"They finally got one for me, a Bloomberg terminal. This is a $24,000 system that gives me instantaneous access to all the financial information in the world," says Sloan Sabbith, played by Olivia Munn, in last Sunday's premiere episode of the final season of HBO's The Newsroom.

One storyline Aaron Sorkin and his writers plan to unspool over the course of The Newsroom's last six episodes is who is behind a hostile takeover attempt of Atlantis World Media, the parent company of the cable news network ACN that provides the show's setting. And the Bloomberg terminal gets a starring role in the reporting process.

"We knew early on that the fate of ACN would be on the table this season, and M&A [mergers and acquisitions] is a common occurrence in the media world, so the idea of a hostile takeover came up early," said Alan Poul, one of the show's executive producers in an interview with BuzzFeed News. "In working out story lines, we decided that if Sloan were an actual business reporter she would have a Bloomberg terminal, as it provides access to all kinds of information not available on the regular internet." (Munn's character, officially, is an economist-turned-anchor.)

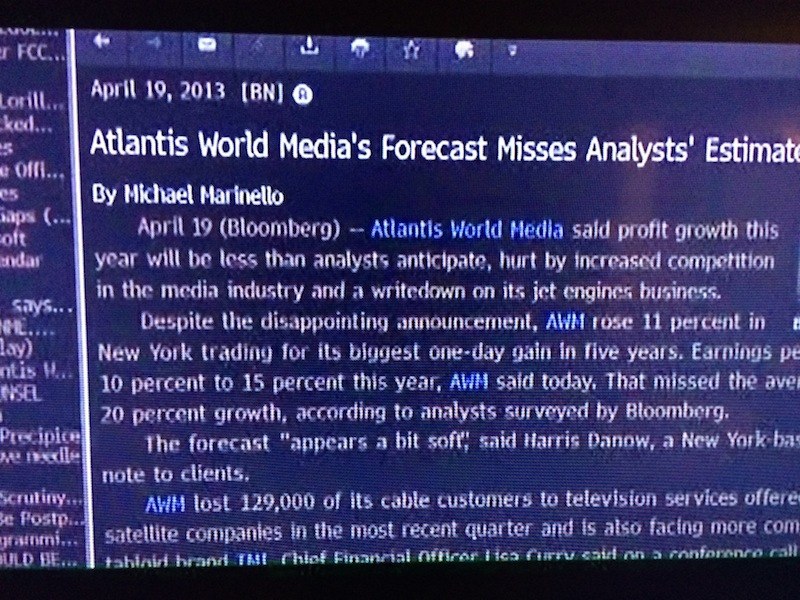

Indeed, since information on the Bloomberg terminal is proprietary, producers weren't able to duplicate or construct a newsfeed the way they do for clips of CNN, MSNBC, and Fox News that are shown on screens throughout the newsroom (most footage of news shows seen on The Newsroom is either obtained under "fair use" provisions or constructed from B-roll footage producers have access to through a deal with CNN). The show's producers asked Bloomberg for permission to feature the terminal, going so far as to have a representative from the former New York City Mayor's financial data giant, valued at more than $22 billion at last count, demo some of its features on set. They created fake screens to fit the show's plot — in one scene, a fake story about AWN's missed earnings report is shown; in another its stock chart; and in one glaring error early in the episode, Munn's character doesn't know the bombing at the Boston marathon occurred because she is engrossed in the Bloomberg terminal, but the service obviously would — and did — flash news breaks about the incident all over its wire and websites and TV network that day.

Poul and representatives for HBO and Bloomberg all said no money changed hands and that this wasn't a product placement. Michael Marinello, the Bloomberg executive who worked on the deal, described it as "branded entertainment" and said a company called Corbis Entertainment connected Bloomberg and the show, for which he paid them a fee to help oversee the project from the ground in Los Angeles.

The plot machinations and backstory to how Munn realizes that AWN is about to be targeted for a hostile takeover attempt are archetypal Aaron Sorkin in the worst possible way. But the gist of it is that she divines from the fact that AWN's stock price was up in trading despite missing quarterly earnings and a rumor that Goldman Sachs was jockeying for an adviser role on an upcoming media deal that her company was the one being targeted for a buyout. And, as a self-proclaimed puzzle lover, she identifies the potential acquirer as the step-siblings of Reese Lansing, played by Chris Messina, based on the fact that they become stockholders in the company upon turning 25 in a few weeks and a bad "relative" pun made a former student who works at a private equity firm, Savannah Capital, involved in the deal.

Got that? I didn't think so. I've been covering media deals for 14 years and I'm confused.

HOPEFULLY, more will become clear in episode four, where Poul said the Bloomberg terminal plays a role in another plot line where Munn's character uncovers through using it a clue that helps her figure out who is trying to buy the company.

Though fictional, the parallels to what is actually happening in the world of media dealmaking is uncanny. Media deals have made headlines this year, from Comcast's pending $45.2 billion purchase of Time Warner Cable to AT&T's $62 billion acquisition of DirecTV and Disney's $500 million purchase of Maker Studios.

But the fake deal on The Newsroom most resembles the real one that didn't happen between Rupert Murdoch's 21st Century Fox and Time Warner, which owns both HBO and CNN. While it has not been explicitly said or acknowledged, the real world corollary to The Newsroom's fictional ACN network is CNN, and Sorkin's aim is to present his ideal for what a non-partisan, objective, serious, global 24-hour news network should be. And ACN, like CNN, also struggles mightily in the ratings.

It just so happens Time Warner, successfully fended off an $80 billion hostile takeover offer from Murdoch's Fox this summer. It is either an amazing coincidence or a devilish inside baseball joke that the fate of Sorkin's fake media empire, AWN, rests in the hands of a dysfunctional extended family where the owner, played by Jane Fonda, and her son (Messina's character) are now pitted against the father's two children from his second marriage. The Murdochs aren't that bad, but they do have some unresolved family issues.

Poul said that Andrew Ross Sorkin, the founder of the New York Times' Dealbook and host of CNBC's "Squawk Box," who serves as one of many journalist consultants to the show, met with The Newsroom's writers and advised them on "hypotheticals" about how a deal would go down, though he stressed any similarity to real situations was purely fictional.

"Andrew was heavily involved in any discussions about financial story lines," said Poul.

Poul said that Ross Sorkin (no relation to the other Sorkin) and the show's writers and other consultants all agreed that Munn's character needed a Bloomberg terminal if her story line was going to involve chasing down the deal. When asked if a Reuters Eikon terminal or the Dow Jones wire service — the main competitors to Bloomberg — were considered or if either company was approached to be used instead, Poul said no.

"We all felt Bloomberg was the premium, sexiest service," Poul said.