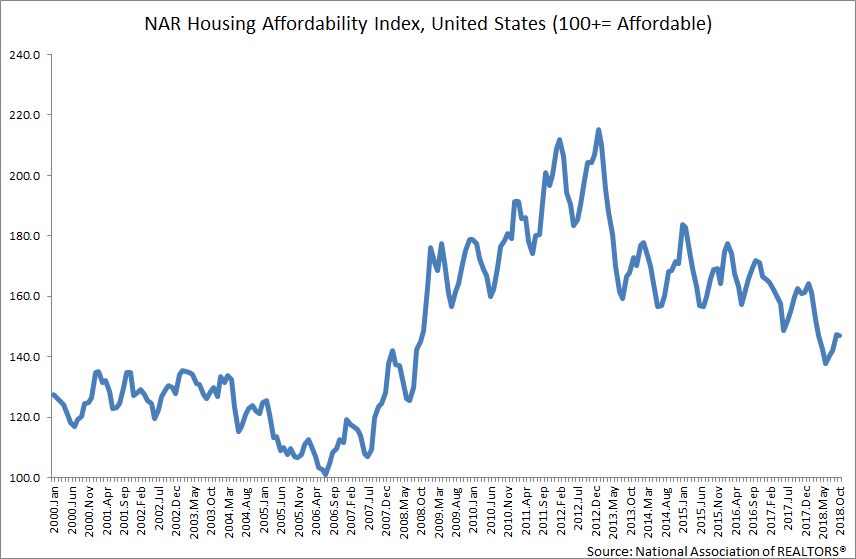

Despite low unemployment, housing affordability in the US continues to get worse for potential buyers, according to monthly data released today from the National Association of Realtors. And things aren't expected to improve for buyers anytime soon either.

"Affordability will continue declining in 2019," said George Ratiu, director of quantitative and commercial research at NAR, as "prices and interest rates are expected to increase."

The trend is of particular relevance to millennials, who despite having been labeled as a generation of renters, have started buying homes in larger numbers as they've gotten older, according to a recent post by a senior economist at the financial services company First American.

NAR's Housing Affordability Index, which measures whether a median-income family earns enough to qualify for a mortgage loan on a median-priced house, fell to 146.9 in October from 162.7 a year earlier (the lower the number, the worse the affordability). The median household income is now $77,000, according to NAR.

"The main reason for the decline is the one-two punch of rising home prices and increasing interest rates, which have made borrowing money more expensive in 2018," Ratiu said. Interest rates have increased to 4.9% recently, from 3% to 3.5% in recent years, which significantly impacts a homeowner's monthly payments.

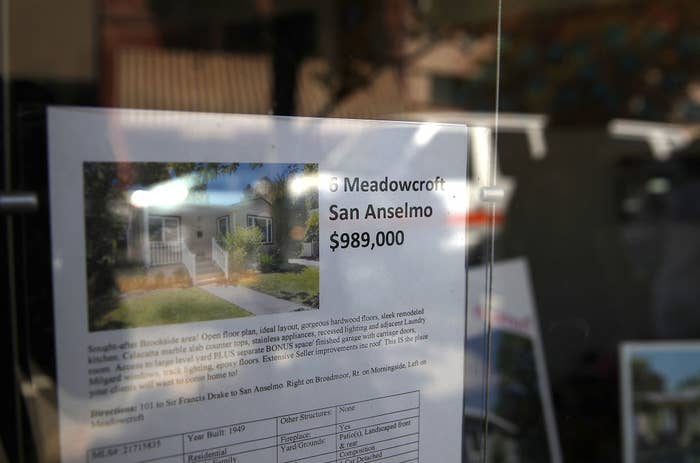

Regionally, affordability continues to be worst in the West (index at 105.3) and best in the Midwest (index at 185). In San Francisco, for instance, where the median price for a condo is $1.2 million, one recent survey found that most millennials will have to save for 20 years to buy, based on current income and saving rates. Worsening affordability already has slowed down the US housing market, although it looks like it will get worse yet.

NAR projects existing home prices will increase by 2.5% in 2019, a more moderate increase than the 4.7% rise in 2018. Mortgage rates are expected to average 5.2% over the year.

Housing affordability for renters and buyers is becoming a crisis in cities around the country. Local governments have been seeking solutions, and residents in multiple states voted on affordable housing initiatives last month.

There is some cold comfort: Ratiu expects the decline in affordability will moderate if home prices rise at lower rates and incomes continue to rise. And mortgage rates (despite having recently gone up) are still low by historical standards, so affordability remains better now than it was back in 2000, when mortgage rates were averaging about 8%, he said.