Warren Buffett

Warren Buffett, chairman and chief executive officer of Berkshire Hathaway, told CNBC today that the political system "will go right up to the point of extreme idiocy," but hopefully not past it. The Oracle of Omaha, as he is known, as said that "If [Republicans] can't get their way on another issue, they'll use the threat of, in effect, defaulting on the government's credit to get their way."

David Einhorn

David Einhorn, head of hedge fund Greenlight Capital, told Bloomberg TV yesterday that the failure to make headway on a deal to end the shutdown or breaching the debt ceiling was "particularly depressing" and "embarrassing." As for defaulting on the debt, he described it as "unimaginable" and said letting things get so far as a government shutdown "is really bad enough."

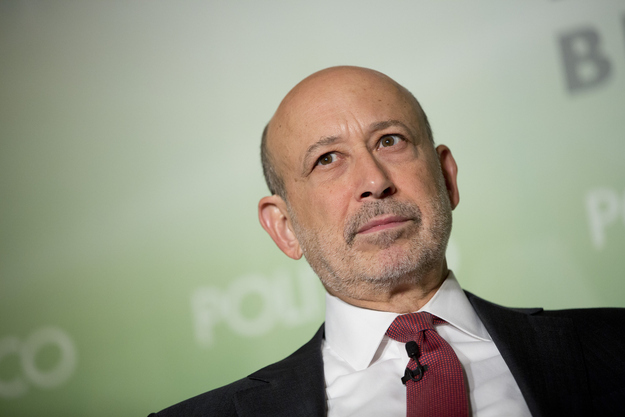

Lloyd Blankfein

Lloyd Blankfein, the CEO of Goldman Sachs, and a group of other bank executives, met with President Obama yesterday to emphasize just how catastrophic a debt ceiling breach would be. Blankfein told Reuters "There is precedent for a government shutdown. There's no precedent for default. We're the most important economy in the world. We're the reserve currency of the world."

He also said in a statement released through the Financial Services Forum, the banking trade group that he chairs: "While the current government shutdown is unfortunate, the impacts of a debt default would be magnitudes worse and should not even be considered a viable option. The economic damage associated with default or near-default would be severe and have serious consequences for the recovery of the U.S. and global economy."

Brian Moynihan

Moynihan joined his fellow big bank CEO Blankfein in making public comments on his White House meeting, telling reporters that, "There's no debate that the seriousness of the U.S. not paying its debts...is the most serious thing we have, and we witnessed that in August '11 and you saw the ramifications: a slowdown in the economy."

Bill Gross

Bill Gross, the "bond king" at PIMCO, told Bloomberg TV on Tuesday that the goverment shutdown could temporarily shave a few tenths off quarterly economic growth but that breaching the debt ceiling and defaulting on some U.S. government debt would be "catastrophic" and would be felt all over the global economy because of "interconnected relationships that depend on the solvency of the Treasury." A default, he said, would be "unimaginable...you don't want to see that happen."

David Cote

The Honeywell CEO said at the end of last month that a prolonged shutdown and debt ceiling breach would be bad and worse. He told Bloomberg that, in the case of a shutdown, "Everyone will get more conservative and pull back on hiring and investing." Cote also said that, "When you hear people starting to think that maybe we should default or not raise the debt ceiling and we will play chicken with it, are you actually serious?"

Dave Barger

The Jet Blue CEO told Bloomberg that a long government shutdown "endangers the economic recovery at best" and that "if this percolates into the psyche of business and everybody starts to back off travel spending and it can trickle down to others. This is really serious."