This would amount to heresy and excommunication in some circles nowadays, but I genuinely thought the movie Crash was a great film. When I stumbled upon odds for the Oscars in January 2006, I put $10 on Crash to win the coveted Best Picture prize. When the envelope was opened and Crash pulled off the upset against the heavily favored Brokeback Mountain, I had netted $70, a 7-1 winner. To a recent college graduate, that was an astoundingly large sum of money; I remember jumping up and down in my parents' living room.

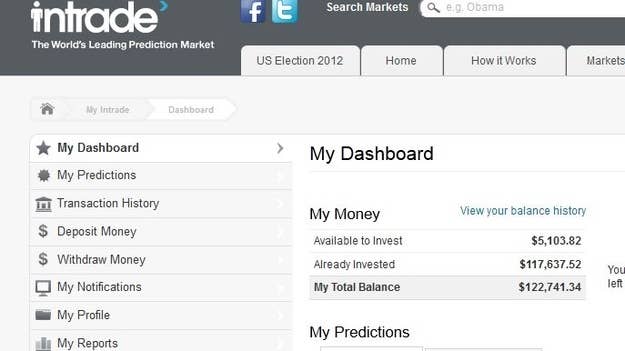

Fast-forward to 2010, and I had netted $40,000 on The Hurt Locker’s Best Picture Oscar win. I believe that I celebrated by going to McDonald’s and buying a large vanilla shake. What happened in the intervening years was the discovery of a site called Intrade. Intrade is a peer-to-peer predictions exchange, where predictions are priced and traded on a 0-100 scale (0/$0.00 meaning it will not happen, to 100/$10.00 meaning it will). With the exception of sports, virtually everything that is a hot topic is included on the site: from predicting the next senator of your state to annual sea ice extent in the Arctic; from whether Sarah Palin will run for the presidency to the discovery of the Higgs boson. (Intrade is also limited by how hard it is to get money in and out. The law forbids credit card companies to be involved, and so Intrade only accepts physical checks mailed to them and wire transfers.)

Movies were the siren song that drew me to Intrade initially and continue to occupy my time during Oscar season, but political wagers have become my forte. It began with the 2006 midterm elections and snowballed into correctly predicting both the nomination of Obama and McCain in 2008. I found success again in the 2010 midterm elections, notably the defeat of Proposition 19 in California, which would have legalized marijuana. In the 2012 GOP nomination market, I was party to a little less than 10% of the trades. For the general election in 2012, I have six figures at risk on various events.

The purpose of this piece is not to regale with stories of success or claims to be an oracle; it is about the work, the thought, and the effort that goes into trading on Intrade. The key to political predictions, and predictions in general, is doing the research necessary to limit the amount of times you are wrong — and the severity to which you are wrong — because you will be wrong quite often. Being right every so often is the easy part.

My Opinions are Often Terrible

In making political predictions, one of my greatest challenges is separating my partisanship from my predictions. I suspect the same is true for most people, be they conservative, liberal, or any shade in between. There is a certain team mentality to politics that damages one’s ability to be entirely rational.

Even when staring at raw numbers, partisanship can poison thoughts and cause one to seek flaws in the data which do not actually exist. One example of this is the advent of Unskewed Polls this year, a farcical website that purports to transform skewed polls into “realistic” ones. That site is really just a manifestation of a sentiment that has existed since the dawn of polling: “The numbers show my guy/gal is losing. That person cannot lose because of their amazing awesomeness. Therefore the numbers are wrong.”

In my own experience, this happened to me in 2008 when it took me longer to accept that McCain would lose to Obama than was otherwise justified by the data. I did end up making a profit on the election by eventually coming around, but had I been more willing to dispense with my own biases, I would’ve been more successful. Lesson learned: Skepticism is healthy; biases are not. This is harder said than done, because a bias-less person is someone I have yet to meet.

I also draw lessons from big defeats, and I’ve had my share. Perhaps my most embarrassing was my prediction that Hillary Clinton would not be the next Secretary of State. I had reasoned it out in my mind: They hated each other; Hillary would never accept it; and Obama would never offer it. Three strikes against it, not a chance. And so I sold around $7,000 worth of shares to my fellow traders at 4-1 odds that Hillary would not be the next Secretary of State. Not only was she offered and did she accept this cabinet post, but she has done a stellar job by all accounts. There are two additional lessons I learned from this loss: You cannot be arrogant or overconfident in your own predictive abilities, and you should not risk a large amount on what is essentially the whim of one person.

Reporters are Vital, Become One if Necessary

Having knowledge is important. If that seems a bit obvious, here’s the longer version of that sentence: You want as much knowledge of the event in question as you can possibly fit into your brain. Beyond the raw numbers from polls and other sources, virtually the entirety of political prognosticating relies upon information gathered from reporters and your own research. The key here is siphoning the good information from the bad.

Reporters are vital, especially great local reporters. They have insights from experience. One single tidbit of information — usually in the form of tweets at this point — can give you a significant edge, especially if others do not pick up on it.

Pundits are white noise that should only be used as a proxy for what everyone else is currently thinking; it can be — and usually is — dangerous to put too much stock into people who are generally there to entertain rather than inform. I will say there are two (and just two) exceptions to my general dismissal of punditry: Mike Murphy (Republican) and James Carville (Democrat). I will listen intently when either of these two men are talking.

In some instances, though, relying on reporters isn't enough: You have to be the reporter and find the story. It was in that vein that I teamed up with a friend to find out the next vice presidential nominee in 2008. The rally to announce the VP was scheduled to take place on August 29. No one besides close aides and possibly reporters who had been sworn to secrecy knew who John McCain would pick as his running mate. We knew, though, that the information existed somewhere, that a pick had to be made before the rally, and we were determined to find it.

On August 28, we started by calling Tim Pawlenty's office. We asked for his schedule the next morning. A fair and a radio interview was the response. Possibly a cover story to nosy reporters. We called the fair and asked if he would be there; he would. Next was Jindal. We confirmed that he had a conflict and reconfirmed. On we went down his list — Lieberman, Romney, and on and on — until his frontrunners and long shots had been exhausted without a definitive answer. Finally late that night, possibly that morning, it dawned on us: The vice president cannot magically appear. The person has to physically arrive at the location via some method. With the airport being the most logical choice, we brought up a website that tracks flights coming in and out of the closest airport to the Dayton, Ohio, rally. And there it was: a private jet coming in from...Alaska. Sarah. Palin. That was a $25,000 victory, and done through hard-nose detective work.

Incidentally, it has been revealed that a single trader on Intrade figured out Paul Ryan would be the vice presidential nominee this year and made a windfall profit. Concerned with some form of political "insider trading," Intrade talked to the person to get his/her story and it checked out. It is little known beyond the Intrade community that members are now two for two in figuring out the secretive vice presidential picks before the press corps — if only by a few precious hours.

Losing With Huntsman

If we flash back to the halcyon days of early 2010, the Republicans were on course to winning sweeping congressional victories and the speculation phase for 2012 was just beginning. It was during this time that I did my deep dive into who the Republican candidates could be. We knew of Romney and we knew of Pawlenty (who were all but announced candidates for the Republican nomination). Beyond that it was a grab bag of Republican politicians, none of whom were very appealing. I didn't much care about which fringe candidate was or wasn’t going to announce (a litany of which would eventually do so); I needed to find potential winners.

I did my research on Wikipedia and YouTube. I went through every list of potential candidates and read their biographies. I looked beyond potential candidates into people nobody was talking about. I canceled out the ones who couldn't run or wouldn't run. From the list of the could-runs and could-wins, I began watching on YouTube. Photogenics mattered, likability mattered, organization mattered, and popularity mattered. Policy, not so much. Policy is malleable, spinable. The 2012 version of Romney is no better example — or the 2012 version of Obama, for that matter.

From that research, I found two candidates who I thought would make formidable Republican standard bearers: the current Texas Governor Rick Perry and former Utah Governor Jon Huntsman.

Rick Perry had made Sherman-esque statements declining to seek the Republican nomination, and I took him at his word. This was not the smartest move in hindsight; Perry was widely available for over 100-1 odds during the early months of the campaign before briefly becoming the frontrunner in September of 2011 after he made his surprise late announcement. He fell equally quickly once he stepped onto the debate stage.

Jon Huntsman, meanwhile, was over in China in 2010, the current ambassador. I deemed his candidacy a long shot for logistical reasons if nothing else, but I began buying hundreds and thousands of Jon Huntsman shares at odds of 900-1 through 200-1, bearing in mind with great clarity that he was currently working for the Obama

administration. By December 2011, I probably had done more research and put more thought into Huntsman’s potential path to the nomination than anyone except John Weaver, his eventual strategist/campaign manager. Yes, probably more thought than Huntsman himself. I had mapped it out in my mind: He would resign in the spring; he would announce 90 days later. He would run the McCain 2000 strategy: Ignore Iowa, camp in New Hampshire. Yes, he did these things, but as we know now, the idea of his path to the candidacy and the implementation of his path to the candidacy were two things entirely.

It did not enter into my trading calculus that he would utter these words in his announcement speech: “We will conduct this campaign on the high road. I don't think you need to run down someone's reputation in order to run for the office of president,” essentially ignoring the zeitgeist of Republican hatred for Obama’s policies that had swelled the ranks of Congress with freshman conservatives. In my calculus — in my campaign I had dreamed up for Intrade — Huntsman had slammed Obama on kowtowing to China in his announcement speech, an opening foreign policy salvo that would invigorate the base and pique the interest of John McCain and other moderate Republicans that this candidate was for real. I pictured a flexing of muscles that no other Republican candidate possessed: foreign policy credentials. It never came to pass, but I did continue to trade the Huntsman prediction, buying him at odds of 30-1 and 20-1 in great numbers, having faith in his New Hampshire strategy and a change in tone that would jump-start his efforts. After all, with Pawlenty inexplicably dropping out after the Ames straw poll, Romney and Huntsman were the only two electable Republicans remaining in a race more reminiscent of a clown car than a field of presidential candidates. The final nail in the Huntsman coffin eventually came with the move by Florida to a January primary, which led New Hampshire to move forward its election by one month in retaliation. This cut his campaign time by four vital weeks in the state he had to win. It probably would not have made much of a difference in the end: Romney beat him in New Hampshire by 22 points.

Failures in campaigns like Huntsman picking the wrong tone become all the more apparent when you have money on the line in the form of predictions. Your senses are heightened to missteps. The Giuliani failure of 2008 is well-known (he chose to skip the first three states and compete in Florida, which backfired), but there are two recent political miscalculations that stick in my mind largely as Intrade memories. One is Hillary’s decision to campaign in the Iowa caucuses in 2008, a state she would lose to Obama (and in fact finish third, behind John Edwards). Had she instead ignored the state and won big in New Hampshire, the air of inevitability would have never left. Hindsight is indeed 20/20, but were she to have skipped Iowa, I am fairly confident she would have been the nominee. The second example was John McCain’s decision, after the stock market crash in September of 2008, to support the bailout of the financial community. In not challenging the idea of this bailout, he passed up a key opportunity to differentiate himself from both George W. Bush and Obama, as well as to take a populist stand against the excesses of Wall Street. It might not have helped propel him to victory, but in my mind it could have made it a competitive race.

Intrade is Fallible

While Intrade offers up a summation of traders’ collective knowledge, the “wisdom of the crowd,” there is one shortcoming of the platform: the possibility for manipulation. Mind you, this isn’t a problem for traders because manipulators often offer non-manipulators prices that they would otherwise never see. Such manipulation occurred in October of 2008 when a “rogue trader” inflated McCain’s price relative to his chances of winning. This was done numerous times, usually in the middle of the night. It was a race to match his offers first, and many sleepless nights were had anticipating when he may show up. After the users prodded Intrade to investigate, it was revealed that this was a large firm hedging their risks of an Obama presidency — or so they said.

Similar claims are made this year that Romney’s price (35% at present) are inflated relative to his actual chances (Nate Silver’s 538 shows Romney’s chances to be 15% at present). It’s impossible to determine without the insight of Intrade itself whether this is a series of wide-eyed Romney optimists or a concerted effort to raise Romney’s prices. From experience and looking at the offers/bids, it’s probably the former. There seems a general sense amongst conservatives, one of which resides in my own family, that Romney cannot possibly lose. But again, what is a potential downside for Intrade’s predictive abilities is a boon to traders who can take full advantage of what they perceive to be bad pricing. Whether it is indeed bad pricing or not will be determined on election day.

The most oft cited criticism of Intrade lately is that the users badly missed the mark on the Supreme Court ruling for Obama’s Affordable Care Act. This is sometimes used as the silver bullet to dismiss Intrade’s prediction history entirely. The users rated the individual mandate aspect of the bill to have about a 75% chance of being struck down the morning of the ruling. I personally thought this was a bit overconfident myself and traded that way, but I also thought that the contract was priced in the right direction (that the mandate would be struck down). The mandate being struck down was also the general consensus among experts: One poll conducted of 56 former Supreme Court clerks and Supreme Court attorneys found that 57% believed it would be struck down. So while indeed Intrade was “more” wrong than most for some reason — perhaps a single user who rated the chances too high — it was not so far off from the general consensus that its predictive abilities should be dismissed. Intrade is nothing more and nothing less than traders combining their knowledge and their desire to make money.

Looking to Tuesday

While my predictions may change at a moment’s notice, I currently expect Barack Obama to be re-elected to a second term on Tuesday. I expect the race to be relatively close, in that Romney will win Florida, North Carolina, and pick off one of Iowa, New Hampshire, or Colorado.

I encourage you to visit Intrade on Tuesday and witness the price movements of traders like me working hard to decipher the latest kernel of information. We will probably end up effectively calling some states before the networks.