A pillar of the US retirement savings system, used by more than 40 million Americans, is achieving very little toward its stated goal of getting people to save more for retirement, according to a new study.

Instead, Individual Retirement Accounts, or IRAs, are now overwhelmingly used to park money already saved as part of 401(k) plans, the study by two Boston College researchers found.

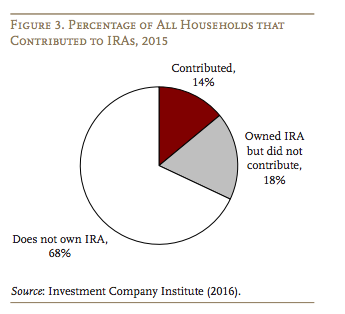

About a third of all US households have an IRA, and the money in those accounts forms more than half of all the assets held in private US retirement plans. But that doesn't mean people are using them to save more.

Instead, the most common use of the accounts, by far, is to roll over money that was already saved in a 401(k).

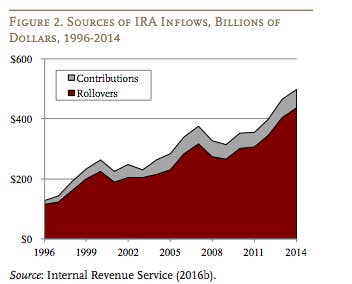

Only 13% of the increase in IRA deposits came from new contributions in 2014. "Almost all of the growth in IRA assets is driven by rollovers from employer-sponsored retirement plans," the two researchers wrote, citing IRS data.

"Workers do not want to leave their money with their old employer, but moving money to their new employer’s 401(k) is difficult and time-consuming. As a result, most workers find it much easier to roll over to an IRA instead," they wrote.

Just 14% of all households contribute to IRA plans. And those people are "more likely to be white, have a college education, and currently contribute toa 401(k)." They also tend to have higher-incomes.

"In 2013, nearly nine in 10 families in the top income fifth had retirement account savings, compared with fewer than one in 10 families in the bottom income fifth," a report from the left-leaning Economic Policy Institute found.