Abercrombie & Fitch's stock took a nosedive this morning after the company reported dismal sales for the three months ended July 28.

"In the U.S., our best theory is while consumers in general are feeling better about the overall economic environment, it is less the case for the young consumer," Chief Executive Officer Mike Jeffries said on a call with analysts and investors today. "Youth spending has likely diverted to other categories ... We expect these effects will abate at some point."

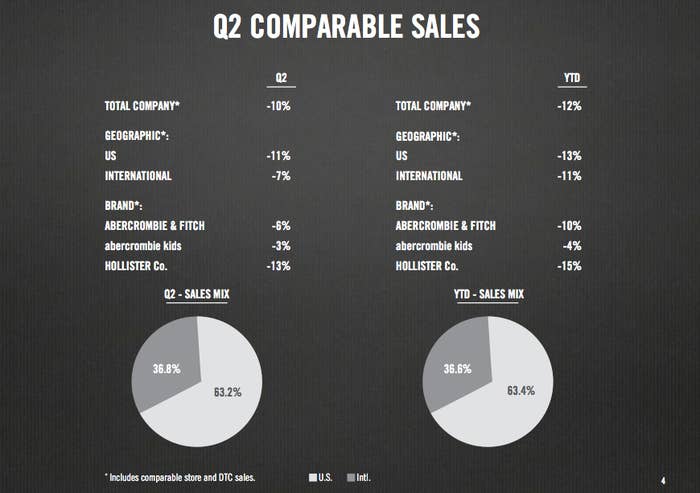

Sales at stores open at least a year and online fell 10% in the quarter and are down 12% for the year. Overall revenue for the second quarter was $945.7 million and profit was $11.4 million, or 14 cents a share. The shares fell 18% to $38.16 before the market opened.

American Eagle and Aeropostale have also had a rough summer, reporting similarly deep sales declines earlier this month.

Citigroup analysts pointed out in a note yesterday that the teen spending environment is challenged, with an unemployment rate of 23.7% for 16- to 19-year-olds and the payroll tax hike taking out an average $30 per paycheck, which represents 30% of a teen's discretionary spending.