Baby boomers are now ages 55 to 73; to housing economists, this fact means millions of homes will hit the market in the next couple of decades “as their current owners pass away” or move in with their children or into assisted living, according to a new and utterly macabre report by real estate search platform Zillow, just in time to make Thanksgiving incredibly awkward.

Does this flood of supply mean housing prices will plummet to more affordable levels? Not likely, unless you’re looking to live in popular retirement destinations or cities with a large elderly population like Miami, Orlando, and Tampa in Florida, or Tucson, Arizona. Still, it will relieve some of the upward pressure on prices created by the current supply shortage.

“The number of extra homes opening up via boomers aging out will be comparable to the extra wave of supply built in the heady days of the early 2000s, which eventually contributed to inventory overhang in many metros,” Jeff Tucker, an economist at Zillow, told BuzzFeed News. “These homes will also be more affordable to a broader range of buyers than most newly built homes, due to the diversity of building ages and conditions.”

Zillow estimated over the next 20 years, 27.4% of owner-occupied homes will hit the market, much of it in or near city centers rather than in the outer rings and suburbs, where new homes tend to be built. About 55% of owner-occupied homes in the US are owned by residents aged 50 or older, according to the site. “As these households age and begin vacating housing, that could represent upwards of 20 million homes hitting the market through the mid-2030s,” the report stated.

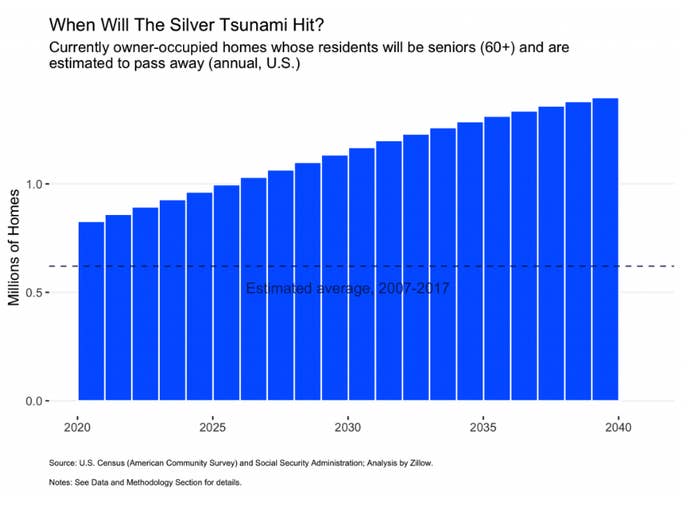

From 2017 to 2027, Zillow estimated, 920,000 homes will be released into the market each year by seniors aged 60 or older; from 2027 to 2037, it predicted, that number will rise to 1.17 million homes per year.

Don’t expect prices around the country to plunge though — the impact will vary depending on the market. Well-known retirement destinations “will experience the most housing turnover,” according to Zillow, and “regions including Cleveland, Dayton, Knoxville and Pittsburgh are also more likely to see bigger effects” as young residents have moved out in recent decades to pursue better job opportunities.

Meanwhile, fast-growing cities with affordable housing stock, like Atlanta, Austin, Dallas and Houston, will see minimal impact as boomers age. Still, the report stated, “homes coming onto the market in high-demand areas — if combined with local changes to land-use policy that allow for more density — could spur more construction of small- and mid-sized multi-unit properties by providing developers more opportunities to acquire lots (and by making it easier to assemble them into larger ones).”