"We do not expect to be profitable for the foreseeable future."

That might not be what investors want to see, but it's written out plainly in the S-1 filing for Box, a cloud storage provider that just filed to go public.

Many reports pegged the company to be burning through cash at a high rate, and the new filing essentially confirms that, with Box losing nearly $169 million in 2013. That number is also growing, up from a loss of $112.5 million in 2012.

Box's business relies on large enterprises buying space to store, transfer, and edit files through the web. It has another rather large competitor in the consumer space, Dropbox, and as such has focused much of its energy on attracting enterprise customers in the Fortune 500. Dropbox, which is valued at $10 billion and recently launched an enterprise service called "Dropbox for Business," is listed as a competitor in the filing.

Hence the spend — Box has to have a huge sales force in order to attract those big-ticket accounts. The company spent $171 million on sales and marketing, almost four times that of its research and development spend, in 2013. In 2012, Box spent $99 million on sales and marketing, compared to $29 million on research and development. The push comes in a myriad of forms, including a giant billboard off the freeway in the southern San Francisco Bay Area. (The idea of a Super Bowl commercial was kicked around internally, according to one source familiar with the discussion.)

Box's revenue is certainly growing, as the company brought in $124 million in 2013, up from $59 million in 2012. But even with its revenue doubling annually, it's still burning through its cash at a rather alarming rate. It had $109 million in cash as of Jan. 31, according to its regulatory filing to go public — hence the initial public offering.

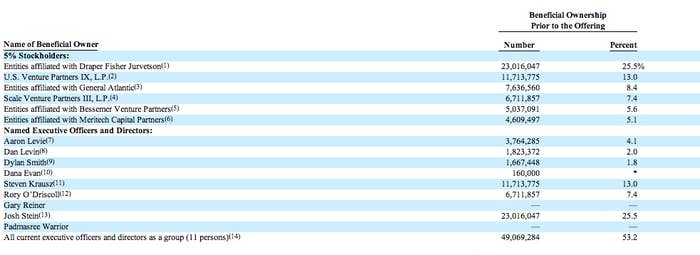

Box's chief executive, Aaron Levie, owns about 4.1% of the company he co-founded — a pretty big dilution compared to many executives who try to hold on to larger ownership of their company, like Facebook CEO Mark Zuckerberg.

In Levie's letter accompanying the filing, he says the company will "find our inspiration in the belief that we can build powerful yet simple technology that improves how the world collaborates, shares, and works." He also stresses that Box can respond quickly and "fail fast." But whether he will be able to turn around the burn rate in time for investors to get excited about the IPO will be another challenge altogether.