Amazon is no longer a website you use to get rid of a few old college textbooks. Many of the mom-and-pop businesses that rely on the retailing behemoth as their main virtual storefront have grown so large that a market has emerged of brokers who buy and sell such companies.

"Almost everything in e-commerce has an Amazon component, if it’s not totally Amazon," Mark Daoust, CEO of Quiet Light Brokerage, which first started brokering online business deals in 2007, told BuzzFeed News. "That is a change from two years ago. Now it’s a rule of thumb: e-commerce businesses have an Amazon store or are completely built on Amazon."

The rise of business brokers who are completely tied to Amazon speaks to the market heft of the e-commerce giant, which is now one of the top five companies by market capitalization — worth around $460 billion. Its revenues have grown by 122% over the last five years, reaching roughly $136 billion in 2017.

Today, 51% of Amazon sales are through third-party sellers — that is, companies that aren't owned by Amazon.

And as Amazon has aggressively expanded its third-party marketplace — where it invites outsiders to do business on its website — so have grown the dollar signs that come from buying and selling those outsiders' businesses. The most valuable businesses that sell their wares on Amazon are anywhere between three and five years old, have established brands on the marketplace, manufacture their own exclusive products, and fulfill shipping and returns through Amazon, according to brokers in the business.

One such middleman, Empire Flippers, told BuzzFeed News it brokered 58 deals last quarter, including the sale of an athletics company in February that went for $1.7 million. Empire said its revenues reached $6.6 million in the second quarter this year.

A large part of this growth comes from a surge in established businesses that fulfill shipping and returns through Amazon. Businesses that participate in the company's Fulfillment by Amazon program (also known as FBA) have a better chance at being the seller in the "add to cart" button, which means more sales. The program grew by 70% in 2016. with more than 2 billion units shipped through the program, Amazon reported in January.

"We are getting a lot more Amazon FBA, because a lot of people who started these businesses are bearing enough fruits to sell," Greg Elfrink, content manager for Empire Flippers, told BuzzFeed News.

But "Amazon FBA businesses are still relatively new, so the market is still gaining faith in them as an investment or business acquisition target," he said.

Elfrink said that in January, Amazon's FBA businesses sold for an average of 20 times their net monthly profit. Since then, they've seen about a 15% rise in their value on average, selling at 23 times their net monthly profit.

Ace Chapman, who bought his first e-commerce business in 1999, told BuzzFeed News that he and several business partners went in on the $1.7 million athletics company deal because it had strong profit margins and sales traffic from both Amazon and its own website. He declined to name the company.

Customer feedback and reviews were also crucial in evaluating whether or not to buy the business because shoppers can easily buy from a competitor with just one click.

"We want something that has four stars and above, on average," said Chapman, who has made a cottage industry of giving advice about buying and selling small businesses. "You're dealing with a really competitive space. Everyone is going to look at the ratings and decide if they want to buy the product or not."

One wrinkle is Amazon's vague approach to sales of the businesses that sell on its site. Transferring Amazon seller accounts is prohibited, according to the company's website, which explains, "If the ownership of a business changes for any reason, the new owner should establish a new seller account."

But as Amazon fulfillment becomes a more integral part of retail companies, it is more common that business owners notify the company about new ownership after a deal goes through. "Amazon will review legitimate transfer requests, such as the sale of a legitimate business, on a case-by-case basis," the company told BuzzFeed News.

And the brokers themselves have words of caution. Daoust, of Quiet Light Brokerage, warned of a "gold rush" atmosphere surrounding the buying and selling of small businesses on Amazon, and added that the market's reliance on Amazon can leave businesses vulnerable to the whims of the company and its policies.

"There is a lot of money to be made, but I think people should be cautious to some extent," he said. "Amazon can change the rules, and when they do, you have no idea how that’s going to affect your business. Like any gold rush, feel free to go for it, but understand the nature of the gold rush — eventually the gold dries up."

Brokers told BuzzFeed News that people come to them with businesses to sell for a number of reasons. Some people have been running their Amazon shops as a husband-wife team and are looking to offload the work it takes to keep the business running. Some owners sell in order to diversify their income streams, and others may have a life change — a new baby, an upcoming retirement — that prompts them to want to cash out.

When working with potential sellers, brokers will evaluate the business — its sales figures, ranking, products, customer feedback — and determine whether or not it can be sold. Some brokers will send out a notice about the business to buyers they work with regularly who then start to make offers.

Similar to real estate brokers, brokers who buy and sell companies that do business on Amazon collect a number of offers and present them to the owner to review. Buyers usually have an opportunity to ask sellers hard questions about, say, sales dips or low rankings during a certain time of the year.

Brokers told BuzzFeed News they earn anywhere between 8% and 15% of the transaction price. Some brokerages, like Empire Flippers, charge sellers a a fee and take a 15% on the sale of the business.

Most brokers only work with sellers who have built legitimate businesses on Amazon, a process that can take years. Because of the personal and complex nature of these deals, brokers step in to make sure that whoever ends up buying the business will take proper care of it.

"It’s not like selling a house, where you don't really care who you sell it to," Thomas Smale, the founder of FE International, which brokers deals anywhere between $250,000 and $20 million, told BuzzFeed News. "Most people who sell a business want to make sure they’re selling to someone who isn’t going to run it into the ground."

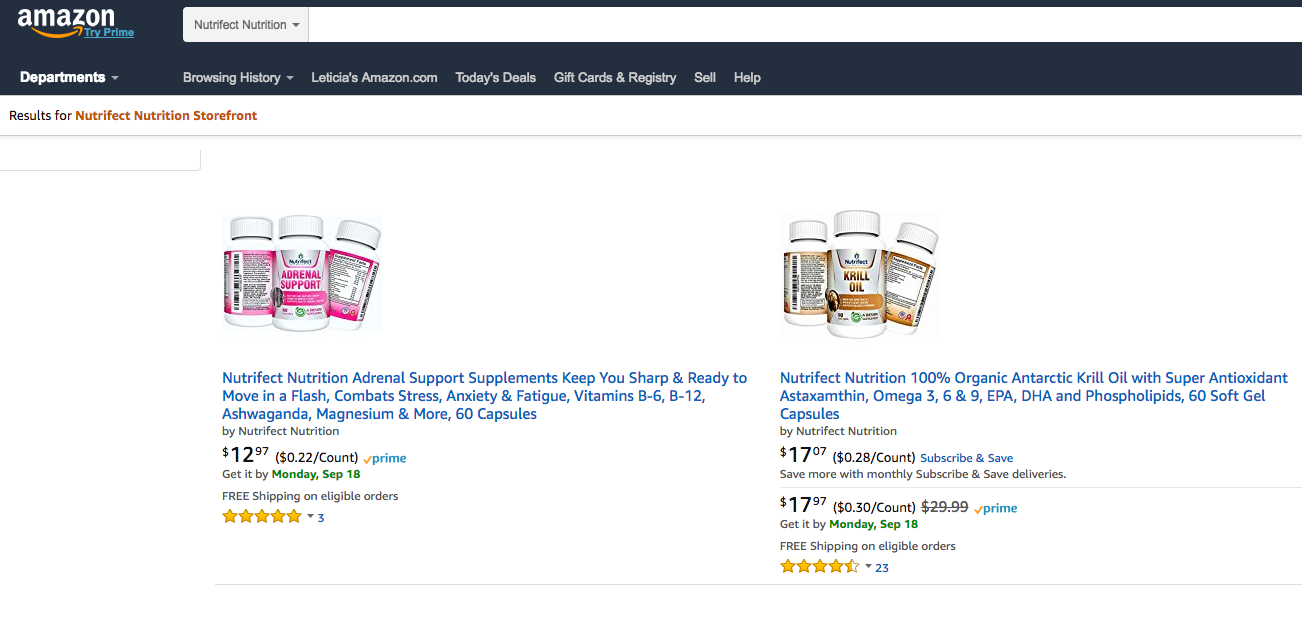

Ken Courtright, an e-commerce entrepreneur, recently bought two nutritional supplement brands — Nutrifect and Naturelle — through FE International. Courtright told BuzzFeed News that he looks for several factors in a potential Amazon acquisition: stable monthly revenues, evergreen products, and minimal competition. Another requirement is that it's fulfilled by Amazon.

"I would not buy any type of business where another seller had inventory out of a home or garage," he said. "If you buy a business FBA, it’s a great safety net and security platform. You can fact-check everything about that product. There is nothing the seller can hide or manipulate or fake."

Not all companies that buy and sell these businesses operate as brokers. Some websites like Flippa.com work like eBay, with the marketplace determining the ultimate price of the Amazon storefront, Sid Galada, Flippa's head of growth and product marketing, told BuzzFeed News.

"Generally speaking, our big vision statement is to have every business up for sale to be facilitated through Flippa," Galada said.

The marketplace sees between 100 to 150 business sales a day, he said. Flippa then takes 8% to 15% of each sale, which can range from $20 to $2 million, he said.

For instance, a spot check of Flippa on Tuesday found that it was taking bids for the domain name ToniaGara.com, an Ontario Canada-based travel website which began bidding at $400,000, and a site called CarInsight.com, a UAE-based company that provides information to new car buyers and had a starting bid price of $3 million.

One Flippa buyer is Dana Rakvica, who paid $20,000 in May for an Amazon FBA business called Opus Health and Beauty, which sells five types of health supplements. The company did $240,000 in sales in 2016, he said, but is now on track to do $700,000 in sales this year after he used marketing techniques to get the storefront back on the first page of search results.

"What’s nice about it is it’s set up for you," Rakvica said. "I have other businesses, and I’m fairly busy. I wanted something I could set up and just grow. It had revenue history, so there was proof it could be done. It just needed some attention and TLC."

While businesses that sell on Amazon may be low maintenance for entrepreneurs like Rakvica, who has sold about 100 apps on Flippa and bought 20 to 30 websites, they aren't without risk.

"You have to play by the rules, and the rules change," he said. "Frankly, in any business, even brick-and-mortar businesses, you have to pivot when the market changes. When the rules change, you need to pivot and change."