This decade saw the rise of subscription services, Kickstarter-backed gadgets, and radical new ideas that aimed to disrupt every industry on the planet. Risky ventures were commonplace: Building a product from scratch, designing a new business model, and raising money based on faith in some prospective growth or feature were standard issue — and, under that framework, both tiny startups and tech titans that became victims of their own ambition.

The 2010s saw many tech flops. But what sets these failures apart is that they taught us something about how adept tech companies (and purported “tech companies”) had become at marketing themselves based on an optimistic future — and how much consumers and investors wanted to believe that the promised innovation was real. Here are the defeated ventures that defined the decade.

16. MoviePass (2011–2019)

MoviePass seemed too good to be true because it was too good to be true. Subscribers could watch an IRL movie a day for a month, all for just $9.95, less than the cost of a single ticket. Millions signed up. But the business model didn’t make any sense: MoviePass was forking over the full price to theaters, while its moviegoers were paying just a fraction. The deal didn’t last. In 2018, MoviePass said it was hemorrhaging tens of millions of dollars every month in an SEC filing. Plus, theaters, envious of the MoviePass’s success, created their own copycat versions and tacked on extra perks, like popcorn discounts.

In September 2019, the service shut down, but not before a massive data breach of customers’ credit card information. MoviePass, like many other VC-funded startups that focused more on growth than profits, dangled irresistible, subsidized prices in front of consumers. Eventually, someone had to pay full price.

15. First-generation Peloton (2014–2019)

When it first launched in 2014, the internet-connected stationary bike company promised to bring the same community and focus of cult cycling classes like SoulCycle into people’s homes. The original bike cost $1,995, plus a monthly $40 subscription to livestream spin classes, broadcast from the company’s New York studio, directly to the bike’s screen. Embedded sensors let spinners compare their stats to others' on a global dashboard displaying the efforts of hundreds of other at-home workout fiends.

Five years later, Peloton’s first fans were in for a surprise. The company announced that it would stop supporting first-generation bikes after updates caused touchscreen performance issues. While all classes would remain accessible, these customers wouldn’t receive any new functionality. The company offered replacement parts for $350, on top of the thousands of dollars already paid, not including the service’s monthly fee. The debacle was a good lesson for all early adopters: Not even luxury gadgets are immune to obsolescence.

14. Google’s Nexus Q (2012–2013)

During Google’s 2012 developer conference, wingsuit flyers wearing Glass prototypes, the company’s just-unveiled face computer, jumped out of an airship (twice!) and landed on the roof of the convention center, all while connected to a Google Hangout. Attendees were awed. Unfortunately, the spectacle couldn’t assuage the failures of the pricey new gadget, a media streamer called the Nexus Q that Google had announced onstage with great fanfare just moments prior. A free Q was given away to every conference attendee.

The Q couldn’t play anything from non-Google services, and the video buffering speed was terrible. It was also a $300 bowling ball. The New York Times reviewer said the Nexus Q was “wildly overbuilt” for how few features it had, and the product was canceled indefinitely in January 2013. But Google learned from defeat: The Q laid the groundwork for Google’s much more affordable — and successful — Chromecast.

13. Jawbone UP (2011)

The Jawbone UP was a very simple always-on activity tracker. It was the first to be worn on the wrist (Fitbit’s offerings at the time were limited to clips) and could measure activity, meals, and sleep. To sync the data to your phone, you plug it into your phone’s headphone jack (RIP). It was wonderful and easy to use — until suddenly, after a few weeks, the bands started to die.

And even though bands stopped functioning in droves, Jawbone continued to make them. The company struggled to diagnose the issue, and the replacement units broke, too. The user complaints piled up and eventually, several months later, the company paused production and offered a refund to all UP users.

The primary issue wasn’t just that the band was crap — Jawbone’s response was, too. The company first minimized the issue, claiming that only a minority of users experienced malfunctions (while nearly every gadget review site said it failed after a week), then failed to implement a long-term plan, while continuing to ship out shoddy bands.

12. Apple Maps (2012)

Apple decided that it had promoted Google Maps for too long as the iPhone’s default maps apps, and introduced its own, Apple Maps, featuring fancy 3D imagery and “flyovers” in iOS 6. The app was built entirely from the ground up, and the launch was a disaster. Some bridges were warbled. London looked like SimCity 2000. A farm was incorrectly labeled as an airport. Directions that led people over train tracks. Directions that required long-distance swimming.

The snafu was so bad that CEO Tim Cook was forced to issue a rare apology for Apple Maps’ shortcomings and pointed customers to alternatives while the company’s app was under construction. “We are doing everything we can to make Maps better,” Cook wrote.

Apple Maps isn’t totally terrible anymore. It has transit directions now. It promises to keep your whereabouts private unlike that other maps app. But a lot of folks were traumatized by AppleMapsgate 2012 and, when they need to figure out how to get somewhere, they go straight to Google.

11. Flammable Hoverboards (2015–2016)

The hoverboard, a two-wheeled, self-balancing personal vehicle, took over sidewalks in 2015. Every YouTube and Vine (RIP) influencer was crazy about them. A video of dudes dancing to Justin Bieber on hoverboards got millions of views. Rapper Wiz Khalifa was arrested for riding one in the airport. It was an epidemic that started with two warring hoverboard makers, IO Hawk and Hovertrax, and snowballed thanks to the millions of Chinese copycats that rushed to market.

That’s until the transports started bursting into flames, causing multiple homes to burn down. One fire claimed the lives of two young girls. The Consumer Product Safety Commission issued a stern safety warning and recalled over 500,000 units. The board’s popularity has waned, but old two-wheelers continue to cause damage, as recently as October 2019. The ultimate takeaway from the board catastrophe is an important one: Lithium-ion batteries are dangerous, and cheap, low-cost ones especially so.

10. Smart cards: Coin, Plastc (2014–2017)

“Smart” cards promised to slim down bulky wallets by combining multiple credit cards into one single piece of plastic. People loved the idea. At launch, Coin offered its smart card for $50 for those willing to preorder and wait. It hit its $50,000 funding goal in 47 minutes and sold 20,000 units within the first five hours. Plastc, a competitor, raised over $9 million through preorders.

Neither the hype nor the capital from backers was enough to get the products off the ground. Coin recipients had trouble swiping the card. Moreover, the card didn’t have a chip required at most point-of-sale terminals. Plastc never even shipped its hardware. In 2017, the startup announced that it was shutting down and being acquired by Edge, a fintech company working on yet another smart card. Edge offered Plastc and Coin backers a discount to preorder its upcoming product. Two years later, the “Edge Card” still hasn’t launched.

The smart card’s demise wasn’t completely the startups’ fault. Mobile payment wallets, like Google Wallet and Apple Pay, would later take over, consolidating credit and loyalty cards onto the gadget already in our pockets.

9. Amazon Fire Phone (2014–2015)

The smartphone is the most influential gadget of the decade and, in 2014, Amazon wanted in.

The company had already made popular gadgets: the Kindle e-reader and Fire TV media streamer. Why not a smartphone? CEO Jeff Bezos introduced the Fire phone in June 2014. Its standout feature was a 3D- and gesture-based interface that showed different content onscreen based on tilts and the position of your face.

While the Fire Phone was great for buying things on Amazon, it was awful at being a smartphone. It couldn’t install any Google apps (even though it was technically an Android phone) and the gimmicky sensor-based navigation was deeply confusing. Amazon announced it would stop selling the phone in September 2015, the same day Apple unveiled its new iPhone at the company’s annual fall hardware event. The company didn’t need a smartphone, anyway — it would go on to expand its online retail, cloud computing, and logistics empires, currently worth over $800 billion.

8. Cryptocurrency (2017–2018)

Bitcoin, the Internet’s first cryptocurrency, was hyped as the first currency that could be exchanged digitally, without the backing of any government, built on something called the blockchain. In late 2016, the price of Bitcoin started to grow, and grow, and grow. In June of that year, it was valued at over $2,900, marking a 500-fold increase over five years, and then briefly peaked at $19,511 in December. Profiteers rushed to acquire coins from dozens of different cryptocurrencies.

The bubble, which also saw the rise of other cryptocurrencies like Ethereum, minted overnight billionaires. Investors and opportunists rushed to buy crypto. Early Bitcoin holders who lost their passwords were devastated to forfeit tens of thousands of dollars' worth of the currency.

After that December 2017 peak, a crash ensued. Economists Joseph Stiglitz and Paul Krugman called the craze a “bubble.” Researchers said the computer power needed to mine it was bad for the environment, too. Plus, the crypto economy was ripe for fraud. Scammers disseminated fake news to manipulate the price of their holdings. There were a number of pump-and-dump schemes. Evidently, Bitcoin’s radical idea — a decentralized money built with a brand-new technology — was still prone to all the problems of a traditional currency.

7. Facebook (2004–ongoing)

You know, Facebook. The one that singlehandedly exposed the personal data of over 80 million people, disseminated more fake news than real news leading up to the election of President Donald Trump, and tanked traffic to news sites, thanks to its massive influence over the media industry. Among other things.

6. Coolest Cooler (2014–2019)

The Coolest Cooler, a $185 do-everything “portable party” accessory, included a blender, wireless speakers, a USB charger, and a bottle opener, among other impressive features. The product is the second-highest-grossing on Kickstarter, with over $13 million in funding from 62,000 backers, slated to receive the coolers in February 2015.

That date was pushed to July 2015, then 2016. Nearly 20,000 people still hadn’t received their product, prompting an investigation from the Oregon Department of Justice and a settlement with the agency in 2017. Coolest never shipped those orders and shuttered operations in December 2019. CEO Ryan Grepper said that customers could claim $20 of the $200 originally paid to the company.

People were convinced that the cooler really could do it all. But Coolest, like many Kickstarter projects, promised too much, and couldn’t do the one thing it was supposed to: ship something — anything — to those who believed in them.

5. Samsung Galaxy Note 7 (2017)

The Galaxy Note 7 was one of 2017’s most well-reviewed phones. Reviewers called it the “best” and “beautiful.” That is, until, devices started catching fire. Like the cheap, flammable hoverboards, lithium-ion batteries were to blame for the Note 7’s downfall. The difference was that the Note 7 was made by Samsung, one of the biggest battery manufacturers in the world.

The company was not typically associated with low-cost, low-quality components — it’s even a supplier for Apple’s iPhone. So when the batteries in Note 7 phones started exploding in planes, cars, and homes, longtime Samsung loyalists were surprised. Samsung cited poor production quality and uneven, or even missing, insulation tape as the reason. Then the replacement devices started exploding too. Two months after its launch, the Galaxy Note 7 was “permanently discontinued.”

Samsung’s reputation plunged after the recall fiasco, showing that a company’s image is defined by how it handles crises.

4. Apple AirPower (2018–2019)

The iPhone 8, introduced in 2017, was just an incremental update over its predecessor — except for one thing: a new glass back to accommodate wireless charging. Alongside the phone, Apple VP Phil Schiller also unveiled an unanticipated device, AirPower, a charging mat designed to power an iPhone, Apple Watch, and AirPods simultaneously, without cables. "Our team wants to make something I think all of us are going to want to use, and it might actually help move the entire industry forward," Schiller said onstage.

“This is not possible with current standards,” he continued. “But our team knows how to do this.”

The AirPower was due “next year” — but 2018 came and went. Then in late March 2019, the company made a shocking statement: The AirPower was canceled. Many had just purchased a $79 AirPods wireless charging case, which was introduced the week before the cancellation and included a direct reference to AirPower, in anticipation of the mat.

Apple had delayed products and software features before, but it was the first time it had outright failed to deliver a promised, already announced product. In a statement, Dan Riccio, Apple’s senior vice president of hardware, said, “After much effort, we’ve concluded AirPower will not achieve our high standards.” Some pointed to the multi-coil design, which was rumored to overheat. The whole thing was an embarrassing blunder for Apple, and sad for the rest of us who want to charge all the things without dealing with multiple stations or fraying Lightning cables once and for all.

3. Juicero (2016–2017)

Juicero was an extravagant Internet-connected $700 juicer (later lowered to just $400) that required proprietary produce packs sold separately through a subscription or at grocery stores like Whole Foods. The company raised $120 million in venture capital from firms such as Kleiner Perkins and Alphabet, the parent company of Google. David Krane, a partner at Google Ventures, said, “It’s the most complicated business I’ve ever funded.”

In April 2017, Bloomberg News published a video showing how the packs of pre-pulped fruits and vegetables could be squeezed by hand, rendering the pricey machine obsolete. Juicero’s CEO Jeff Dunn vigorously criticized the hack as “messy” and “mediocre.” But the damage had been done — the Wi-Fi juicer, already mocked for its price, became the poster child for Silicon Valley stupidity.

Investors were duped into pouring millions into an over-engineered machine. Add that to the fact that the product’s audience was essentially the tech elite — wealthy health nuts — and Juicero had created the perfect storm: a classic example of Silicon Valley creating tools for itself and “fixing” a problem that didn’t require a tech solution in the first place. Eat a peach.

2. WeWork (2010–2019)

Adam Neumann, the founder and CEO of WeWork, a commercial real estate and shared workspace company, charmed investors for the entire decade before meeting his day of reckoning earlier this year. Neumann used documents featuring sky-high projections to convince SoftBank and others that WeWork was not merely a real estate company, but a technology platform like Uber and Airbnb, and, most importantly, worth billions. The entrepreneur continued to raise capital despite a series of questionable moves, including illegally transporting weed on a private jet and acquiring the trademark for “We” and forcing WeWork to buy it for $5.9 million.

That is, until WeWork’s value plummeted 80%, from $47 billion to $8 billion earlier this year. The company nearly ran out of cash. Neumann stepped down as CEO in September 2019, and WeWork laid off 2,400 employees in November 2019. WeWork’s fall, detailed by the Wall Street Journal, was emblematic of both the boom-and-bust startup cycle and investors’ susceptibility to charismatic, larger-than-life male founders.

1. Theranos (2003–2018)

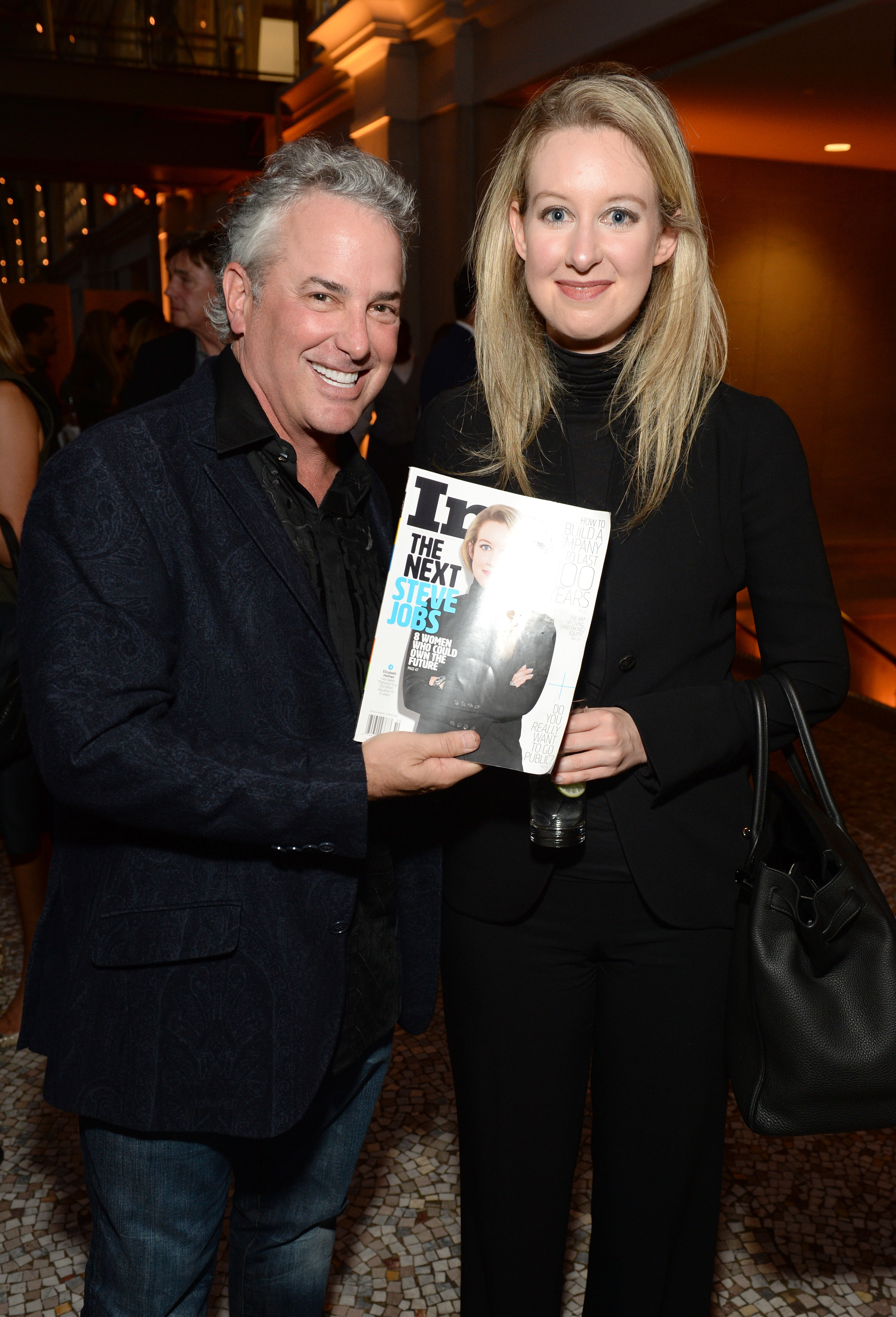

Theranos’s founder, Elizabeth Holmes, dropped out of Stanford at 19 to work on a blood-testing product that she claimed would revolutionize medicine. Theranos’s special machine, called the miniLab, could run hundreds of tests with just a few drops of blood. It could allegedly detect viruses like Zika and perform routine tests, like blood glucose measurement. It was also faster, cheaper, and more accurate than existing lab equipment, Holmes said. This was the first of many untruths the CEO told throughout the decade.

The hype surrounding Theranos’s technology was boosted by magazine covers for Forbes, New York Times Style, and Inc. featuring Holmes as an innovator and self-made billionaire. Theranos at its peak was once valued at $9 billion.

But it was all built on a lie. According to a complaint filed by the Securities Exchange Commission, the founder faked demonstrations for Walgreens executives by testing blood on outside equipment instead of its own before securing a contract with the pharmacy chain, asserting that Theranos technology had been used by the military in the battlefield (it hadn’t), and telling investors that the machine didn’t need FDA approval (it did). The miniLab also produced faulty results for patients in Arizona, where one woman was sent to an emergency room after inaccurate tests showed signs of an imminent stroke.

Holmes might have escaped scrutiny if not for reporter John Carreyrou of the Wall Street Journal, who published a series of stories that led to the company’s collapse. In June 2018, Holmes was indicted for wire fraud and conspiracy. The trial is set to begin in August 2020.

Theranos is a cautionary tale about companies built on the promise of a future technology, and the great lengths to which their overzealous founders will go to convince investors — and themselves — of that destiny.

Correction: John Carreyrou's name was misspelled in an earlier version of this post.