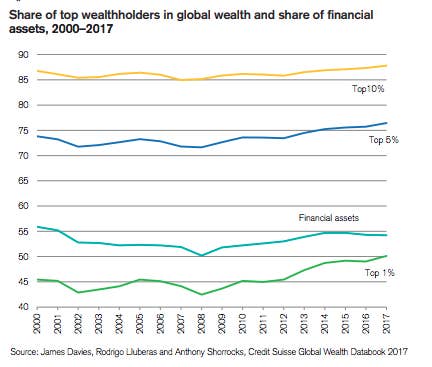

While the whole world has gotten richer, it's been especially good for the global top 1%, who now control just over half of world's personal wealth.

The Swiss bank Credit Suisse's annual Global Wealth Report shows the richest areas of the world adding to their share of the world's wealth — and the richest getting more and more of it. Overall, the bank said, the top 10% of the global wealth distribution, meaning those with at least $76,754 in net worth, control 88% of global assets. The bottom half of adults, on the other hand, have less than 1% of all wealth.

The share of global wealth controlled by the wealthiest 1% has been rising since 2008 largely thanks to rising stock and financial asset prices, as well as a stronger US dollar. So far this year, the MSCI World Index, which tracks global stocks, is up over 16%, while the S&P 500 is up 15%, boosting portfolios across the world, and the biggest ones more than everyone else.

The report also made a specific note of how poorly the world's millennials are likely to fare in building up wealth of their own. Thanks to high student debt in many of the world's rich countries, high unemployment following the financial crisis, and expensive real estate markets that make wealth-building difficult, Credit Suisse said that millennials are facing a "perfect storm" that is "holding back wealth accumulation."

If it's any consolation, the US is also still, by far, minting the newest millionaires, according to the Credit Suisse data, adding about 1.1 million of them to its share of 15.4 million people with a net worth north of $1 million.

Almost half of all new millionaires were in the US, while the United Kingdom and Japan saw around 373,000 millionaires reduced to measly hundred-thousand-aire status thanks to declines in both the pound and yen. The US, not surprisingly, has the most members of the global 1%, Credit Suisse said, and four times as many people with at least $50 million as China, which has the second most.

These figures for the world's wealthiest are likely underestimations of how much they really have. People at the very top of the wealth distribution tend not to fill out surveys and carefully document how much they have, and they are also far more likely to have large caches of wealth hidden offshore, Gabriel Zucman, an economist at the University of California, and one the world's leading inequality researchers, told BuzzFeed News.

In a recent paper, Zucman and two colleagues estimated that about 8% of the world's financial wealth is held in offshore tax havens. This wealth is also far more likely to be held by the very wealthiest, making an estimation of wealth distributions at the very top quite difficult. "In all the micro-data we have access to," Zucman and his colleagues write, "offshore wealth turns out to be extremely concentrated: the top 0.1% richest households own about 80% of it, and the top 0.01% about 50%."

The report found that, overall, global wealth grew by 6.4% in 2017, a $16.7 trillion advance to $280 trillion. North America is still by far the world's wealthiest region, Credit Suisse's data found, with just over $101 trillion and it was also the fastest growing, alongside with India, which also grew 9.9%.

Overall, however, India has only $5 trillion in household wealth, while Africa has $2.5 trillion, the Asia-Pacific region has $55 trillion, China has $29 trillion, Europe has $80 trillion, and Latin America has $8 trillion.