Apple CEO Tim Cook wears the Apple Watch during an Apple event at the Flint Center in Cupertino, California, on Sept. 9.

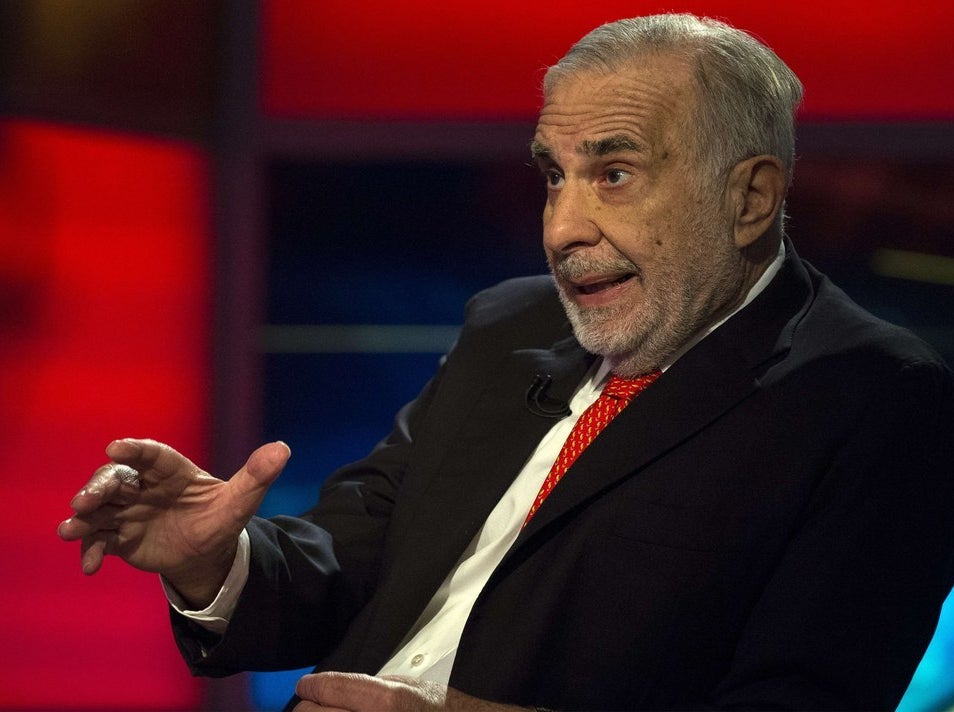

After a several months of near-silence on Apple, the billionaire investor Carl Icahn is back, once again releasing an open letter in which he said the company's shares were undervalued and demanding that Apple buy more of its own stock.

Icahn said Apple stock, which was trading at $100.80 at the close of trading Wednesday, was worth twice as much. Ichan owns about 53 million shares, worth about $5.3 billion. Apple shares rose 0.89%, or $0.90, to $101.70 in early trading Thursday.

While he's only the 12th-largest shareholder, the other 11 are big asset managers and banks holding shares on behalf of clients who tend not to weigh in on the corporate strategy of the companies whose share they own. The 78-year-old Icahn, who owns 0.88% of Apple's shares, has disproportionate influence thanks to his long investing track record and extreme outspokenness.

As is usual in his more than a year of public letter writing and TV appearances to discuss Apple, Icahn declined to criticize — and even praised — the company's actual performance, calling the release of the iPhone 6 and 6 Plus "truly a watershed moment" and that Apple Chief Executive Officer Tim Cook was "the ideal CEO for Apple."

Since Icahn disclosed his Apple stake last year, the stock has gone up 44% while the S&P 500 is up only 16%.

Icahn said that based on his own projections of the company's revenue and earnings over the next two years, Apple's current market valuation of just over $600 billion is "irrational and transient in nature." Icahn said that Apple's real worth was $203 per share, for a total market capitalization of $1.2 trillion, which means that Carl Icahn thinks Apple's fair value is some three times the worth of oil giant Exxon.

This analysis, for Icahn, means that Apple should buy a ton of its own stock. "Given the persistently excessive liquidity of $133 billion net cash on Apple's balance sheet," Icahn wrote, "we ask you to present to the rest of the Board our request for the company to make a tender offer, which would meaningfully accelerate and increase the magnitude of share repurchases."

"We always appreciate hearing from our shareholders. Since 2013 we've been aggressively executing the largest capital return program incorporate history," the company said in a statement. "As we've said before, we will review the program annually and take into account the input from all of our shareholders."

Icahn disclosed his stake in Apple more than a year ago and spent several months asking that Apple buy back billions of stock and even managed to get a meeting with Cook. Over that time, he reduced his initial request from $150 billion worth of buybacks to $50 billion and called off the fight — for the first time — in February after Apple bought back $14 billion in just two weeks.

Apple spent $66 billion sending cash to its shareholders through April of this year, after announcing that it would stay paying out dividends and buy back stock in August, 2012. In April, Apple announced a plan to increase its total dividends and buybacks through the end of next year to over $130 billion.

Updated with a statement from Apple.