Sprint will pay almost $3 million in civil penalties tied to its handling of a program that levies an extra fee on consumers with low credit scores, the Federal Trade Commission said today.

Sprint sets an account spending limit for customers with bad credit histories, restricting how much they can rack up on their monthly bill. If the limit is exceeded, the company says, "your outgoing phone calls will be routed to our finance group for payment." For limiting how much the customer is allowed to spend, the company charges $8 per month.

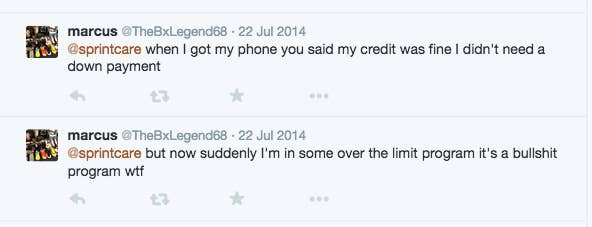

That fee can be waived if customers sign up for automatic bill payment. But according to the FTC, Sprint failed to tell consumers about the "key factors" that hurt their credit — as required by law — making it harder for customers to know how to improve their score and avoid the extra monthly fee. Sprint also allegedly waited to tell some customers they were in the $8-a-month program until it was too late to cancel without paying an early termination fee, the FTC said.

The conduct dates back to at least November 2013 and continued through at least June 2014, the FTC said. People will not receive refunds as part of the settlement, but Sprint will be required to notify customers about their enrollment in the ASL program within five days of signing up for service, or by a date that allows them to avoid recurring charges.

The penalty is connected to the FTC's "risk-based pricing rule," implemented in 2011, which requires companies to notify consumers when they use information in their credit reports to give them materially worse terms than most other customers. (As many have noted, it is expensive to be poor in America.)

Time Warner was fined $1.9 million by the FTC in late 2013 for failing to properly inform customers who were required to pay deposits or pre-pay their first month's bill based on less-than-favorable credit reports.

"Decisions about pricing based on consumers' credit histories can have a significant impact on consumers who may already face financial challenges," said Malini Mithal, acting associate director in the FTC's division of financial practices, on a call with reporters today.

The FTC "requires certain specific disclosures in specific formats be provided by letter to ASL customers and applicants," said a spokesperson for Sprint, which didn't admit or deny any of the FTC's allegations. "The FTC agreed that we were including almost all of the relevant information in our ASL letters, but requested that we modify the format of the letter," the spokesperson said, adding it has "already implemented the changes requested."