British lawmakers are launching a formal inquiry into “deeply troubling” questions raised by the FinCEN Files, a global money laundering investigation based on documents BuzzFeed News shared with the International Consortium of Investigative Journalists.

The investigation revealed how the giants of Western banking move trillions of dollars in suspicious transactions, enriching themselves and their shareholders while facilitating the actions of terrorists, kleptocrats, and drug kingpins.

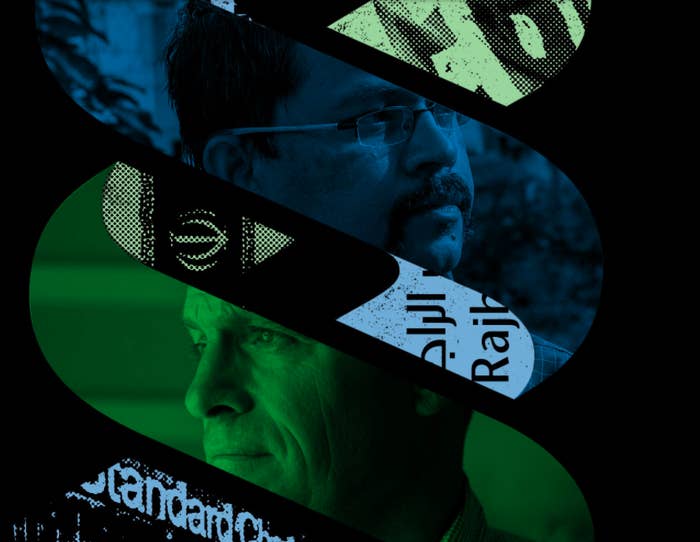

The documents included many revelations about the British financial system and some of its largest banks, including HSBC, Standard Chartered, and Barclays. Money launderers often use British shell companies to move their cash thanks to the country’s lax company formation laws. The UK’s problems are so extensive that a secret US government report described the country as a “higher-risk” jurisdiction for money laundering.

Parliament’s Treasury Committee announced the inquiry just after midnight local time on Friday.

Mel Stride, the committee’s conservative chair, said the inquiry will examine what progress government regulators and law enforcement have made in preventing money laundering.

“It’s important that the relevant bodies are held to account and scrutinised effectively to ensure that the UK is a clean place to do business,” he wrote in a statement. British parliamentary inquiries typically gather evidence via both written and oral testimony, much of which is made public, before issuing a final report.

When the FinCEN Files investigation first came to light in September, Stride declared that its findings were “deeply troubling” and sent a series of questions about it to key government agencies. Stride released the agencies’ formal responses to those letters on Thursday.

The Financial Conduct Authority, which oversees banks operating in the UK, said it had written to all of the banks named in the FinCEN Files to ask for further information, and said that in the event of any “serious suspected misconduct,” it would open its own investigations.

James Brokenshire, the government’s minister of state for security, wrote in a response to Stride that the Home Office and the National Economic Crime Center were “carefully considering the allegations” contained in the FinCEN Files to “see what more should be done.”

The FinCEN Files investigation was based on thousands of “suspicious activity reports” sent by banks to the Financial Crimes Enforcement Network, the US government agency charged with preventing money laundering.

Responding to questions about whether the FinCEN Files had resulted in banks filing fewer SARs, Brokenshire said law enforcement “have not raised any concerns” over the submission of suspicious activity reports. In the week following publication, “SARs continued to be submitted at, or above, their normal rate.”