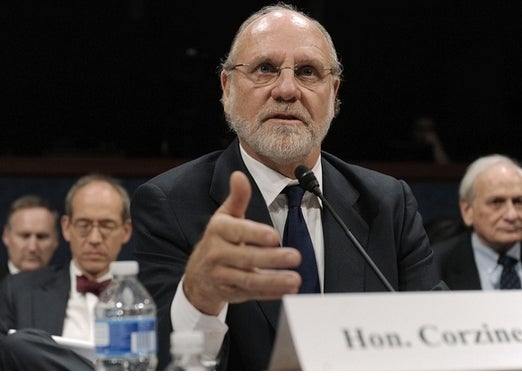

The Commodity Futures Trading Commission sued former MF Global CEO

CEO Jon Corzine and former Assistant Treasurer Edith O'Brien this afternoon in the District Court for the Southern District of New York for their roles in the collapse of the futures brokerage and misplacing customer funds as the firm fell apart in October, 2011. Corzine, the former co-CEO of Goldman Sachs, senator and then governor of New Jersey, took over the sleepy brokerage in March, 2010, with the intention of turning it into a high-flying investment bank. The company fell apart as a large bet Corzine made on risky European bonds demanded more and more of the company's funds. What remains of MF Global, which filed for bankruptcy on Halloween 2011 settled with the CFTC to pay back $1 billion of lost customer funds and a $100 million penalty, but only after it settles its claims in bankruptcy.

The CFTC said in a release that "the firm repeatedly and unlawfully used customer funds for firm needs," that Corzine was "aware of the firm's true low cash balance," "did not act in good faith," and failed to supervise the behavior of the firm as he was legally required to. O'Brien, the firm's assistant treasurer, is charged with "aiding and abetting the firm's misuses of customer funds" and is accused of improperly transferring hundreds of millions "to help meet the firm's needs during the final days." The CFTC's suit also seeks restitution and penalties from O'Brien and Corzine, as well as bans from future commodities trading. Corzine's representative Steven Goldberg said in a statement that the suit was "based on meritless allegations that Mr. Corzine failed to supervise an experienced back office professional who was located in a different city and who did not report to Mr. Corzine" and that "there simply is no evidence that Mr. Corzine was aware, or had reason to be aware, of any alleged misuse of customer funds."

1. The firm was “skating on the edge” without “much ice left.”

On October 6, the senior management of MF Global saw the end in sight. According to the CFTC's complaint, O'Brien and her boss, the firm's Global Treasurer, talked about a payment of $50 to $70 million they had to make to keep up Corzine's European sovereign debt bet. They agreed to make the payment from "excess cash" the firm had in customer accounts (which they were legally allowed to use), but there was only $80 to $100 million.

2. The situation was “not sustainable” and “the situation is grave…we have to tell Jon that enough is enough.”

This is also on October 6 – the firm was clearly going to have serious issues meeting all its obligations and Corzine was determined to use the excess cash in customer accounts to keep on funding the company, even as those funds were running low. Corzine's nickname for the employee who tried to slow him down? "The Gravedigger."

3. “We need to go through what the real number is at the FCM. You know, what’s the drop dead amount”

According to the CFTC, Corzine said this to an employee and was "determined to squeeze the MF Global's customer segregated accounts and customer secured accounts for cash." FCM refers to client cash kept in accounts at MF Global.

4. “We have no buffer, no room for mistake”

Corzine on October 18, saying that it's dangerous to rely on cash kept in customer accounts. But the CFTC says that MF Global used $55 million more than what was available according to company policy and that it was "the third day in a row Corzine received information that the Firm had violated its policy with regard to using funds from the FCM customer accounts."

5. “It is a total clusterfuck…I need the money back from the broker-dealer I already gave them.”

On October 26, the CFTC alleges MF Global had taken $298 million more from customer segregated accounts than it was allowed to and did not file the required regulatory reports. The company also drew down the last $303 million from a revolving loan and O'Brien allegedly transferred over $500 million from customer accounts to the company to make other required payments. The CFTC says that O'Brien "understood that any use of customer segregated funds was unlawful, even if these customer funds were later returned to the segregated accounts." Even after O'Brien was able to get $325 million back from Bank of New York, they still had overdrawn their customers' accounts.

Edith O'Brien and Jon Corzine (Reuters/Getty)

6. “That’s cash seg for clients – it has nothing to do with greasing our wheels for Chase to move.”

This is from a recorded phone conversation Corzine had with an MF Global employee on October, 27 that appears in the suit. The CFTC alleges that Corzine was trying to figure out "how they could use customer segregated funds" to get JPMorgan to conduct trades so MF Global could get more cash. JPMorgan was reluctant to do so because it was becoming less and less clear if MF Global would be viable entity in a few days.

7. “I don’t want to take anyone down with me”

The CFTC alleges that same day, O'Brien transferred $525 million from customer accounts to the company. $325 million of that was held by Bank of New York Mellon, which asked MFGlobal if, after the transfer, MFGlobal would still be complying with CFTC regulations on segregating customer funds. O'Brien said in an email that the $325 million "was not required to be segregated" and, the CFTC alleges, "deliberately did not copy other MF Global Treasury Department employees" because, as she allegedly said in a recorded phone call, "I don't want to take anyone down with me."

8. The “moral equivalent” of cash

The suit claims that Corzine knew that MF Global had only $82 million left in cash, "but not more than that." They also had $602 million in assets that "were not immediately available for the Firm to use to meet its cash needs," but that Corzine referred to as the "moral equivalent" of cash.

9. This “leaves us with a problem – a big problem”

On October 28, MF Global's United Kingdom subsidiary had overdrawn its London bank accounts with JPMorgan. To get JPMorgan's help selling off assets to survive, it first needed to cover $134 million worth of overdrafts. So O'Brien transferred $200 million from a customer segregated account and sent $175 million of that to cover the UK overdraft. She said in a phone call the next day, according ot the suit, "the only place I had 175 million, ok, was in seg." When O'Brien heard they might not get the $175 million back, it was "a big problem."

10. “That could be game over, you guys”

On the evening of the 28th, O'Brien said that $355 million had to be transferred back to customer accounts, but she was only able to get $177.5 million back, alleges the CFTC. That day, the CFTC claims that MF Global filed a false regulatory report saying it had excess customer funds of $200 million.

On Monday, MF Global declared bankruptcy.