It's been two weeks since the U.K. voted to leave the European Union.

A lot has happened politically: Prime Minister David Cameron said he would resign, the head of the anti-EU U.K. Independence Party resigned, Conservative politician Michael Gove’s failed bid to succeed Cameron threw the Tories into disarray, and a Labour coup attempt is in retreat.

And that's not even counting the economic impact in the U.K.

The most obvious and immediate effect of the referendum vote last Thursday was the devaluation of the British pound, which hit new 31-year lows. It fell from just over $1.50 per British pound before the vote to below $1.30 on Friday.

This has made the British pound the "worst-performing" currency — the one that's lost the most value — of the year, according to data collected by Bloomberg. Much like the English soccer team, the pound has even underperformed Argentina's peso.

The pound is now the worst-performing currency of 2016 https://t.co/fF2Isw8eB8 #Brexit

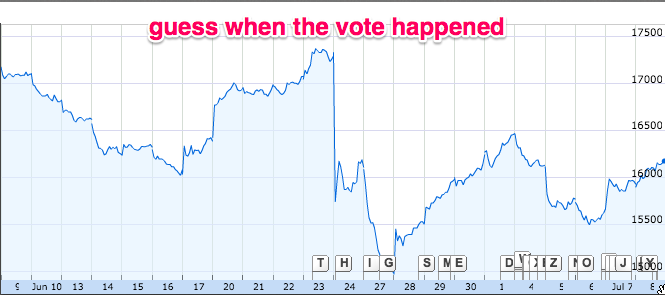

British stocks, however, are more of a mixed story. The FTSE 100, an index of large British companies (like mining and pharmaceutical companies) that get the bulk of their revenues overseas, is actually up 4% since the vote. FTSE 100 companies earn much of their revenue in currencies that gained against the pound, so their shares went up after a big devaluation.

But the FTSE 250, which consists of medium-sized public companies that do most of their business in Britain, has been hammered by referendum decision. This index is down 6.5% compared to the day before the vote.

Several U.K. mutual funds that primarily own commercial real estate, including Aviva and Standard Life, had to prevent their owners from redeeming their shares after investors tried to flee.

The funds own property that can take months to sell if they have to raise cash, while investors in them can buy and sell shares daily. Some fund managers are also cutting the value of their funds, meaning investors get less when they sell their shares.

Mark Andrew Wilson, the chief executive of Aviva — which shut down redemptions in a property fund — said at an investor conference Wednesday: "I think the market and commentators' response in the first few days, or I guess first two weeks after referendum, consisted mainly of words of the four-letter variety."

Some analysts predict a U.K. recession in 2017. Goldman Sachs economists said they expect a "mild recession" next year, while Mark Carney, the governor of the Bank of England, said, "The economic outlook has deteriorated and some monetary policy easing will likely be needed over the summer.”

Consumer confidence in the U.K. plunged in response to the post-Brexit gloom. A survey done by GfK between June 30 and July 5 showed that "confidence has dived" following the vote, and said the drop in consumer confidence was the most steep in 21 years. Of those surveyed, 60% said they expected the economic situation "to worsen over the next 12 months."

One sign of that deterioration in confidence: a decrease in job listings from a year ago, according to the consulting and data firm CEB, which the Financial Times described as a "worrying" sign for growth.

@JolyonMaugham @PickardJE Is it any wonder? Its a self fulfilling prophecy. Less negativity is required. Nothings happened yet? Still in EU!

Immediately following the vote, many worried that American and European investment banks — which employ tens of thousands in the U.K. — would abandon London for an EU country. Although Ireland, Germany, and France have been actively recruiting U.K.-based businesses, a group of investment bank executives and Chancellor of the Exchequer George Osborne said in a joint statement that they would would "work together ... with a common aim to help London retain its position as the leading international financial centre."

The U.S. stock market, meanwhile, is pushing towards all-time highs. After dipping 3.5% the day after the vote, the S&P 500 is up over 4% in the last five days, and above its pre-Brexit-vote levels. U.S. stocks were buoyed by a strong jobs report that showed 287,000 new jobs being added to the economy in June.