As Paulie Rodriguez looks out from his girlfriend's family trailer home perched on dry, uneven ground on Native land in Pojoaque, New Mexico — their temporary residence since the pandemic uprooted their lives in the Bay Area — he wonders how things ended up this way.

He was the first in his immediate family to graduate high school. He went on to coding school in Washington state, hopeful he would join the country’s tech workforce. As he looked for jobs, he worked as a barista at a café. He carefully played his hand, but none of it mattered when the coronavirus pandemic swept across the country and brought much of the US economy to a grinding halt. This spring, he found himself unemployed, evicted, and left behind by the US’s few remaining safety nets.

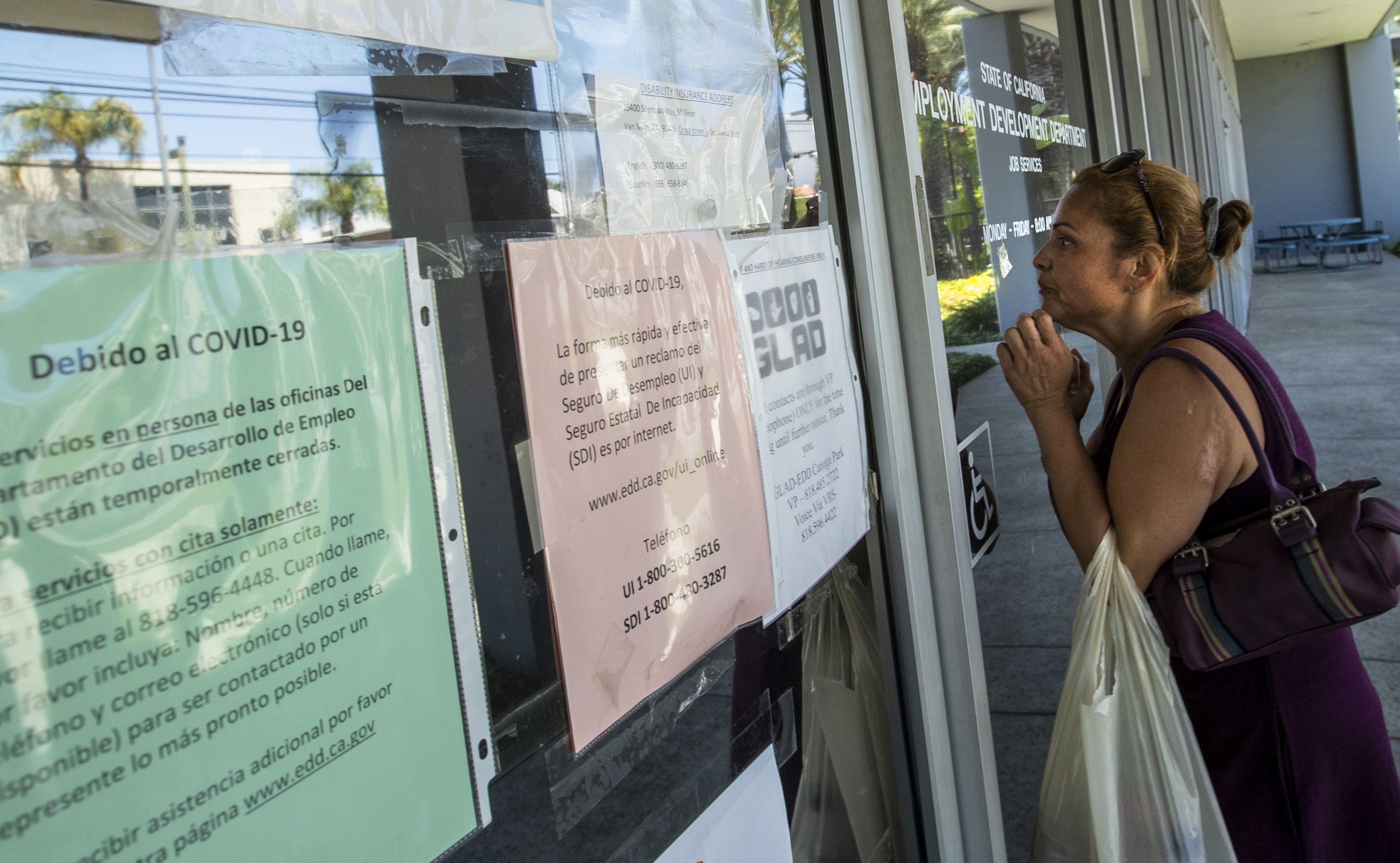

By July, 23-year-old Rodriguez had been waiting for months for the unemployment benefits that the state’s Employment Development Department, had yet to pay out. He’s one of 1.1 million Californian residents who have fallen through the cracks. The state’s unemployment system, progressive in many ways compared to other states, has been a bureaucratic black hole through the pandemic, understaffed and reliant on outdated technology unfit for a crisis of this scale. It has compounded an already devastating crisis for people like Rodriguez. Now — with the nation’s most populous state poised to resume evictions and foreclosures on Sept. 1 — some 30,000 people in California, unable to work or collect unemployment benefits, are in danger of being put out on the streets.

For Rodriguez, that reckoning has already come. On June 30, as he approached his fourth month without financial relief, he and his girlfriend packed up their things, rented a U-Haul trailer that they hitched to their car, and drove three days to find shelter. They crossed into New Mexico on Independence Day, where they would settle into a three-room trailer that his girlfriend’s mother shares with three other family members.

Now he has $70 left in his checking account. He earns grocery money making websites for clients he finds online, coding from the kitchen table of this trailer home near Santa Fe.

“It’s upsetting because right now it feels like I was doing everything right and was trying my absolute hardest,” Rodriguez told BuzzFeed News. “And even then, I have everything taken from me. It was still not enough.”

Millions of Americans like Rodriguez face unemployment, homelessness, and debt as governmental safeguards crumble under the weight of this pandemic. In California, outdated technology has largely rendered the labor department ineffective and overwhelmed since March, when a flood of unemployment insurance applications began rolling in. Meanwhile, families waiting for financial relief have been forced out of their homes despite federal and local eviction moratoriums. It has disproportionately affected people like Rodriguez who are nonwhite and have low incomes.

“It's upsetting, and it's not like there is one figure I can blame for it,” he said. “It's this domino effect of neglect of the [United] States never caring about their social safety nets because they don't care about the lower class.”

Atrophied Systems

Rodriguez can tell you tricks he’s learned to try to get through to an agent to resolve his unemployment benefits claims in California. If you hear one recorded message, hang up; you’re stuck on hold and you’ll never get through. But if you hear a long pause and then a different message, you’re in luck, he said.

He’s called the labor department as many as 80 times in one day, looking for answers. There were none.

As of early August, 1.1 million unemployment claims in the state had yet to be paid and could require months to clear. If Congress approves any new unemployment benefits, the head of the EDD has told reporters it could take up to 20 weeks to process those.

The EDD’s website, where people can file for unemployment, is no better. The agency is the last in the state to rely on COBOL, a 60-year-old computer language “so old that most of its programmers have retired,” according to state lawmakers. EDD’s mainframe-based computer systems are 30 years old.

That this antiquated infrastructure would buckle under high levels of employment is no surprise. California’s unemployment system caused delays in paying benefits to 117,000 people in 2009 during the Great Recession as well, when more than 12% of the state’s workers became unemployed. A decade ago, EDD entered into a contract with the consulting agency Deloitte, but the project ran over budget and overtime. Lawmakers said it required $94 million and six years, compared to the original $47 million and four years the agency expected — and it remains inadequate as the need for a functioning portal soars far beyond anything seen in the recession.

Of the roughly 11 million calls EDD received each week, only 5% are answered.

"For too long, EDD has been run by an insular group of bureaucrats rooted in the status quo and unable to drive reform. Many of the problems we are seeing today existed during the Great Recession. Back then, EDD told lawmakers these problems would be fixed, but they never were,” said David Chiu, a member of the California State Assembly.

Just in the last week of July, the EDD paid an average of $792 million a day in unemployment benefits, a 1,033% increase over average daily benefits paid at the height of the Great Recession. And that’s only going to a portion of the people who need help, as others — who have errors on their applications or need to verify their identities and wage information, as Rodriguez did — are captives on an endless hold over the phone.

As of the end of July, all of California — a state of about 40 million people — was served by just 100 EDD claims specialists who only resolve issues during a narrow window from 8 a.m. to noon, according to state lawmakers. Getting through to one of them, when 1 million other claims remain unpaid, requires not only superhuman effort but also a great deal of luck. There are an additional 1,000 or so call center agents on EDD’s main phone line for unemployment insurance, but they can do little more for callers than provide information similar to what is found on EDD’s website. Of the roughly 11 million calls EDD received each week, only 5% are answered, the agency’s director recently said.

“A few people slipping through the cracks is one thing, but when well over a million Californians haven't received income for months, that suggests the entire system is broken. I don't think our existing safety nets are adequate to help people get through this crisis, and EDD's failures have made the situation even worse," said Chiu.

EDD’s problems have become so severe that in early August, more than 60 state lawmakers signed a letter to Gov. Gavin Newsom demanding the agency get its act together:

Millions of our constituents have had no income for months. As Californians wait for answers from EDD, they have depleted their life savings, have gone into extreme debt, and are in deep panic as they figure out how to put food on the table and a roof over their heads. Every hour, we field countless calls from constituents reaching out to us as a last resort, after weeks of dead ends and misinformation from EDD. As legislators, we have exhausted all avenues at our disposal to get resolution for the people we serve. We’ve waited months for EDD to provide a roadmap out of this crisis, but none has been forthcoming.

Newsom later said in a press conference that he recognizes “the magnitude of the challenges with IT here in this state that are going to require a stubborn, long-term grinding of effort.” He added, “It took us decades, quite literally decades, to get into this place, but we're now accountable.”

In a statement to BuzzFeed News, the EDD said it has been working to update its call center service “to be more customer friendly.”

The agency added, “The modernized virtual platform will help route callers to the appropriate staff for response. … The EDD is in the midst of an expedited mass hiring effort to add 5,300 staff while at the same time enhancing technology systems to gain efficiencies and developing more communication methods.”

For Rodriguez, the holdup started when the EDD sent him a letter that stated his benefit amount was $0. That’s when he started to reach out to agents from the department who told him they had trouble verifying his identity and wages. So he mailed copies of his ID and pay stubs; a tracking receipt showed they were delivered in early June. But EDD said it still did not have them. He sent them again, via fax this time, but still received no response. There was no option to email them. Weeks went by, and there was still no response. Then in July, four months into the process, he was told via a message on EDD’s online portal to speak with an agent and file a new claim, he said. He had to call about 40 times to get in touch with an agent to restart the process.

“This is money I created through my capital that my family created through their work through their labor.”

Rodriguez reached out to a number of state assembly members for help early on in April, but he was told the average time it was taking for a response was 45 days. As he waited day after day to get through to EDD, he watched his savings run down. So he packed up his apartment and left the state.

“I'm supposed to get unemployment,” he said. “That's money that I've paid over my entire life, in taxes and every bit of money that I've given out to a business. It's money that my parents or my siblings, aunts and uncles, across generations have been paying their entire lives. And so this isn't a handout from the government,” Rodriguez told BuzzFeed News. “This is money I created through my capital that my family created through their work through their labor.”

While the federal government expanded unemployment benefits due to COVID-19, California’s program “is funded from UI taxes paid by employers annually on the first $7,000 of each employee’s wages,” according to EDD.

There is little relief in sight — and for the many people like Rodriguez who are waiting to receive unemployment benefits, options are quickly dwindling.

Unprotected From Evictions

Rodriguez and his girlfriend moved in with a roommate in February to save money; they didn’t expect to have to move again so soon. Going into four months without stable income, he felt like his options were running out. Their landlord continued to demand rent, threatening to evict them (despite the eviction moratorium) and repossess their roommate’s car, which she needed to continue working as a nanny.

“With us struggling to get by on rent and everything like that, we decided it would be better if we just fell back on family,” he said. They packed up for the second time this year and left the apartment before their landlord could start an eviction process in court.

His situation is not unique. People are losing their homes across the state and nation despite federal and local eviction bans passed to keep people housed during the coronavirus pandemic. In some cases, this is due to landlords locking renters out; in others, it’s due to intimidation tactics.

The share of California renters who amassed unpaid rent going into August, about 32%, is slightly higher than the 30% share nationally; due to high housing costs in the state, California renters tend to owe more, according to data provided to BuzzFeed News from Apartment List. Nationwide, 37% of renters told Apartment List in August they were at least somewhat concerned about eviction; 8% were extremely concerned.

The protections that have been put in place in various cities and states around the country have mostly put a halt to evictions though there have not been any significant debt forgiveness programs for renters, leaving those unable to pay their rent with debt waiting for them at the end of the pandemic.

Carroll Fife, the director of the Alliance of Californians for Community Empowerment and cofounder of the Moms 4 Housing activist group, told BuzzFeed News that these policies are mostly delaying evictions and that politicians and advocates alike are looking at a major crisis once moratoriums are lifted, especially now that the additional federal unemployment insurance of $600 a week has run out.

Fife, who is also running for city council in Oakland, said that the number of people reaching out to her to take part in a rent strike has tripled since the pandemic started, now totaling about $400,000 of withheld rent per month in Oakland alone. She has also said her members have also experienced aggressive evictions attempts, with senior citizens being intimidated, landlords removing furniture without tenants’ knowledge, and immigrant renters being threatened with calls to ICE.

“They are calling it an eviction tsunami,” said Fife about the impending problems renters will face. “[Politicians] are just twiddling their thumbs. ... There’s been no significant legislation.”

On July 24, Newsom addressed the unequal impact of the pandemic in California: “When people ask, as they often do, “where are we seeing the spread?” This is where we’re seeing the spread: the essential workforce, disproportionately represented by the Latino, Latinx community.”

People of color are not only more likely to be impacted by the coronavirus health crisis, they are also more likely to be unemployed due to the resulting economic crisis. In July, the unemployment rate for Latinos in the US was 12.9%, compared to 9.2% for whites and 10.2% overall.

Just like in the Great Recession, Rodriguez and his peers fear that many of the effects of this crisis will leave lasting scars for generations. Rodriguez — the child of an immigrant, whose father was a letter carrier and union shop steward for the US Postal Service — had planned to secure his future through hard work and ambition — the American dream. But in just a few weeks, it all became ash.

He needed a silver lining, and in August it came: word that he would start a three-month, paid apprenticeship program with Pokémon Go developer Niantic next month.

“I see a lot of politicians who are worried about impending evictions and trying to extend the CARES Act benefits, and that's all great stuff. But it's alarming because I feel like a lot of people were getting left behind. And there's a lot of people who have already been displaced, who've already been evicted,” Rodriguez said. “And so it just seems like screaming into the void right now.”