The Sound Of Money

Spotify, the music-streaming service founded by Daniel Ek, is now worth $4 billion after raising $250 million in a new funding round led by Technology Crossover Ventures. Spotify, which has 24 million active users but only 6 million of whom pay a subscription fee, double revenue last year to $571 million but still lost $45 million.

Hit The Brakes

Despite posting solid third quarter results — including a narrower loss, the sale of 5,500 cars, and an eightfold increase in revenue — investors sent shares of Elon Musk's Tesla Motors down almost 15% Wednesday on weak guidance for next quarter.

Net Gain

Netflix, led by CEO Reed Hastings, now has more U.S. subscribers than HBO and ranks as the most-watched cable network by certain metrics. Small wonder its stock is up about 300% this year and is one of the best performing stocks in the S&P 500.

Chairwoman

Janet Yellen made history this week by becoming the first woman to be nominated to chair the Federal Reserve.

Twitter Is Going Public

The social network, led by Chief Executive Dick Costolo, made official what technology and financial pundits have been speculating for well over a year: that it will go public. Papers were filed with the SEC and an offering is expected later this year or early in 2014.

Dell Wins Dell

Michael Dell and private equity firm Silverlake Partners appear to have won the hard fought battle to take computer maker Dell private after activist hedge fund manager Carl Icahn dropped his competing proposal.

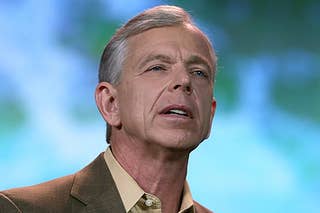

How Does $130 Billion Sound

Verizon, the company behind the ubiquitous "Can you hear me now" commercials, agreed to pay $130 billion to buy out partner Vodafone Group's stake in its U.S. wireless business.The deal, which ranks as the third-largest in corporate history, ends an often tense 14-year partnership between Verizon, led by CEO Lowell McAdam, and Britain's Vodafone.

End Of An Era

The impending retirement of Microsoft CEO Steve Ballmer within the next 12 months comes during a difficult time for the software giant.Microsoft is in the midst of charting a new strategic direction after losing ground to rivals and credibility with consumers. Ballmer's departure, along with a number of other senior executives over the last year, leaves Microsoft with more questions than answers.

Wrongdoer

As part of a settlement with the U.S. Securities and Exchange Commission, hedge fund manager Philip Falcone was banned from trading for 5 years and fined $18 million.Most significantly, and unlike in most of these types of cases, the founder of Harbinger Capital Partners was forced to admit to wrongdoing as part of the deal.

For Sale

After more than a year of denials from Chief Executive Thorsten Heins, BlackBerry said on Monday it was exploring a potential sale of the company. Once the dominant smartphone provider, BlackBerry has struggled in recent years and is now ranked fourth globally, according to research firm IDC.

Heavy Heart

Washington Post Co. CEO Donald Graham, pictured below with publisher Katharine Weymouth, announced the sale of the Washington Post newspaper to Amazon CEO Jeff Bezos for $250 million, ending 80 years of family ownership. Graham said the family weren't the best owners for the paper anymore.

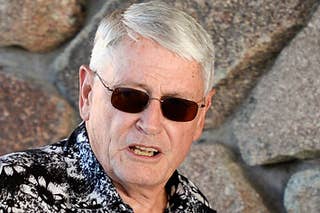

All Smiles

Two of the advertising industry's biggest companies, Omnicom and Publicis, announced a $35 billion deal over the weekend. The combination creates a behemoth with a combined $23 billion in revenue and vaults it above WPP as the world's largest ad agency.

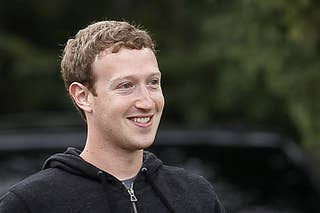

Upwardly Mobile

Shares of Facebook, led by founder and CEO Mark Zuckerberg, soared after the company reported blowout second quarter results Wednesday.Investors applauded the social network's gains in mobile advertising, which now accounts for 41% of all its advertising revenue.

This Man Is $600 Million Richer

Dan Loeb, the activist-investor who leads hedge fund Third Point, sold 40 million shares of Yahoo stock Monday, effectively ended his campaign against the company.Loeb made more than $600 million during his 21 month Yahoo crusade.

PC Problems

Shares of Microsoft, led by Chief Executive Steve Ballmer, ended the week on a dour note, down about 10%, after the software giant reported weak second quarter earnings that were impacted by the declining PC market and a nearly $1 billion charge for unsold Surface tablets.

Money Man

Goldman Sachs, led by Chief Executive Lloyd Blankfein, posted another blowout quarter, earning $1.93 billion, or $3.70 per share, for the three months ended June 30. Analysts were expecting the bank to earn $2.88 per share.

Vote Of Confidence

Michael Dell's offer to buy his namesake computer company received a huge boost Monday when proxy advisory firm Institutional Shareholder Services recommended investors vote in favor of his $24.4 billion bid. A vote on the deal is scheduled for July 18.

Shocker!

Zynga announced Monday that founder and controlling shareholder Mark Pincus would relinquish his role as Chief Executive Officer, bowing to investor pressure. The company hired Don Mattrick from Microsoft as CEO to steer a turnaround and position it for the mobile era.

Hanging Up

Shares of smartphone maker Blackberry lost roughly a third of their value Friday after first quarter earnings missed expectations. The company's market value has shed about $3 billion since Thorsten Heins took over as CEO in January 2012.

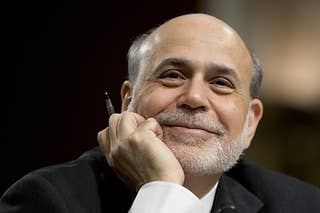

Time To Move On

Federal Reserve Board chairman Ben Bernanke may step down when his term expires in January, President Obama hinted in a PBS interview Monday. Bernanke has been Fed chairman since 2006, staying "a lot longer than he wanted or he was supposed to," said President Obama.