Day care expenses or mortgage payments? Bills or birthday celebrations? Breakfast with or without bacon?

These are the strategic financial decisions agonizing roughly 800,000 federal workers as they miss their first full paycheck on Friday — the 21st day of the partial government shutdown.

Many of the federal employees who have been furloughed or are working without pay have said that they live paycheck to paycheck, and are using quick math and gut instinct to determine whether they skip a mortgage payment, let a credit card bill go unpaid, or short their student loans, car loans, utilities, phone, internet, and day care expenses.

Several federal workers who spoke to BuzzFeed News on the eve of missing their first full paycheck described the agony of these decisions. Many are the primary income earners in their families and are supporting young children.

The shutdown will be the longest in the nation’s history on Saturday, and there is no clear end in sight. It is a political crisis created by President Donald Trump, who said he won’t reopen the government until he gets money for a wall along the country’s southern border.

One furloughed parent told BuzzFeed News that she might not pay her phone bills in order to pay for her children’s day care for fear of losing valuable spots once the government reopened.

“I'm borrowing from my future just to pay for my present."

Some parents, like Kevin Cason — a 39-year-old Navy veteran who works for the International Trade Commission and has two young children — didn’t have that choice.

This Friday’s paycheck would have usually gone toward his mortgage and day care. The mortgage payment is due in a few days, so, Cason said, “We’re taking our kids out of day care next week.”

Parents also told BuzzFeed News they are struggling to explain to their kids why mom and dad aren’t going to work every day, why breakfast is just a few eggs, or why they’re spending more time at home to save on gas.

A federal employee for a library who spoke to BuzzFeed News on the condition of anonymity said she had been planning to take $300 out of Friday’s paycheck to buy a textbook for her online MBA course. Without the paycheck, she had to extend her extensive student loans to afford the book.

While she had previously cut back her hours working a second job at a gym, the library employee said that she recently called the gym “groveling” for hours she could cover during the shutdown.

T.J., a 29-year-old scientist with the EPA who declined to use her full name for fear of repercussions at work, told BuzzFeed News that she was taking money from her retirement account to pay for her bills.

“I'm borrowing from my future just to pay for my present,” she said.

Some furloughed employees didn’t want to talk politics. Others told BuzzFeed News that they were angry at being used as pawns in political games. But all of them felt increasingly depressed and demoralized about not being able to do the jobs they were passionate about.

Here are how seven federal employees and their families will be hit after losing their first full paycheck.

Kelly Cardwell-Roman

Kelly Cardwell-Roman had to explain to her 4-year-old daughter why they were suddenly only eating eggs — and no bacon — for breakfast every day.

“Well, the bacon is $7, honey. We’re gonna go with eggs every single morning,” Cardwell-Roman said.

For the 35-year-old park ranger in New York, having only eggs and cheese for breakfast is not the biggest concern at the moment.

Cardwell-Roman, who has been a federal employee since 2001, is the primary income earner for her family of four and is likely going to miss her paycheck, which will come on Tuesday. Her husband works for a farm equipment company distribution center and doesn’t earn enough to cover the family’s day-to-day expenses.

“I need to figure how I’m going to feed my family and which bills I’m not going to pay,” she told BuzzFeed News.

“I’m probably not going to pay my phone bill,” she said. “Paying for child care is more important because I need to make sure my kids have someplace to go to” when the government reopens. She’s trying to bargain with her 1-year-old son’s day care provider to waive their fee for the week.

She used her last paycheck to stock her freezer with groceries. One of her friends whom she assisted in his time of need is returning the favor by helping her pay for groceries on Thursday, she said.

Cardwell-Roman said she was also seriously looking into whether she qualifies for unemployment and food stamps. She is also doubtful that her bank is willing to help her out with the mortgage payment. Her student loan company did not help ease her financial woes.

“It’s been stressful,” Cardwell-Roman said. “I didn’t want mine to be the family to bring back the Christmas presents. We can survive with eggs and cheese. I’m not going to tell my kids that Santa needs to take back their presents.”

Kristian Gamble

As an employee with the National Oceanic and Atmospheric Administration (NOAA) for nine years, Kristian Gamble’s job usually involves dealing with the weather and fisheries.

On Wednesday, however, Gamble was preparing to address 250 envelopes in calligraphy for a party in New York City. She will be paid $600 for the job, money that is crucial to the 50-year-old single mother of a 7-year-old boy in Maryland.

Gamble started calligraphy as a hobby, helping out friends with wedding invites. But now, she’s putting out feelers and looking for actual clients to monetize her hobby.

“It’s so weird to not know when I’m going to see money again,” she told BuzzFeed News. “It’s frightening.”

To cut back on expenses, Gamble said she tries to stay at home with her son as much as possible.

“I don’t go anywhere, so I don’t spend on gas,” she said. “I stay home, because if I go out, we’d have to stop for something to eat. I just can’t afford the little things we take for granted every day.”

She said her son had been noticing the changes in their lives and had started asking questions.

“I tried to shield him for the first two weeks, but this past week has been tougher,” Gamble said. “He’s noticing that I’m not going to work every day.”

Gamble said she didn’t take her son to the movies on the weekend to save around $30, which will go toward groceries. She hasn’t been driving him to see his friends, because that would mean spending money on gas. She makes pizzas at home.

Her son’s father, who pays child support money, is also a federal employee, Gamble said. “We’re all getting hit,” she said.

Fortunately, the before and after school center her son goes to has deferred the $500 tuition payment for a month. “They have a lot of federal employees,” Gamble said. “It was amazing.”

Because it’s uncertain how long the shutdown will last, she’s subscribed to a couple of job websites.

“It kills me,” she said. “I’ve spent 10 years with the federal government because I want a pension. I don’t want to leave and go back to the private sector.”

Courtney Groeneveld

Courtney Groeneveld, 39, and her husband, 43, — both federal employees — just had their third baby in July. Now they’re considering removing their 5-month-old from day care because of the $1,300 monthly payment.

But that’s a risky move. Getting into day care is “really hard and expensive” in the crowded DC area.

“We would likely lose our spot, and it’s also unfair to the day care provider who would lose a big part of her income,” Groeneveld said.

Groeneveld has been a federal employee for eight years for an agency that supports sustainable fisheries and healthy habitats. Her husband, a 12-year federal employee, works for an office that regulates toxic substances.

Even when Groeneveld and her husband were working, having three kids was “really expensive.”

Now, they’re reconsidering celebrating their daughter’s 6th birthday at a climb zone area.

Groeneveld said she’s filed for unemployment and is going to request her student loan company, car loan holders, and cellphone company defer her next payments.

The family also has two mortgages. Groeneveld said that the mortgage company told them that it wouldn’t charge late fees or send their account to a collections agency if the couple didn’t pay in January, but that they would have to pay two months’ worth next month.

If the shutdown lasts longer than that, the company said it hadn’t decided what it was going to do.

The family is trying hard to avoid digging into their savings because after the last shutdown, in 2013, it “took a lot of time to get back to where we had been,” Groeneveld said.

The couple is also not confident about getting back pay like with previous shutdowns.

“We have two mortgages, day care expenses, student loans, etc. ... it's hard to keep our heads above water in the best of times, so that would set us back really far financially,” Groeneveld said. “Not working is frustrating enough — the thought of both of us losing out on weeks of pay is really scary.”

Apart from the family’s financial crunch, Groeneveld said the shutdown was “demoralizing and depressing.” She said that people who supported it saw federal employees as “disposable,” merely there to coast along and collect a paycheck.

But federal employees are all “hardworking and dedicated people,” Groeneveld said.

“It sucks,” she said. “I would like to be at work. I want to be doing my job. It’s depressing to be at home. My brain is atrophying. I don’t support the reasoning behind this shutdown. We’re just the pawns of this political game.”

Whitney Caskey

Whitney Caskey, 31, quit her job in December to prepare for her family’s upcoming move from Jacksonville, Florida.

Her husband, who works for the Coast Guard, moves every four years and the family needed to get ready for the stressful move in June.

“It was a bad time to quit,” she tweeted on Monday.

Caskey’s husband has been in the Coast Guard for 13 years and is one of the furloughed employees who will miss his paycheck on Friday. The Coast Guard is funded by the Department of Homeland Security and unlike other military departments that are under the Department of Defense, it is subject to the shutdown.

In her tweet, Caskey said her family lives “pay check to pay check with little saved.” The couple has two small children, ages 3 and 6.

“Usually we have a bigger budget to play with,” she said. “That we’re very on edge is an understatement.”

She is now looking for work at local restaurants “to hopefully pick up some of the financial burden we will be facing.”

Caskey said that while their landlord has been understanding, she fears that the electricity and phone company might not be that flexible for January’s payments.

“Our grocery budget might have to be cut in half,” Caskey said. The couple is also considering turning one of their two cars back in, using their phones and the internet less, and cutting back on all unnecessary expenses.

“It’s a disgusting feeling to be a pawn in a political game, to have your life and livelihood in someone else’s hands completely,” Caskey said. “[Trump] boasts about border patrol and border protection, but he’s not protecting the people who work for him.”

Luis Rodriguez

Luis Rodriguez has been working since he was 19. For the first time in his life, the 48-year-old Environmental Protection Agency (EPA) employee is planning to apply for unemployment after being furloughed during the shutdown.

Rodriguez, who has been with the EPA for 17 years, is a single parent supporting a daughter who is in college.

“The only income is mine,” Rodriguez said. “I’m going to use my little savings and then use my credit card and let’s see what we can do after that.”

Because the EPA continued to function a week after the shutdown, Rodriguez, like other EPA employees, will be receiving half his paycheck on Friday.

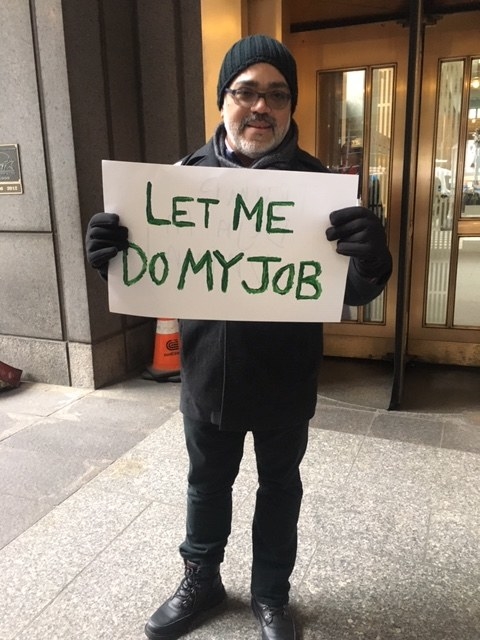

He said that he is trying to adapt to life during the shutdown by buying less and spending on only necessary expenses. Rodriguez was among around 15 EPA employees protesting the shutdown during a union rally on a bitterly cold Thursday morning in New York.

Referring to Trump’s claims that many federal workers support his border wall shutdown, Rodriguez said, “I want to get this clear. Nobody is supporting this idea.”

Jorge Rivera

Jorge Rivera, 51, has worked for the Bureau of Prisons in Guaynabo, Puerto Rico, for 26 years and is furloughed.

Rivera said he would have spent the paycheck he’s not going to get on Friday on basics like food, utility bills, and his mortgage, in addition to paying workers to continue repairs on his house, which was damaged during Hurricane Maria.

He said he has the materials ready to fix his broken windows but now can’t pay contractors to fix them.

“There’s no question, I was very fortunate to have been able to have bought those materials before the shutdown even kicked in, but I need the income to pay those who are professionals to install them,” he said.

Lydia Kenlaw

Lydia Kenlaw, a furloughed employee with NOAA, who said she is also a “pastor by vocation,” said it has been tough to “think about leaning on my elderly parents for possible loans” or “going into more debt.”

Kenlaw said that first paycheck would have gone to meeting her basic needs: “Mortgages. Food. Home equity line of credit. Just, you know, basics. Groceries. Basics of living, really,” she said.

Kenlaw, who noted that she was expressing her own opinion and not representing NOAA, said she was frustrated by the political situation. “When they came back [from the holidays] and nothing has happened, that’s — you know, that’s odd, and sort of a tough place to be. It’s almost like this wall is more important than people,” she said.