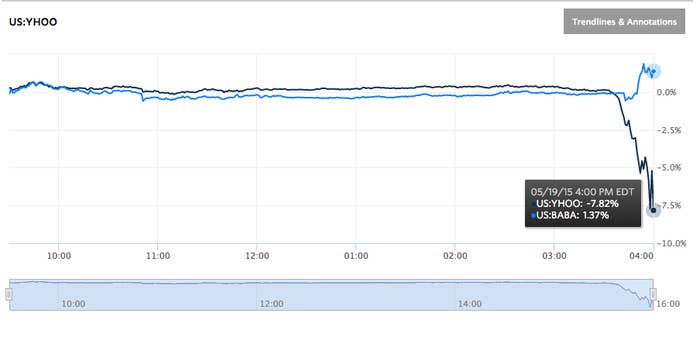

Yahoo stock fell 7.6% to $40.98 a share today, with the plunge happening in the final half hour before the market closed.

Also in the dying minutes of the day, shares of Alibaba, the Chinese e-commerce giant in which Yahoo owns a large stake, rose 1.3% to reach $88.21. Yahoo plans to shed its Alibaba stake through a tax-free spinoff later this year.

The stock moves may have been linked to comments from an IRS official, made at a D.C. Bar Association event. The comments suggested the IRS may hold back on approving spinoff deals like that of Yahoo's stake in Alibaba, Bloomberg reported.

The comments were first reported by Tax Notes, which published an article at around 2:45pm, and sent out an alert for the story at about 3:30pm. Yahoo shares began falling minutes later.

this is the $YHOO "news" that twitter seems to have not figured out yet:

Yahoo did not immediately respond to a request for comment.

According to the reports, Isaac Zimablist, an official in the Internal Revenue Service's Office of Associate Council, told a Bar Association event that the agency may change rules that govern spinoffs like Yahoo's. For Yahoo to get a favorable tax treatment of the Alibaba shares contained in the new company, it needed to include an actual ongoing business.

When Yahoo first announced the spinoff, the company said it would include a "legacy, ancillary" business, that was later revealed to be Yahoo Small Business, which does marketing and online sales for small businesses.

The Wall Street Journal reported that the unit had more than 100 employees who would be able to join the spun-off company. The IRS must decide whether that's enough to meet the requirements.

"The issue comes down to whether we've dropped a hot dog stand or a lemonade stand into a business that is primarily publicly traded stocks, cash and other wonderful things that I call appreciated property," Zimbalist said.

Zimbalist said requests for rulings that the IRS has already received will continue on as planned, but that could change, according to the reports. When Yahoo first announced the spinoff, it said that it was conditional on " the receipt of a favorable ruling from the Internal Revenue Service with respect to certain aspects of the transaction and a legal opinion with respect to the tax-free treatment of the transaction."

A Yahoo spokesperson said in an email Wednesday morning that the company's spinoff of its Aliababa stake is continuing as scheduled and that Zimbalist's comments Tuesday were not "specific" to Yahoo's plans:

“An IRS representative stated Tuesday that the IRS plans to study its rules for issuing private letter rulings regarding the active trade or business requirement in spin-off transactions and will hold off processing new ruling requests. Yahoo understands that the IRS's statement is not specific to Yahoo's planned Q4 2015 spin-off of its remaining stake in Alibaba Group and Yahoo Small Business, reflects no change in applicable law, and does not affect previously filed ruling requests. Yahoo filed its pending ruling request with the IRS in Q1 2015. Yahoo continues to work toward completing the planned spin-off in Q4 2015.”