Lots of people are suddenly predicting that a recession is coming. President Donald Trump's in a trade war with China, the stock market is shaky, and the yield curve was briefly inverted — whatever that means. (It means interest rates on short-term bonds were better than rates on long-term bonds, signaling that investors are not confident about the economic outlook.) OK, sure!

If you have no grown-up memory of going through one, you might wonder, what IS A RECESSION, EVEN? And why are people scared? And when the recession comes, what will it be like? What is all this quasi-practical advice being flung around about paying down my loans now and updating my résumé for jobs I’m not even immediately applying for? You’re certainly not alone: About 40 million American adults (a lot!) haven’t experienced a recession since they started working, and these are big and valid questions.

We’re here to help. BuzzFeed News spoke to New York University’s Mark Gertler and Stanford’s Pete Klenow, directors of the Economic Fluctuations and Growth Program at the National Bureau of Economic Research, the research organization that officially dates recessions, about what to expect — whenever it happens. One of their most poignant observations: Many young people’s career development is stunted during a recession, and they can experience the effects years after the recession ends. Here’s what we learned.

millennials to Gen Z as the recession nears

First, here’s a human explanation of what a recession is.

On the broadest level, a recession is a sustained shrinking of the economy. Specifically, “a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales,” according to NBER.

The last recession, usually called the Great Recession, was a huge one — abnormally big, in fact. Lasting from December 2007 to June 2009, it was a period of decline not just in the US but around the globe. It was the worst financial crisis since the Great Depression. Ten years later, many people are still recovering from the impacts of that period, which include stagnant wages, delayed marriage and childbearing, and delayed retirement. “We had to work so hard to get back on our feet with two kids, after going from six figures to food stamps,” one reader wrote to BuzzFeed News, describing how the Great Recession changed their life. (There are a lot of incredible personal stories in that article, which you can find here.)

The good news is, of the 11 recessions since World War II, none hit with the severity of the last one, so there’s a chance it won’t be as bad next time. Still, there are things that all recessions, no matter their duration or depth, tend to have in common.

It can be fucking hard to find a job, no matter how hardworking, smart, or pedigreed you are. And it’s not your fault.

One of the biggest effects of a shrinking economy is a tough job market — really tough. The unemployment rate shot up to 10.8% in October 1982 and 10% in October 2009 . It was less severe in other recessions, rising as high as 7.7% after the 1990–91 recession, and over 6% after the 2001 recession.

When hiring freezes or layoffs increase, people who still have jobs stay in them, making it harder for anyone looking for work to find a position. One reader wrote, “My law firm laid off a bunch of lawyers and rescinded its offer to all its incoming lawyers. It took me 14 months to find another legal job, and even then, it was very low-paying because I felt like I needed to take any job.”

To make matters worse, your parents might say incredibly stupid shit about how you should go about finding a job. Be nice to them — they have no idea.

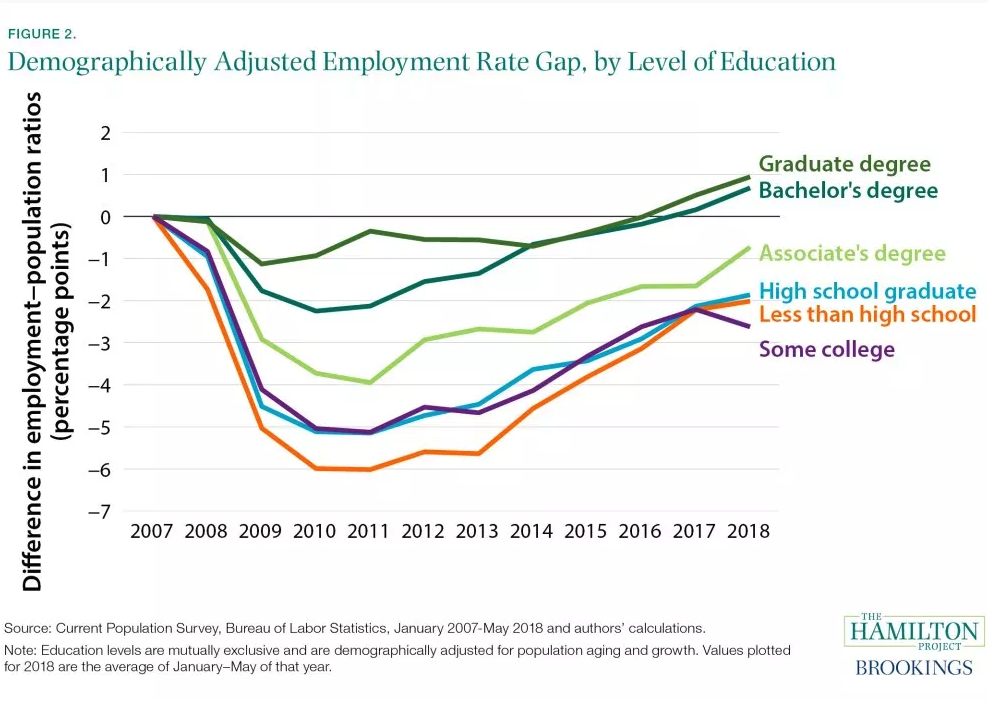

You might doubt the value of education, but recessions are hardest on people who don’t have college degrees.

“I never went to college, so I’m lucky enough to not have student loan debt. But I have plenty of other debt because I’ve had nothing but part-time job after part-time job,” one reader wrote. College-educated workers — who earn more during boom times — have better security in lean times. Stanford’s Klenow said that less-skilled workers who earn lower wages are at a higher risk of being laid off.

“College raises average lifetime earnings, and it also helps insulate workers from economic downturns, providing economic security in the times they need it most,” according to a report by the Brookings Institution.

If you’re just starting work, you’ll likely have lower wages than people who entered the workforce in better times. And it can stay that way.

“You get on a lower ladder if you enter the labor market in a recession, and your wages are affected for years,” according to Klenow, who said there is research that workers are “stunted” when they start their careers during a recession. Internships, part-time work, and gigging are hard ways to start off your work life. And they leave lasting marks.

The business you work for — or ones that you’re a customer of — might go through really tough times. They may even declare bankruptcy or close.

Companies already struggling with sales or debt may go out of business or declare bankruptcy. There are certain industries that are more sensitive to recessions than others. Sales of what economists refer to as “durable goods” — for instance, appliances, furniture, tools, cars and car parts, garden equipment, consumer electronics, and toys — tend to decline as people decide to hold off on buying or replacing these products. That means these companies, and their workers, are often vulnerable.

Your older colleagues may just retire early.

There’s some evidence that older workers who are laid off and find it difficult to find a job end up retiring early, said NYU’s Gertler.

One BuzzFeed News reader wrote about watching it happen during the last recession: “Dad got laid off after working for a great company for 17 years in 2008. He said it was one of the saddest times of his life. He used part of his 401(k) to help pay the mortgage, found full- and part-time work here and there, but being in the manufacturing field during the recession, he would get laid off again and again. He eventually had to retire early due to disability at 61 years old and used the rest of his 401(k) to pay off the mortgage.”

The exception is people who have a lot of their retirement savings in stocks, because if the stock market plummets, they may end up working years longer until those accounts rebound.

It will be harder for you to borrow money.

With rising unemployment and lower wages for many workers, banks often tighten their lending standards. Following the Great Recession, for instance, mortgage interest rates fell to historic lows — so it was cheaper to borrow money — but banks had raised their credit standards on loans, meaning that borrowing money was cheaper mainly for those with excellent credit.

Perhaps most profoundly, you’ll find it hard to feel secure.

This impact is emotional, and for some, it lingers long term. As one reader said: “I’m doing well but still have anxiety about my and my family’s financial situations. I don’t know if I can ever feel fully secure in that regard. I learned a lot from that time and try not to look back with resentment of the idea that people a little older than me and people a little younger than me had a vastly different experience. I’ve only slowly recognized the effect that period had on me and my entire future, but I learned you can only move forward.” ●