Hedge fund activist Bill Ackman's campaign against dietary supplement company Herbalife has taken an unprecedented and intensely personal turn.

The latest move from Ackman's Pershing Square Capital, which has a $1 billion short position against Herbalife, targets former employees personally on a new website called, "Herbalife is a Pyramid."

Experts said that singling out individual former employees as "wrongdoers," is at best unprecedented and at worst legally questionable.

"That's a little unusual to discuss individual employees, but it's an unusual fight," said Charles Elson, professor at the University of Delaware. "People say all kinds of things about candidates and management, but this seems to go to lower levels of employees, which is different. This isn't your average proxy fight; it's fascinating for sure."

According to David Becher, associate professor at Drexel University's LeBow College of Business, while activist investors have been employing increasingly aggressive tactics in their campaigns, Ackman is moving into unchartered territory.

"This is a new extreme. I do not know of a hedge fund that's set up a website like this," Becher said.

Ackman's battle with Herbalife began in summer 2011 when a researcher tipped him off that the stock might be a good potential short play. In the two and a half years since, Ackman has spent $1 billion shorting the stock and compiling a handful of presentations aimed at proving Herbalife is a pyramid scheme. Late last month he won some support when Massachusetts Sen. Ed Markey called for an investigation of Herbalife's business practices, sending the stock down 12% to around $65 per share.

All of Ackman's campaigning against Herbalife seems to have agitated the company in recent months. In December, Herbalife, tired of Pershing Square's crusade to bring down its stock, and turned the tables on Ackman, calling his investors and pleading with them to pull their money out of his hedge fund. Other hedge fund titans such as Carl Icahn, George Soros, and Dan Loeb have taken long positions on the company's stock, going directly against Ackman.

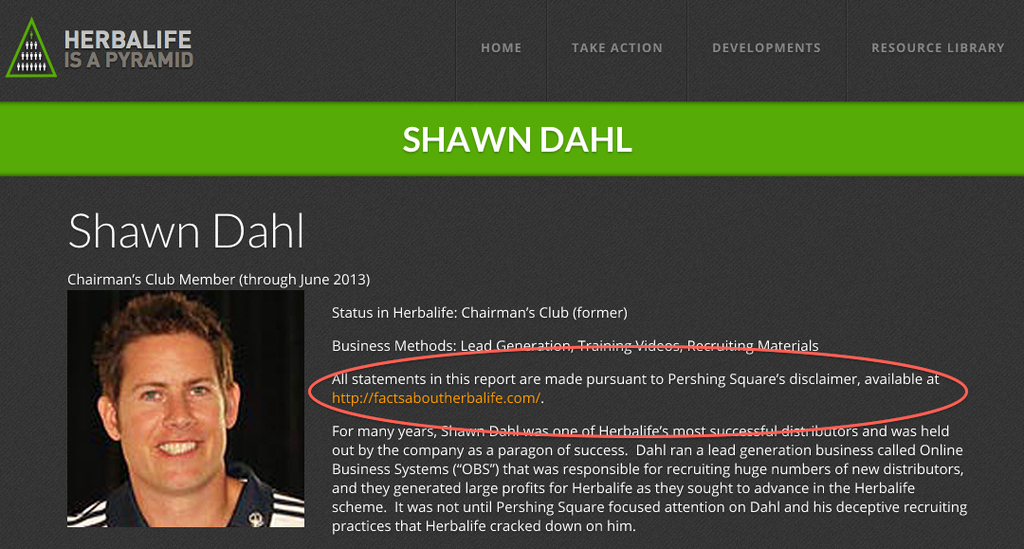

Some think that Pershing Square has put itself in murky legal territory by launching the "Herbalife is a Pyramid" website. The website, according to a Pershing Square press release, intends to profile Herbalife "wrongdoers," the first of which it alleges is Shawn Dahl, a former Herbalife employee at whom Pershing Square lobs a litany of allegations. Most of the facts on the Dahl page are annotated with links to documents, videos, and Powerpoint slides. The page also includes photos of what appear to be Dahl's family members and friends.

In featuring not just current employees, but also former ones, Ackman may be leaving the door open to potential libel charges, said Mark Chen, associate professor of finance at Georgia State University's Robinson School of Business.

"Is this a case of libel? It's hard to say for sure, but there are a lot of facts listed there, so false statement of fact is needed to show libel," Chen said. "For defamation, you have to have false statement of fact and harm to the reputation of the individual. The devil is in the details, so to speak, it depends on which of these facts might be false."

For it's part, Pershing Square said it is using the targeted attacks on the website to assist regulators in bringing Herbalife's corporate malfeasance to light and ultimately holding the company responsible for its alleged years of operating a pyramid scheme.

"The Shawn Dahl case study is the first of a series of exposes we will publish on the wrongdoings of Herbalife's top distributors," Roy Katzovicz, Pershing Square's chief legal officer said in a statement. "Each of these senior distributors have enabled Herbalife to perpetuate an unlawful pyramid scheme that has victimized vulnerable people across the globe. Shining a spotlight on their activities will assist regulators and law enforcement in shutting down this scheme."

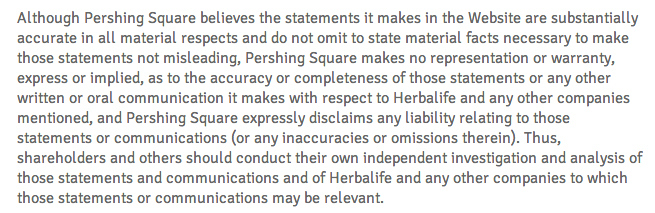

A disclaimer on the Shawn Dahl profile page links to a different Herbalife website run by Pershing Square that states:

Chen also found the website's use of photos featuring private citizens potentially risky, noting that the standard for demonstrating libel and defamation is lower for them than it would be for a public official.

Beyond the potential legal ramifications, the website also may be hurting the hedge fund's financial cause.

"I think the timing of it is pretty interesting given the fact that [Herbalife] just announced good financial results," said Chen, adding that the company's strong earnings could decrease the credibility of Pershing Square's argument.

Disclaimer continued: