Breaching the debt ceiling — getting to the point where the federal government legally can't take on any more debt to meet its obligations — "would be like the financial market equivalent of that Hieronymus Bosch painting of hell," says JP Morgan's chief economist Michael Feroli Feroli. The U.S. Treasury says "even the prospect of a default can be disruptive to financial markets." Consumer confidence is already tanking, and economists at RBC Capital Markets say that "crossing the debt ceiling would be catastrophic."

But why do some House Republicans, and presumably their supporters, disagree? Well there's at least one well-credentialed exponent of the view that it's best to face up to what he sees as the problems of high debt, slow growth, and imminent inflation head-on: James Rickards.

Rickards, a senior managing director at the merchant bank Tangent Capital and author of the book Currency Wars, is a vocal crtic of most mainstream economic thinking, at least as it comes from the Federal Reserve, the Treasury, and most major U.S. financial institutions.

If #Washington understood the mathematical certainty of debt default, they'd see the benefits of doing it now.

Jim Rickards

@JamesGRickards

If #Washington understood the mathematical certainty of debt default, they'd see the benefits of doing it now.

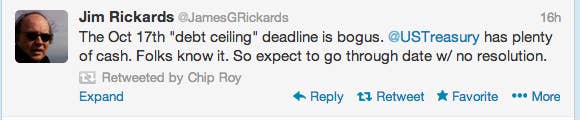

And Ted Cruz's chief of staff, Chip Roy, is a fan of Rickards's recent debt ceiling commenatry

Rickards told BuzzFeed that much of the concern over the debt ceiling was at best overblown and at worst hypocritical: "At the end of the day, the U.S. will pay the interest on the debt." He said that, if they wanted to, the Treasury could easily choose to make interest payments and not make other payments, at least temporarily (this is a minority view).

And if raising cash while staying under the statutory debt limit is really a problem, Rickards is also confident that the White House and Treasury could make all the payments they need to to avoid outright default, including issuing IOUs to contractors and federal employees and even selling some of the Treasury's $11 billion gold hoard (the Treasury argues this isn't feasible or desirable.)

"Everyone says default is unthinkable," Rickards said. "Default is the worst thing in the world, but we're going to default on our debt in one of two ways, either we're not going to pay it, or we're going to inflate it away."

The way Rickards sees it, the US economy has been stuck in a depression, by which he means growth has been well below it's pre-crisis trend, since 2007, and that means unless there are drastic spending cuts, the federal government will have an ever growing debt without the revenue or economic growth to support it. If growth isn't going to snapback anytime soon, what's going to happen to that debt, that stands at 73% of US GDP?

Some kind of default by not making good on all the spending, entitlement and interest payment obligations, Rickards argues, is inevitable, or failing that, inflation. If inflation shoots up, the dollar-amount of the debt won't change but the debt's value will decrease, so it's easier for the federal government to pay off. "It's default by another name," Rickards says.

And inflation, Rickards argues, is wealth destroying for most normal people — like anyone who depends on fixed annuities, bonds, or savings accounts, "Inflation is a way to steal money from every day Americans," Rickards says.

To be sure, and Rickards acknowledges this: inflation has been very, very low thanks to slow economic growth.

But that doesn't mean it always will: "if you look at the math, it's not going to be fine." Despite the fact that the deficit is rapidly decreasing, Rickards is still convinced that the growing total debt will eventually bring about some sort of crisis when it become clear that the government can't service that debt. So, he says, why not try to take care of it now?

Rickards thinks some members of Congress vaguely get it — "you can't expect congressmen to be expert economists, but they have the vague sense we're going broke and we need to do something." So there's some hope, Rickards says, in the fight over funding the government and raising the debt ceiling might be a way, "There is a way out, cutting spending, that would get us on a sustainable path."

So the crisis over the budget and the debt ceiling is precisely the chance Rickards thinks we need to face up to government debts: "It would be a lot more honest to freeze the debt for now, work on a restructuring plan to cut spending, to stop stealing money from children and grandchildren and stop stealing money through inflation."

"You hear among Israelis if not now when, if not us, who."