Growing up surrounded by the failure of financial institutions and a fragile economy, a "surprising" number of young people are now using "alternative financial systems" like pawn shops, payday lenders, and cash back services, according to a study done by the audit and consulting firm PwC and George Washington University.

The study found that 42% of 23 to 35 year olds used "an AFS product, such as payday loans, pawnshops, auto title loans, tax refund advances, and rent-to-own

products" in the past five years.

While this could be attributed to young people having low incomes or a lack of access to the traditional financial system, alternative financial services are also popular among the middle class. "Typically over the years people thought those types of things had gone down or were nonexistent for college graduates" said Shannon Schuyler, corporate responsibility leader at PwC. The numbers suggest otherwise.

While half of young people with a high school degree or less used an alternative financial services product, 28% of people with a college degree also did. "AFS is widespread among this generation, common even for households generally referred to as “middle-class," the study said.

And there's still one big way that the traditional financial system has ensnared college graduates: student debt.

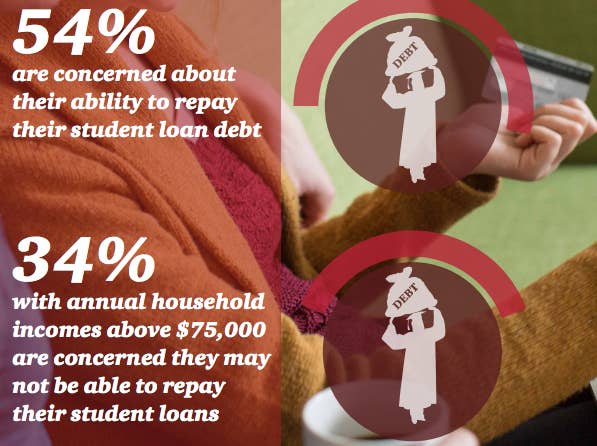

PwC analyzed data from the 2012 National Financial Capability Study, and found 54% of young people "are concerned about their ability to repay their student loan debt" and that even a third of those with incomes over $75,000 "are concerned they may not be able to repay their student loans."

Young people's distrust in the traditional financial system also manifests itself in their avoidance of mainstream financial advisers. "This is a group not asking for help and not looking at professional financial advisers," Schuyler said.

The trend has been a big problem for the brokerage, wealth management, and banking industries, with many young people believing that mainstream financial institutions can not be trusted in the wake of the financial crisis. Younger people with fewer assets and lower incomes are also more likely to get advice from brokers who are paid according to what products they sell and don't have fiduciary duty to act in their best interest.

But, Schuyler cautions, this understandable mistrust of the financial industry doesn't pay off when it comes to poor decisions some young people make with their money, like using payday loans, missing credit card payments, overdrawing checking accounts, or taking hardship withdrawals from retirement accounts.

More than a fifth of young people have taken hardship withdrawals from retirement accounts, about 30% have overdrawn checking accounts, and almost half couldn't come up with $2,000 within a month, according to the survey.

Young people "haven't necessarily learned the lesson that you can’t kick the can down the road, when you start to look at [using alternative financial services] and other things the ramifications just snowball, Schuyler said. "There’s distrust of the financial services system, but with the action they’re taking, they’re making their own situation worse."