The online payday loan industry was dealt a serious blow Wednesday when Google banned it from its advertising networks. But short-term, high-interest lenders still have somewhere to go, for the time being at least: Microsoft's Bing, which powers much of Yahoo's search operation and is a distant number 2 in the search market.

Bing has not announced a ban on the lenders, who Google described as peddlers of "harmful financial products." Instead, Microsoft told BuzzFeed news that it "respects the integrity of consumer choice" and is "listening to consumer and industry feedback with respect to payday lending ads."

Oh, and "our advertising policies comprise strict requirements for advertiser compliance, and expressly prohibit any misleading or illegal practices," a Microsoft spokesperson said in an emailed statement.

While Google is the king of search ads, the consumer and civil rights groups working to ban online payday loan advertising also went to Microsoft, according to Aaron Rieke, a principal at the Washington, D.C. tech and policy consulting firm Upturn, which did some of the research those groups relied on.

Microsoft "heard us out, read the report, we’ve had good conversation, at this point they haven’t gotten back to us and changed their policies," Rieke said.

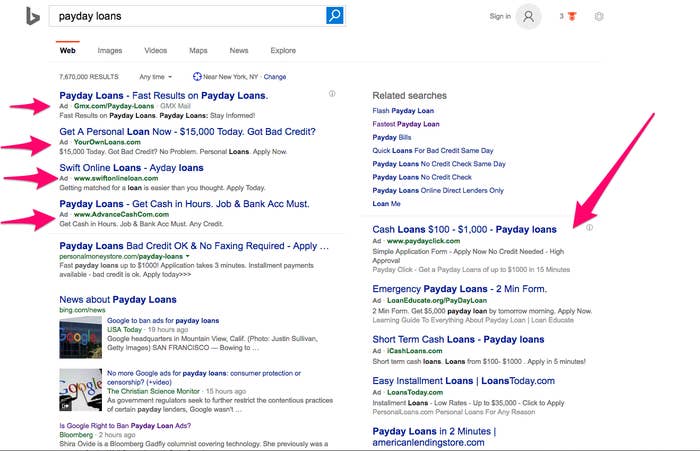

Microsoft declined to comment when asked about its interactions with the advocacy groups. A quick search on Bing for phrases like "payday loans" shows plenty of paid results from advertisers.

"Unlike Google, Bing didn’t have as many policies in place concerning payday lending," Rieke said.

A Microsoft spokesperson pointed to its own policies, which say that advertisers "must ensure they comply with all applicable local laws and regulatory requirements" and that advertisements for payday loans, along with other types of consumer financial products, "can raise appreciable compliance concerns and may attract heightened scrutiny."

According to data from comScore, Google has 64% of the desktop search market, while Microsoft has just over 21% and Yahoo has 12%.

Before Google's payday lending advertising ban — which will take effect in July — it had instituted policies specific to the industry, such as only allowing ads to show up when people searched for loans specifically, and requiring lenders to disclose rates and terms in the ads.

Short-term, high interest loans often end up with effective interest rates well over 100%, and are frequently paid off with new loans — a system that can trap borrowers in a cycle of debt. Online payday lenders also frequently charge high fees to borrowers and, a CFPB study found, can cause customers to lose access to the traditional banking system entirely.