Buried in the footnotes of Bebe Stores' latest regulatory filing is a legal, if sketchy, instance of self-dealing with 75-year-old founder and majority owner Manny Mashouf.

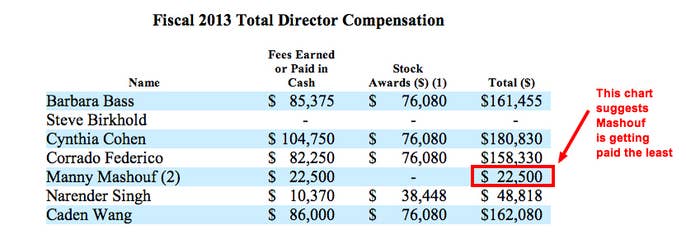

Mashouf was the chief executive officer of Bebe between 1976 and 2004, and he had a second stint as CEO from 2009 through January of this year. After months of searching, he elected to step down to non-executive chairman of the board after finding his replacement, Lacoste alum Steve Birkhold. Mashouf was paid $191,077 for the six months he was CEO through Jan. 3, 2013, and then $22,500 for the rest of the fiscal year through July 6 for his board role, Bebe said in a Nov. 1 filing. In a chart of the directors' compensation, it appears that Mashouf took a far smaller paycheck for his work on the board than the other six directors.

But in the fine print, it turns out Mashouf is the president of a consulting firm called SKID Holdings LLC, which started consulting with the board on Jan. 3 for $46,250 per month — that is, providing advice to the very entity he is already paid to be the chairman of.

SKID Holdings has never been mentioned in Bebe's filings before, or in connection with Mashouf, until this series of footnotes. Coincidentally, it was registered in Nevada in January, right around the time Mashouf took on his non-executive chairman role, state records show.

The payments add up to $277,500 for the six months through July 6, even more than what Mashouf made as CEO in the first half of the fiscal year. Bebe excluded that figure from the chart showing annual director compensation, and his combined annual total of just under $500 million isn't listed in the overall executive compensation chart either.

Multiple emails and phone messages to Bebe's investor relations department, public relations department, and chief financial officer's office were not acknowledged or returned.

"If he left the board and consulted, that's not odd, but to remain on the board and label yourself a non-executive chair and consult is," Charles Elson, director of the Weinberg Center for Corporate Governance at the University of Delaware, told BuzzFeed. "Transparency is critical in these sorts of things."

Mashouf, listed as the managing member and sole officer of SKID Holdings, resides in Los Angeles, though he may have a vacation home in Nevada, as per public records. He registered SKID Holdings using Corporate Credibility LLC, which helps people form LLCs, typically in order to save on taxes. Because Mashouf is in his seventies and just left the CEO post, it's possible he's using the entity for estate planning and distributing his wealth after he's gone.

"These kinds of related party transactions are kind of red flags for shareholders, " said David Larcker, a professor at Stanford's Graduate School of Business. "Good governance would require some discussion around that to fill in the gaps" versus just a footnote, he said.

It's unclear why Bebe wouldn't just disclose the payments outright, especially since Mashouf holds about 58% of Bebe's stock. The native of Tehran opened his first Bebe store in San Francisco in 1976 and brought the company public in 1998.

What adds to the opaque nature of the payments is that Bebe isn't exactly in a glowing situation, financially.

The retailer, which CEO Birkhold is trying to revamp as the shopping destination for partying "bad girls," has yet to recover the sales it boasted before the recession. Most recently, they fell about 9% to $485 million, compared with $629 million in the year through July 5, 2008. Furthermore, Bebe, which has around 240 stores, has reported an annual profit just once in the last four years.

Janney Capital Markets analyst Adrienne Tennant cut her buy recommendation on Bebe shares to the equivalent of a hold on Nov. 1, citing "ongoing sluggish mall traffic and consumer malaise."

The stock has rallied 41% so far this year to $5.62 through Nov. 4, after losing 52% to $4 in 2012.