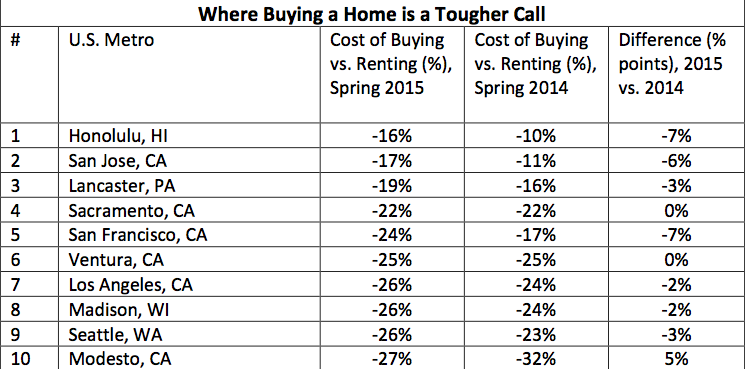

In others, the gap is smaller (but still in favor of buying):

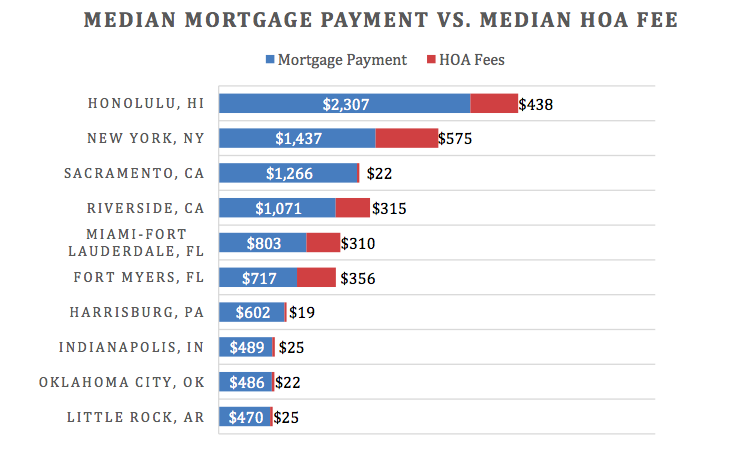

There's a catch though: The advantage of buying evaporates in some cities once you factor in things like homeowners association (HOA) fees.

Those fees can be very high, high enough to wipe out even very significant gaps between buying and renting. The median monthly HOA fee in New York City is $575, and in Honolulu it's $438.

Once those steep fees — which typically pay for things like building maintenance and common grounds — are taken into account, McLaughlin found it is just 1% cheaper to rent than buy in Honolulu, and only 4% cheaper to buy than rent in NYC, a number that jumps to 24% without the monthly HOA fee.

Contrast that with Baton Rouge, Louisiana, New Orleans, and Memphis, where HOA fees are just $30, $63, and $25, respectively, making it between 46% and 51% more affordable to buy versus rent.

While it may hurt to pay almost as much in HOA fees as owners in more affordable cities pay in mortgages, those fees often cover costs like water, garbage, sewer, and building maintenance, and some of those costs will also hit owners of homes with no fees.

"At the end of the day," McLaughlin said in the report, "if your dream home comes with HOA fees, it isn't necessarily a deal breaker."