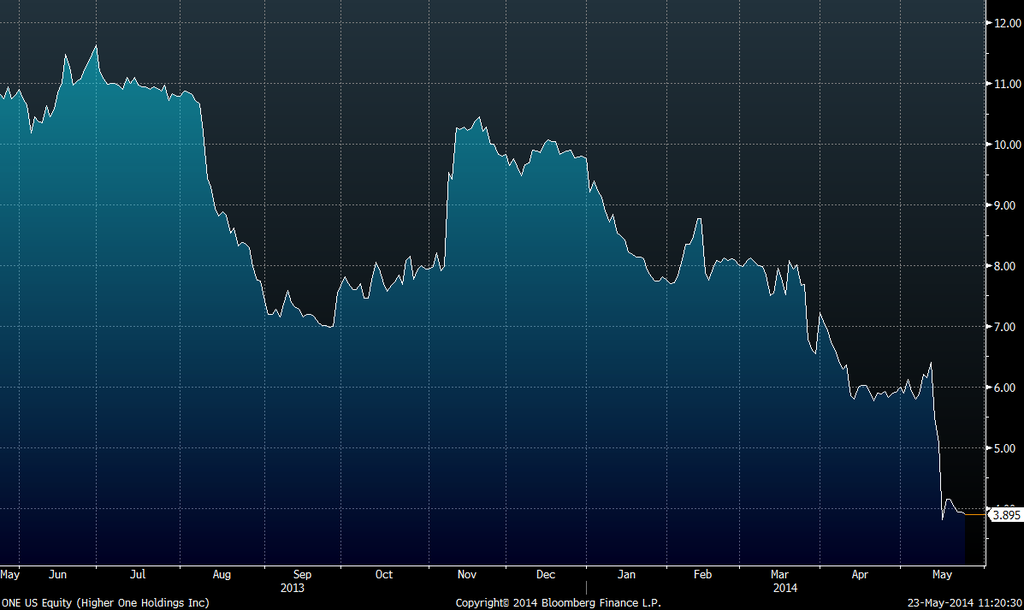

Shares of New Haven, Connecticut-based Higher One fell below $4 Friday as the higher education financial services company's prospects took another hit.

Two separate developments during the week look likely to severely crimp Higher One's marketing practices and the bulk of its revenue base. The first was the end of the Department of Education's "negotiated rulemaking" process, where a committee that included Higher One's chief operating officer Casey McGuane and consumer protection advocates that have been criticizing the company unsurprisingly failed to reach agreement on new rules governing the disbursement of financial aid. That means that the Education Department is now free to propose a final rule on its own, without direct input from the company, that is largely expected to impose stricter guidelines on disbursement practices.

"If that draft closely resembles the final rules, you're going to see a lot of changes with fees and marketing practices that would significantly impact [Higher One's] revenue and earnings," Compass Point analyst Michael Tarkan told BuzzFeed.

Separately, House and Senate Democrats last night proposed a bill that would prohibit schools for giving a preference to a certain method of disbursing financial aid refunds, and ban revenue sharing agreements between companies and colleges to promote debit cards. The bill, sponsored by several powerful House and Senate Democrats, including George Miller, Elizabeth Warren, and Dick Durbin would also require companies to submit any agreements they have with banks to the CFPB.

The lawmakers that proposed the bill are also the very same ones that have encouraged the Department of Education to pursue new guidelines on its own.

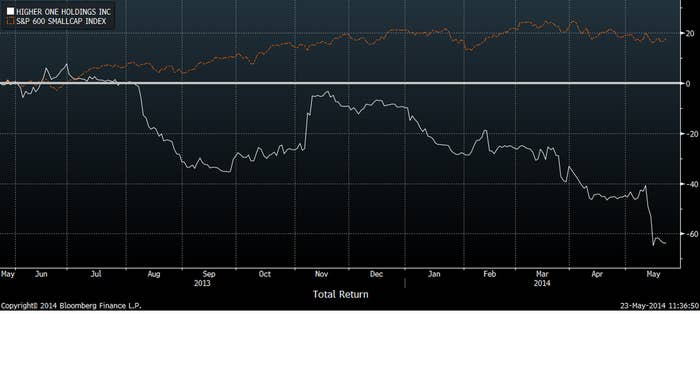

The company's stock has fallen 64% in the last year, while an index of small-cap companies has risen 16%

Higher One has been in turmoil for more than a year now and the government looks to clamp down on companies that disburse financial aid via debit cards and checking accounts provided to students. The company last month replaced its co-founder and CEO Mark Volchek with former JPMorgan Chase auto and student loan executive Marc Sheinbaum. Its stock price has plummeted 64% as the regulatory noose has tightened.

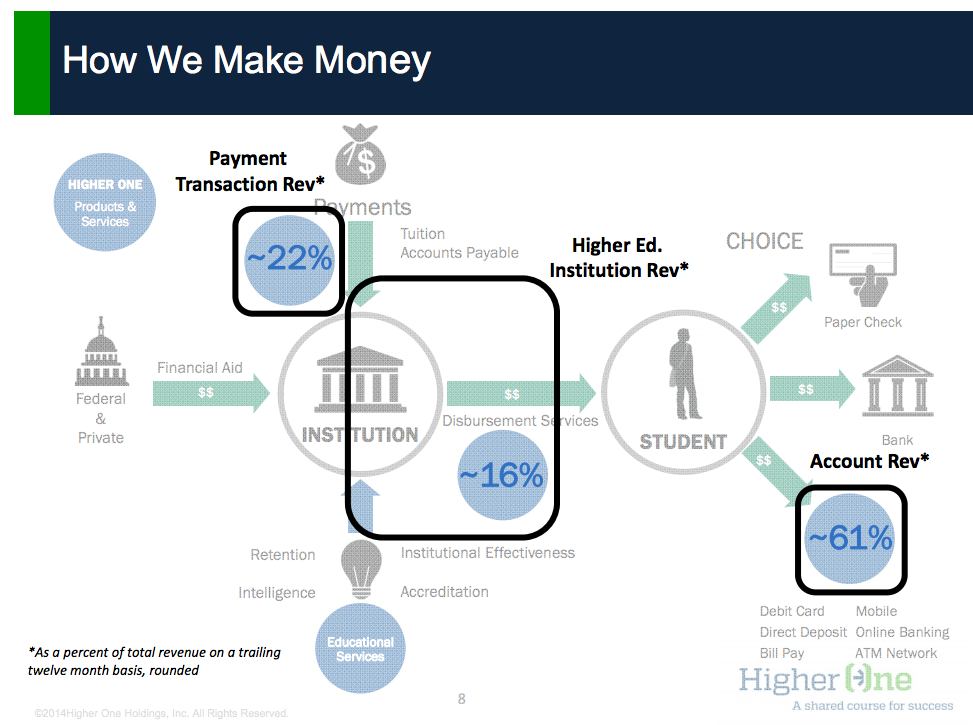

Higher One provides either payment processing or tuition refund services on over 1,900 campuses. The company's core business, disbursing financial aid via debit cards and checking accounts provided to students, accounts for more than 60% of its revenues. The Government Accountability Office said in a report issued earlier this year that 11% of colleges and universities can provide financial aid through prepaid or debit cards, and that those schools cover 40% of all college students. The GAO said that Higher One was the "dominant provider" in this market, with 57% market share in 2013.

McGuane, in a presentation to the Department of Education's rule-making committee earlier this month, said that the elimination of Higher One's standard 50 cent debit swipe fee, the pre-mailing of cards, and instituting some no-fee ATM withdrawals, "represent...significant changes in the underlying economics involved in offering accounts," as well as "significant and complex operational changes."

Higher One, because of McGuane's role on the negotiated rule-making committee, hasn't commented on the effects of the proposed rules. When asked if the company was planning for stricter rules, new CEO Sheinbaum said, "I think we're spending a lot of time on this topic."

A Higher One representative said Friday was too early to say what effects the potential rules or the proposed bill would have on the company.

The company's stock has fallen from almost $11 to under $4

The OneAccount, the company's basic account, charges a $2.50 fee for using a non-Higher One ATM, $0.50 cents for debit transactions, $29 for initial overdrafts, and $38 for additional overdrafts. Tarkan said that Higher One earns $5 per account. The company has 2.3 million accounts.

Already, the company's changes in its fee schedule in response to activist and regulatory pressure have dampened its revenues. In its conference call to discuss earnings earlier this month, Higher One's chief financial officer Christopher Wolf said that the "overall effects of the change in fees led to a decrease of approximately $230 million in account revenue year-over-year" and that the elimination of a fee on unused accounts that came into effect in August "is still continuing to impact our account revenue." The company's revenue grew 16% to $66 million in the first quarter from a year before, but the amount of student aid refunds going into OneAccounts fell 6%. The company's net income was $9.7 million.

The latest draft from the Department of Education that many expect will form the basis for the final rule will limit the fees banks and other companies could charge, including getting rid of the monthly maintenance fee, the debit pin fee, overdraft fees, and would limit ATM fees. "If the majority of those fees go away or become lower, the profitability of that segment comes into question," Tarkan said, adding that, "the company would have to consider alternatives for that business."

Higher One also took a hit from the Consumer Financial Protection Bureau, which called for more disclosure in agreements between colleges and schools in providing debit cards. In a presentation to the rulemaking committee, the Bureau said that only 0.5% of students are unable to get a banking account that could receive a direct deposit of their student aid money, undercutting a key rationale for Higher One's OneAccount product.

Chris Lindstrom, who runs the higher education program at US PIRG, an activist group that has long been critical of Higher One and other companies that offer debit cards on campuses, said that she expects a largely similar rule to the draft proposal to be issued by late October, before a November 1 deadline for it to go into effect by July 1, 2015. Lindstrom served on the rulemaking committee. Since the committee could not reach consensus before it ended earlier this week, the Department of Education will largely be on its own in writing a rule, even though they have to put it out for public comment.

She described the Democrats' bill as largely complementary to the Education Department's approach, saying that fuller disclosure of the arrangements between colleges and companies would remove "the rationale for building in aggressive and outrageous fees in the products to begin with, if the college wasn't making a lot of money with the fees."

A huge chunk of Higher One's revenue — from its debit accounts — is under threat from regulations.