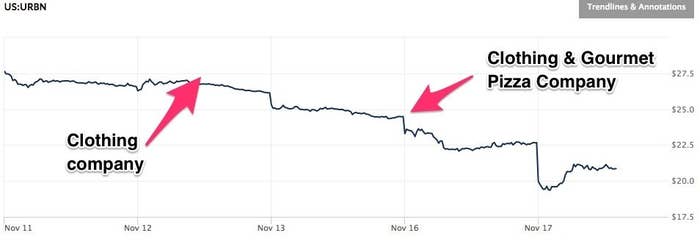

Urban Outfitters' stock closed at a six-year low on Tuesday, after the combination punch of reporting tepid earnings and announcing the acquisition of a gourmet pizza chain.

The acquisition of a group of Italian restaurants, including Pizzeria Vetri, was touted as a way to help drive traffic to stores yesterday, as well as a successful standalone concept.

"A big attraction of this concept is the enormous breadth of its appeal," CEO Richard Hayne said on an earnings call yesterday. "Very young to very old, everyone loves great pizza."

Academic research backs up Hayne's claim: everyone really does love great pizza. But Wall Street isn't shouting Mozzerella Tov just yet. Instead, the move has confused analysts and investors, and served as a warning shot for the retail industry.

The purchase represents an "overly optimistic solution to reverse a decline in sales momentum," Eric Beder, an analyst at Wunderlich Securities wrote today. He added that the company is facing a "crisis of investor confidence."

Worse, while the retailer's purchase might be viewed as a creative solution to declining foot traffic in malls, it served as "a form of affirmation that the traffic-dependent retail model is facing structural concerns," Simeon Siegel, an analyst at Nomura Securities, wrote in a separate note today.

That concern was reflected in Urban's stock: After falling 7.4% on Monday it tumbled another 3.8% Tuesday, closing the day at $21.80. That's the lowest closing price since July 2009. Urban has lost more than $300 million in market value in the past two days.

Urban Outfitters' purchase of the Vetri Family group of restaurants, which also includes higher-end Italian eateries in Philadelphia, cost less than $20 million, the company told Bloomberg News. The company's CFO, Frank Conforti, told the news outlet that it will spend only $1 million each to add new restaurants.

Hayne told investors yesterday that new locations "can be standalone restaurants or part of a larger retail complex."

Urban Outfitters reported sales and earnings that missed analysts' estimates, amid weaker-than-expected customer traffic — something Nordstrom and Macy's also noted last week. In addition the company, which also owns Anthropologie and Free People, has been dealing with a shaky transition to a new fulfillment center, and is recovering from missteps at the Urban and Anthropologie brands.

"We wonder what the overriding need was to invest the company's capital when they could have probably franchised the restaurant expansion," Beder of Wunderlich wrote of the company's decision to invest in the restaurants. "Frankly, it seems a poor use of company capital."