1. What are these bulls and bears I keep hearing about? Why are animals investing?

According to investment adviser Josh Brown, who also blogs prolifically under the moniker Reformed Broker, the terminology is dates back to 100 years ago.

"The idea is if you're bullish, you expect things to be better, where stock prices and the market to go up," Brown said. "If you're bearish you expect the opposite. It's just a way to describe people's attitudes about the market at a given time."

But why a bull and a bear specifically? That's a question without a clear answer. However, there are two prevailing theories about the specific choice of animals.

The first suggests that the way each animal attacks an opponent generated the tie into the stock market, with a bull's horns going up and a bear swiping down, thus representing market moves.

The other theory holds that the middlemen in the bearskin trade historically sold skins they didn't yet have in an effort to make money on the bet that the price of the skins would drop before they obtained them. These sellers were then known as bears, which represented the hope that the market would drop. And because the sport of bear-and-bull fighting was once a popular occurrence, many thought of bulls as the opposite of bears and the name stuck to describe the market going up over time.

2. How do people decide what a stock is worth...like, what makes a stock go up and down?

Stocks move up and down based on a combination of fundamentals about a company, like earnings, leadership changes, and any news events surrounding the brand. The fluctuation of a stock's price is also dependent on people's expectations of what the forward motion of those fundamentals is going to be.

3. Can a good trader beat the market over the long term or is that impossible?

This is possible, but only for a time. "There's something called mean reversion, so the longer you beat the market, the more likely it is that your performance will revert to the mean," Brown said. "So now there are more skilled people trying to find the same inefficiencies in the market to exploit, so the more skill there is, the harder it is to rise above it and outperform it for any one person."

And even when a good trader is on top, in today's market it's a fleeting occurrence. "Your streaks of outperformance are likely to be of a shorter duration than they would in previous generations — 50 years ago, it wasn't Ph.D.s from Stanford and Harvard building algorithms with geniuses trying to play the same game. Most people are trained at the same 10 or so universities; it's more sophisticated endeavor."

4. Is it OK or advisable to own stock in a single company?

This, according to Brown, can work out really well or really terribly. If you put all of your money into one company and things go poorly, the stock can crash and take your investment down with it. "Since there's no margin of error," he said, "that's a really hard game to play."

That's why most people diversify their stock holdings, in order to hedge against having all of their eggs in one basket, should the basket implode. Most successful investors advise diversifying holdings by sector and allocating different amounts of money to various stocks and bonds.

5. What is the difference between private equity, venture capital, and hedge funds?

A private equity company invests in the stock of a company, often with the intention to later sell or raise the stock price over time as a part of a fund it constructs for its own investors. It also buys public companies and takes them private, and buys private companies and takes them public.

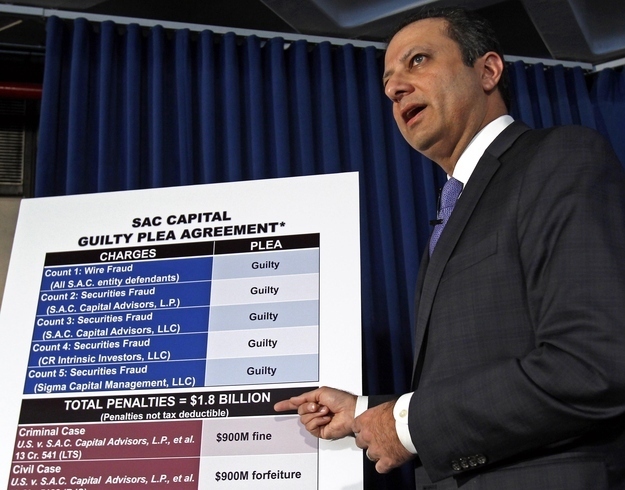

A hedge fund, while similar, requires investors be accredited and has access to what are often even more exclusive investments than any other sector. Because of the nature of hedge funds operating in high level investments with a large amount of money, it is more difficult to get your money out of a hedge fund. They are more illiquid investment vehicles for highly sophisticated investors.

Venture Capital firms focus on startups and provide early investment in what are usually higher risk entities than average stocks and private equity opportunities due to the embryonic nature of the companies they are funding.

6. When do stock tips from your friends cross the line into insider trading?

This, white collar crime attorney Nicholas De Feis said, depends on the source.

"If somebody comes to an individual evaluation of a stock and thinks it may be a good opportunity, obviously they're not passing along insider information," said De Feis, who is a partner at New York-based De Feis, O'Connell & Rose. He adds that a measure of insider trading is: "If the person passing along the information is breaching a fiduciary duty to the company and with the intent to obtain a benefit."

Even so, the intent question is tricky one to answer in this case: "So if somebody is on a board of directors and passes along some information that he heard in a board room innocently without intent to confer benefit at all, that may not be insider trading for a person to act on it," De Feis said. "However, if he passes the information along with the intent to receive a benefit, than that crosses the line into a violation of the law."

7. What are these derivatives and credit default swaps I've been hearing so much about?

"A derivative is anything that is based on something that is less tangible than a stock or a bond, it's basically an artificial financial indicator — a contrived financial instrument," De Feis said. "A credit default swap is a species of derivative itself. It's basically a bet on whether a company or an entity is going to be able to pay its obligations or its bonds. It goes up in value when a company's bonds go down, and was designed by financial engineers to satisfy investors' desire to place bets or have an interest in various financial movements."

8. Are all traders really methed out lunatics from Long Island and North Jersey?

According to Brown, who is a former trader from, you guessed it, Long Island, "Most, but not all."

9. What does the C in CNBC stand for?

Cramer! No, it actually doesn't stand for anything. When the network launched in 1989, it originally meant "consumer news," but that's all.

10. How does the E-Trade baby talk?

This is easily the deepest mystery of finance. And we may never have an answer: The advertising agency responsible for the E-Trade Baby, Grey, resigned the account in June.