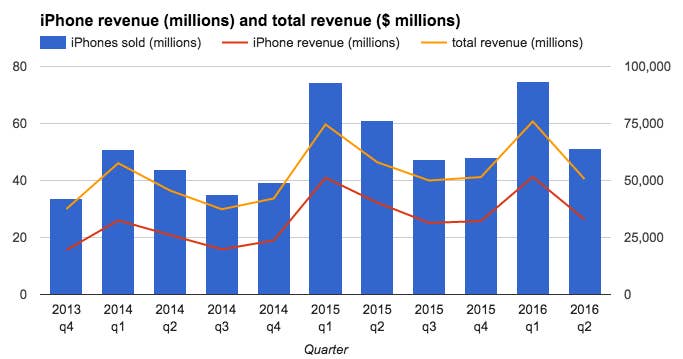

Apple is an iPhone company — and there's no better proof than its financial results. The company had its first year-over-year revenue decline for a quarter since 2003, largely thanks to slumping iPhone sales. The company sold 51.2 million iPhones in the first three months of the year, compared to 61.2 million in the second quarter of fiscal 2015 a 16% drop in units sold. Analysts polled by Bloomberg expected Apple to sell 50.7 million iPhones.

Apple's decline still produced revenues and profits that would be the envy of literally any other company, largely thanks to its success in getting people to buy a huge number of expensive phones all over the world.

Apple's profits in the second quarter were $10.5 billion with $50.6 billion in revenues, a 22.5% and 13% decline respectively. Analysts had expected $52 billion in revenues. The decline in revenue — which the company had projected three months ago — is Apple's first since 2003, almost four years before Steve Jobs first unveiled the iPhone .

Apple's stock price has declined slightly so far this year, while the NASDAQ Composite, which is heavy with technology companies, is down 2.4%. In after-hours trading, Apple stock is down more than 5%.

Apple chief executive officer Tim Cook pointed to "ongoing macroeconomic headwinds" and "difficult year-over-year comparisons" on a call with analysts to explain the company's "pause" in revenue growth. Cook said that had currency values remained stable over the year, revenue would have declined 4 percentage points less.

"The smartphone market is expected to see single-digit growth this year, as most of the developed markets are now near saturation," Deutsche Bank analyst Sherri Scribner said in a note last week.

UBS analysts called the upgrade cycle to the 6s and 6s Plus "mediocre in terms of installed base upgrades." The release of the 6 and 6 Plus, on the other hand, helped drive Apple to one of the most financially successful quarters in the history of public companies at the end of 2015.

"The market...is currently not growing," Cook said, but that that growth doldrums in the US and the rest of the world "shall pass." Cook also pointed particularly to revenue growth in emerging markets, like India, where revenue grew 56%. In Greater China, which includes China, Taiwan, and Hong Kong, however, revenue fell 26% to $12.5 billion.

"We remain very optimistic about the China market over the long-term," Apple's chief financial Luca Maestri said on the call. Maestri also pointed to the dollar strengthening as well as supply constraints in China as helping drag down results. A year ago, annual revenue growth was 81%.

While some analysts expressed skepticism about whether Apple can grow substantially in the developed world, Cook pointed to the base of iPhones growing 80% in the past two years, meaning a larger base for upgrades to more expensive phones.

"I think there is still really, really good business in the developed market, so I wouldn't want to write those off," Cook said. He also pointed to high levels of Android users switching to iPhones, including "more switches in the first half of this year than any other six-month period ever.

But in the near term, Apple is predicting a sales slowdown. The company said it expected between $41 and $43 billion in revenue in the next quarter, which would be mean another revenue drop on an annual basis. In the third quarter of last year, Apple's had $49.6 billion in revenue.

Apple sold 10.3 million iPads, while analysts expected 9.4 million, although that's still a 19% decline in sales from a year ago.

This year's earnings report also marked the one year anniversary of the Apple Watch, which was released just over one year ago. While the company doesn't break out Apple Watch revenue specifically, the company's "other products” revenue, which includes the Watch, grew 30% from a year ago to $2.1 billion. Apple sold around 12 to 13 million watches in the last year, according to analyst estimates, which would be just over twice as many iPhones sold in its first year.

The company has also started to emphasize the revenue it earns from services sold to users of its products, like the App Store, iTunes, ApplePay, and iCloud storage. Investors like companies with large, recurring services revenues because they are thought to more consistent than sales of devices, which can be highly volatile.

Apple has over 1 billion active device users, which "are a source of recurring revenue that is growing independent of the unit shipments we report every three month," Cook said.

Apple had $6 billion in revenues from its services business, up 20% from a year ago. While this could sustain an entire public company for a whole year — Salesforce had $5.4 billion in revenue in all of 2015 — it’s still a small portion of Apple’s overall business, just under 12% of its revenue in the last three months.

Despite Apple's management talking more about its software and services businesses, analysts and investors tend to view Apple more simply as a hardware business, and more specifically, an iPhone business.

Steven Milunovich, an analyst at UBS, said on the call that the role of Apple's services business is "more creating an ecosystem that supports the high margins that supports the high margins on hardware as opposed to independently driving earnings."

“We are very happy with the continued strong growth in revenue from Services, thanks to the incredible strength of the Apple ecosystem and our growing base of over one billion active devices,” Apple chief executive officer Tim Cook said in a statement.