Last week, a single trading company you've never heard of, Knight Capital, managed to lose more than $10 million per minute trading stocks -- $440 million in all, in the course of just one morning. That was the result of a trading algorithm gone horribly wrong. And data company Nanex has put together an amazing GIF showing just how out-of-control algorithmic trading has become.

We don't normally think that the stock market has changed in just the past five years, but it has. In 2007, people would issue buy and sell orders only if they genuinely wanted to buy or sell stocks.

1. Back then, the "noise" in the market introduced by high-frequency traders, putting in and taking out orders thousands of times per second, was no big deal. This GIF shows the amount of high-frequency trading in January 2007.

2. By mid-2007, the algorithms started making themselves visible: the machines were beginning to take over.

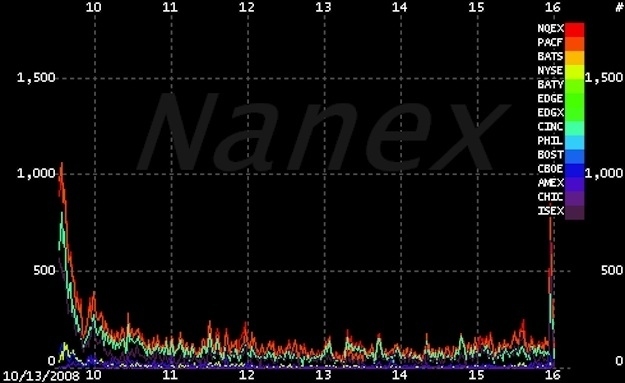

3. And by October 2008, they were dominating activity, especially at the very beginning and very end of the trading session. Check out that spike on the left: it shows that in the morning, there were more than 1,000 quotes for every actual trade.

4. The one thing that algorithms can't be is predictable: if they're predictable, other algorithms will trade against them and make money. So by the end of 2008, the algorithmic spikes were taking place pretty much randomly.

5. In fact, the algorithms were SO unpredictable that sometimes, like at the end of 2010, they would just go away for a few days.

6. But that just meant they would come back more crazily and more aggressively than ever. Here's one day's activity from March 2011.

7. And here's January 2012. This is a market out of control, a complex system which can fail in any number of unpredictable ways.

8. On Wednesday, a single stock — CTC — had 1.1 million quotes across the various exchanges, but it traded only 27 times in total. It's time to crack down on the algobots, before they blow us all up.

With Rebecca Elliott