President Trump's broad tax plan — outlined only in sparse detail so far — would deprive the federal government of $3.5 trillion of revenue over 10 years, and would drastically reduce the taxes paid by the highest earners, according to an analysis by the Urban-Brookings Tax Policy Center, a tax research organization, published on Wednesday.

So far, the White House has only released a one-page summary of its tax policy goals, which include drastically slashing taxes for businesses run by their owners, reducing the number of tax brackets, scrapping the estate tax, eliminating many deductions, lowering the corporate income tax to 15%, and including some tax benefits to make child care more accessible.

The summary was missing some key details, including the income levels for the new tax brackets, making it hard to analyze. The TPC filled in the blanks by including proposals the Trump campaign made. The tax-cut provisions alone, not counting various proposals to get revenue back, would cost $7.8 trillion, according to the analysis. The most expensive proposals are the corporate tax cut, which would cost $2.3 trillion over 10 years, and the "pass-through" tax plan, which would cost $2 trillion. When possible economic growth generated by the tax cuts was included, the deficit was increased slightly less.

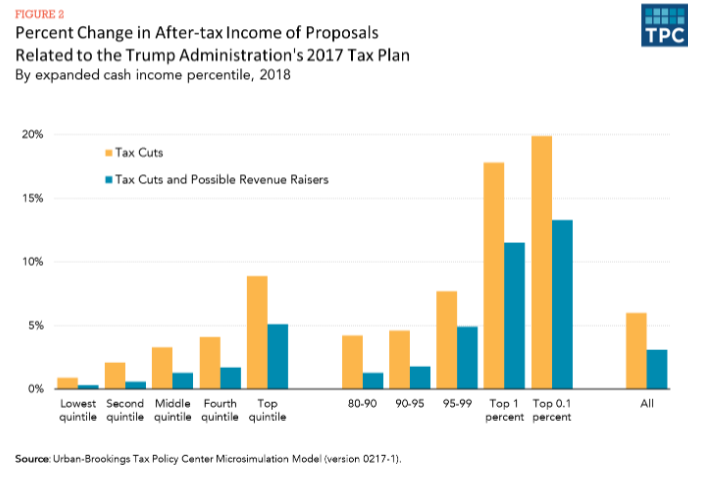

While Treasury Secretary Steven Mnuchin has said on several occasions that there would be "no absolute tax cut" for the wealthy, the authors said: "Even when taking the tax cuts and all possible revenue raisers together, the administration’s proposed tax changes would be highly regressive, with most benefits accruing to the highest income households."

Many of those gains come from tax ideas contained both in the administration's tax outline, as well as in other pieces of legislation, like health care repeal — which would scrap taxes on investment income that were used to fund the expansion of Medicaid and subsidies for private insurance.

The TPC had previously estimated that cutting the tax rate for business owners whose profits "pass through" to their personal income tax would deliver the lion's share of its benefits to high earners. Pass-through businesses bring in over half of all US business income.

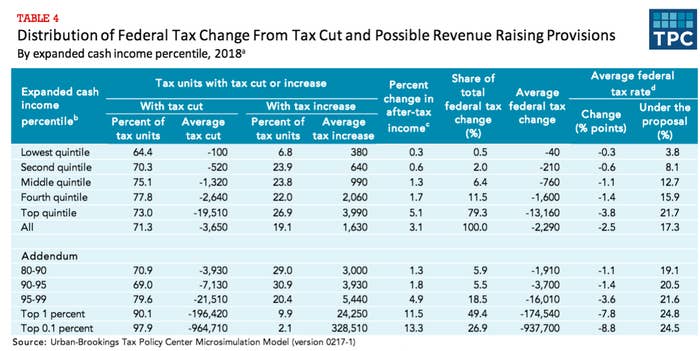

The researchers found the top 1% of taxpayers would receive, net, a $175,000 tax cut — an 11.5% boost in their income after taxes — while the top 0.1% would get a $938,000 tax cut on average. The lowest 20% of taxpayers would get a $40 tax cut. The middle 20% would get a $760 tax cut, and a 1.3% bump in after-tax income.

"Almost half of the aggregate net tax cut would flow to households in the top 1% of the income distribution, giving those households an average of almost $175,000 per year," the report says.

But these are only broad averages. TPC says that about "70% of households would receive a net tax cut, while about 20% would see their taxes increase ... every income category shows a net tax cut ... because more households would receive tax cuts than experience tax increases."

The biggest sources of new revenue would be scrapping itemized deductions except mortgage interest and charitable deductions — raising $1.5 trillion over 10 years — and getting rid of personal exemptions — which would raise more than $1.6 trillion in the same period.

Axios reported that the White House's chief strategist Steve Bannon floated a tax hike for high earners, but there's no public indication that the administration has backed down from the core elements of its tax plan. The White House and Treasury did not respond to requests for comment.