In a letter to shareholders in the bank's annual report, Goldman Sachs CEO Lloyd Blankfein and President Garcy Cohn said the investment banking firm received 43,000 applicants to be analysts in 2013 and only accepted "about 4 percent of them."

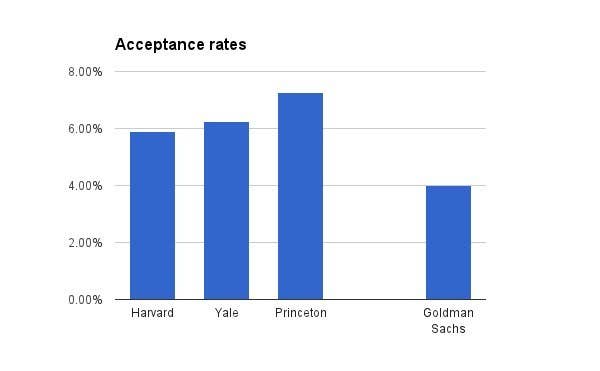

The strikingly low rate — below the acceptance rates of Harvard, Yale, or Princeton — comes as Goldman and many other banks have instituted policies to make life easier on their youngest and newest employees. College graduates who would have gone to work on Wall Street before the financial crisis are now instead heading to technology companies or nonprofits. Blankfein and Cohn also said that "more than 80 percent" of those offered an analyst job accepted it. There were 1,900 analyst positions open.

In October, Goldman said that junior investment banking employees would not be allowed to work from Friday night through Sunday morning. The rule changes were the result of the work of the bank's "junior banker task force." The group also forced changes for the managers of younger employees, who are now expected to be more disciplined in how they assign projects to their charges.

Many large banks followed suit by instituting some kind of policy to protect a few weekends every month. Goldman also ended the practice of offering two-year contracts to its new analysts and instead hired them as full-time employees. "Getting junior bankers to focus on the marathon rather than the sprint is why we made changes to our analyst program," David Solomon, the bank's co-head of investment banking, said in a memo announcing changes to the analyst program for investment bankers.

Typically, Goldman does not report the acceptance rate for its analyst program and in previous annual reports has only disclosed numbers for applications to jobs across the firm. At a conference last year, Cohn said Goldman was "having no problem attracting people" and that for investment banking analyst jobs, the firm was accepting between 300 to 350 out of more than 17,000 applicants.

"We are fortunate to have a diverse group of young people from around the world who continue to view Goldman Sachs as a great place to begin and sustain their careers," Blankfein and Cohn said in the letter.