What's with Mitt's Mormon money?

The question began bouncing around the blogosphere following the midnight release of Mitt Romney's tax returns. According to the documents, Romney paid at least $4.1 million in tithes to the Church of Jesus Christ of Latter-Day Saints between 2010 and 2011. And the candidate's controversially low effective tax rate of just 13.9 percent was made possible, in part, by the hefty deductions he got for his charitable contributions to the church. (The church and other charities, in fact, got more money than the Treasury.)

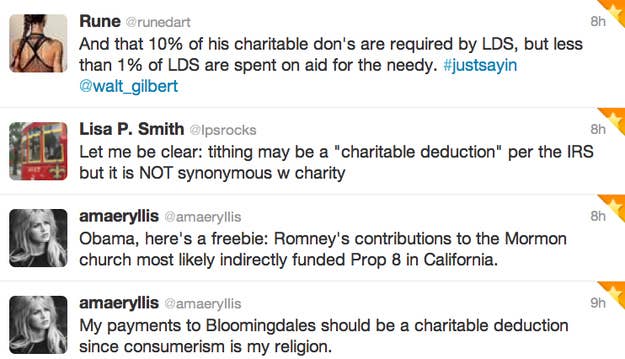

The massive tithing -- and deductions -- set off a flurry of confusion, outrage, and snark on Twitter in the wee hours of Tuesday morning.

The debate over whether religious donations should qualify as charitable deductions is an old one, typically separating churchgoers who benefit from the policy, and others who don't. But in the case of Mormon tithing--which is supposed to total 10 percent of one's income--the question is especially fraught because the LDS Church is still so little-understood, and because it has dabbled in the intense politics of same-sex marriage.

The church itself is not disposed to transparency when it comes to its money, offering very little in the way of financial disclosure. Instead, it offers on its website an upbeat fact sheet full of statistics meant to illustrate its charity and humanitarian work:

"In a typical year, the Latter-Saint Humanitarian Center will ship about 12 million pounds of shoes and clothing, 1 million hygiene kits, and 1 million pounds of medical supplies to relieve suffering in more than 100 countries," it says.

A large chunk of tithing money funds the church's expansive missionary program, which enables Mormon missionaries to both proselytize throughout the world, and provide community service such as free language classes, construction of clean water wells, disaster relief, and immunizations. It's also used to build churches, temples, subsidizes church education (including Brigham Young University), and funds youth programs.

But while Romney's tithing undoubtedly went toward a lot of traditional charity work, the issue is complicated by the fact that the LDS Church controversially engaged in one high-profile political battle in recent years: California's 2008 referendum on same-sex marriage.

Since Mormon leaders called on members in California and elsewhere to help pass a ballot initiative constitutionally banning same-sex marriage, the church has come under fire for providing "in-kind donations" to a political cause--by paying for the travel of church leaders organizing its efforts, and the like. Mormon leaders argue that, for them, Prop. 8 was a moral issue, not a political one. And the total amount spent on the ballot initiative came to $190,000--a small fragment of even Romney's tithing, let alone the church's total expenditures.

As a lifelong Mormon, it's likely that there was never time when Romney didn't tithe. In Mormon families, young children are often taught the principle by being encouraged to set aside 10 percent of their weekly allowance "for the Lord."

The practice is common, if not as uniform, across faiths, and Romney recently defended it on Fox News Sunday.

"If people want to discriminate against someone based upon their commitment to tithe, I'd be very surprised. This is a country that believes in the Bible. The Bible speaks about providing tithes and offerings. I made a commitment to my church a long, long time ago that I would give 10 percent of my income to the church. And I followed through on that commitment," he said.

"Hopefully, as people look at various individuals running for president, they'd be pleased with someone who made a promise to God and kept that promise. So, if I had given less than 10 percent, then I think people would have had to look at me and say, hey, what's wrong with you, fella, don't you follow through on the promises?"