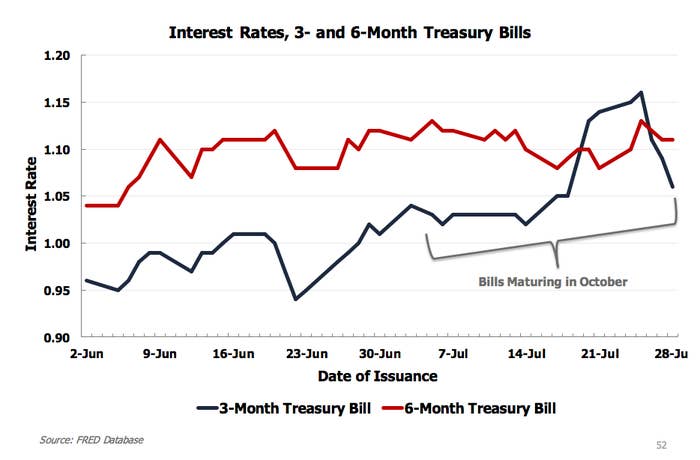

Something funny is happening in the markets for debt issued by the US federal government. Investors are demanding more money to buy up debt that comes due in October, as opposed to being paid back later in the year. Typically, debt that's scheduled to be repaid earlier is cheaper to buy, because the government has to pay back less in interest on it. These inversions typically only happen in times of great stress, like the global financial crisis or when the US federal government might not pay its debts.

The current inversion is a sign that investors lack perfect confidence that the statutory debt limit will be increased before the government is no longer legally able to pay all of its obligations. It also means that the fiscal effects of breaching that limit are already being felt.

"We are paying higher interest costs from the federal government on the order of millions of dollars because of this impasse," Shai Akabas, the Bipartisan Policy Center's director of economic policy said on a call with reporters.

Analysts at Nomura said "the risks of breaching the debt limit are lower than 2011 and 2013, but slightly higher than in 2015."

Treasury Secretary Steven Mnuchin said in a letter to Congress in July that the debt limit should be increased by Sept. 29, while the Bipartisan Policy Center estimated that the date the federal government would no longer be able to pay its bills would be Oct. 2.

This is not the first time that a mere threat of a debt-ceiling breach has led to increased costs for the government. During the 2011 debt-ceiling showdown, which was ended by a last second deal that averted a crisis, a broad range of economic indicators dipped downward, including stock prices, consumer confidence, and small business optimism, a 2013 Treasury Department analysis found.

The volatility of stock prices shot up and investors started to demand more money to lend to businesses as well. A study by Federal Reserve researchers found that the 2011 and 2013 debt-limit crises increased borrowing costs for the US Treasury by about $500 million.

Debt issued by the US government is generally considered in the market to be risk-free, and it underlies trillions of dollars worth of financial instruments and transactions. In a 2015 report, the Congressional Research Service said that if investors began to think that there was some risk that Treasury securities could not be paid back in full, "the effects on global capital markets could be significant."

The ratings agency Fitch said on Wednesday: "If the debt limit is not raised in a timely manner prior to the so-called 'x date' Fitch would review the US sovereign rating, with potentially negative implications," threatening its triple-A rating for US government debt. After the 2011 debt-limit showdown, Standard & Poor's took away the US's triple-A rating, citing, among other factors, "the prolonged controversy over raising the statutory debt ceiling."

That there's even the chance of a debt-limit breach in October is a bit strange because of unified Republican control of the House, Senate, and White House. But the president already appears to be blaming Majority Leader Mitch McConnell for letting the country get so close to breaching the debt limit, tweeting early on Thursday morning that Congress could have passed the debt-ceiling increase as part of popular veterans affairs legislation.

I requested that Mitch M & Paul R tie the Debt Ceiling legislation into the popular V.A. Bill (which just passed) for easy approval. They...

...didn't do it so now we have a big deal with Dems holding them up (as usual) on Debt Ceiling approval. Could have been so easy-now a mess!

"It’s somewhat ironic we’re again up against this deadline," Bill Hoagland, a senior vice president at the Bipartisan Policy Center who was a longtime staffer on the Senate Budget Committee, said on a call with reporters.

"I’m not quite sure I’ve ever seen a situation where the debt limit and government shutdown come so close together. And in particular I’ve never seen this happen when one party was in control of the House, Senate, and White House."

Politico reported that a so-called "clean" debt-ceiling increase, meaning that the amount of debt allowed to be issued goes up without accompanying cuts in spending, would only have around 20 Republican votes in the House of Representatives, and 10 to 20 in the Senate.

Some analysts think the far more likely risk is that the federal government will continue to be able to pay out its obligations and raise the debt limit, but may shut down when the current continuing resolution funding government operations runs out, also at the end of September.

President Trump said in a speech on Tuesday "If we have to close down our government, we’re building that wall.” Goldman Sachs analysts put risk of a shutdown at 50/50, according to Axios. President Trump headed off a government shutdown in May by signing a spending bill without funding for new border wall construction, but which did include a few hundred million dollars for repairs to existing barriers.

"President Trump’s apparent commitment to securing funds for the border wall as part of this funding agreement dramatically raises the specter of a shutdown in October," Isaac Boltanksy, an analyst at Compass Point, said in a note on Wednesday.

Not only do Democrats oppose funding a border wall, Boltansky wrote, but some congressional Republicans do as well. "President Trump’s injurious relationship with Congressional Republican leadership further complicates the underlying calculus."