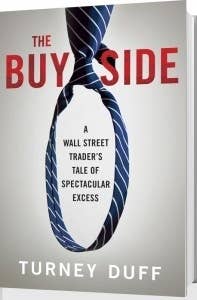

Turney Duff's The Buy Side is every Wall Street memoir and every addiction memoir in one. Duff, a hedge fund trader who, not surprisingly, developed a nasty cocaine habit, documents his unlikely rise from solidly middle-class Kennebunkport, Maine, to Ohio University (where he got a journalism degree) and, eventually, to Morgan Stanley and a series of hedge funds, including a stint with that of convicted insider trader kingpin Raj Rajaratnam's Galleon Group. The book is subtitled A Wall Street Trader's Tale of Spectacular Excess, and on that it totally delivers: line after line after line after line after line. But the "spectacular excess" is little more than one finance cliché after another, packing less punch than the very mediocre recent disillusioned-by-Wall Street memoir, Why I Left Goldman Sachs by Greg Smith, and the classic that defined the genre: Michael Lewis' Liar's Poker.

1. Stumbling Into Finance

2. Scary Colleague Who Throws Stuff

Duff meets Dave Slaine, a tall, muscular trader whose "hair-trigger temper is legendary on the floor." Although Duff is unclear about exactly what transpired, one story follows Slaine around: He gets mad for some reason and rips out his keyboard and throws it across the room. "Dave scares me. He scares just about everybody."

In Why I Left Goldman Sachs, Smith recounts an instance during his internship when one managing director asked another intern for a cheddar cheese sandwich. "The kid came back with a cheddar cheese salad," Smith writes, "[the managing director] opened the container, looked at the salad, looked up at the kid, closed the container, and threw it in the trash."

3. Screwing Clients Is Appalling

4. Bonus Obsession

Duff, like the rest of Wall Street, spends much of the narrative fixated on his bonus. His "low" $200,000 salary "barely covers the bills," and he depends on a bonus several times that amount to cover his vacations, personal shoppers, and rent on his triplex. He goes into work on New Year's Eve and tries to squeeze out whatever trading gains he can to get a bigger bonus and books $10 million in trading profits after mildly screwing over one of his brokers by canceling short-sell orders and then buying the stocks. The next chapter is just a picture of a check for $1,864,999, the amount of his take-home pay in 2003.

Smith is disappointed with fellow Goldmanites when they become transfixed by their bonus and start counting on a certain amount every year to finance their costly lifestyles. Smith is even more disillusioned with bonuses automatically determined by the revenue each employee produced — which lead, Smith claims, to the "poisoning of young minds."

5. Vegas!

6. Turning to Writing

Duff starts writing in rehab, where "the words came out of me in a kind of Keuroac flourish — the quantity, that is, not the quality." Just writing the book is a relief for Duff: "This book represents a beginning, a middle, and a new beginning. I wrote it for myself. Writing it is something I had to do."

Smith's book started with a New York Times op-ed that he wrote while he was working in London. Before he distilled his disappointment with Goldman into the Times, he began to write compulsively: "Writing was my way to distill into simple terms exactly what I felt was wrong." He wrote "on airplanes, in airport lounges, in hotel rooms, and in my flat late at night" for three months before it occurred to him to speak out publicly. The result: one of the most-read Times op-eds of all time and the subsequent memoir.

Lewis, on the other hand, was a writer during his finance career; he worked as a freelancer on nights and weekends at Salomon Brothers. He's written since then too.