This story is intended to provide helpful and informative material. But every situation is different and you should consult with a financial, investment, accounting, tax, or other professional adviser regarding your own situation. The advice and strategies described may not be suitable for every individual and are not guaranteed or warranted to produce any particular results. Also, relevant laws vary from state to state.

If talking about money can make people uncomfortable, talking about how to get more of it can sometimes feel downright daunting.

What’s the best way to think about money? What are some of the things I need to know to start saving or investing? When and how should I start planning for retirement? And what secrets do rich people know that I don’t?

Sometimes these questions can feel overwhelming, especially if you’re someone who is just starting to make your way as an adult.

In a bid to demystify financial strategy or planning, BuzzFeed News asked readers to share what financial advice they would relay to those 10 years younger than them to give them a head start.

We received a range of responses from people who shared their biggest money lessons — and regrets — as well as how their thinking about their finances has changed over time and how they feel about their standing now.

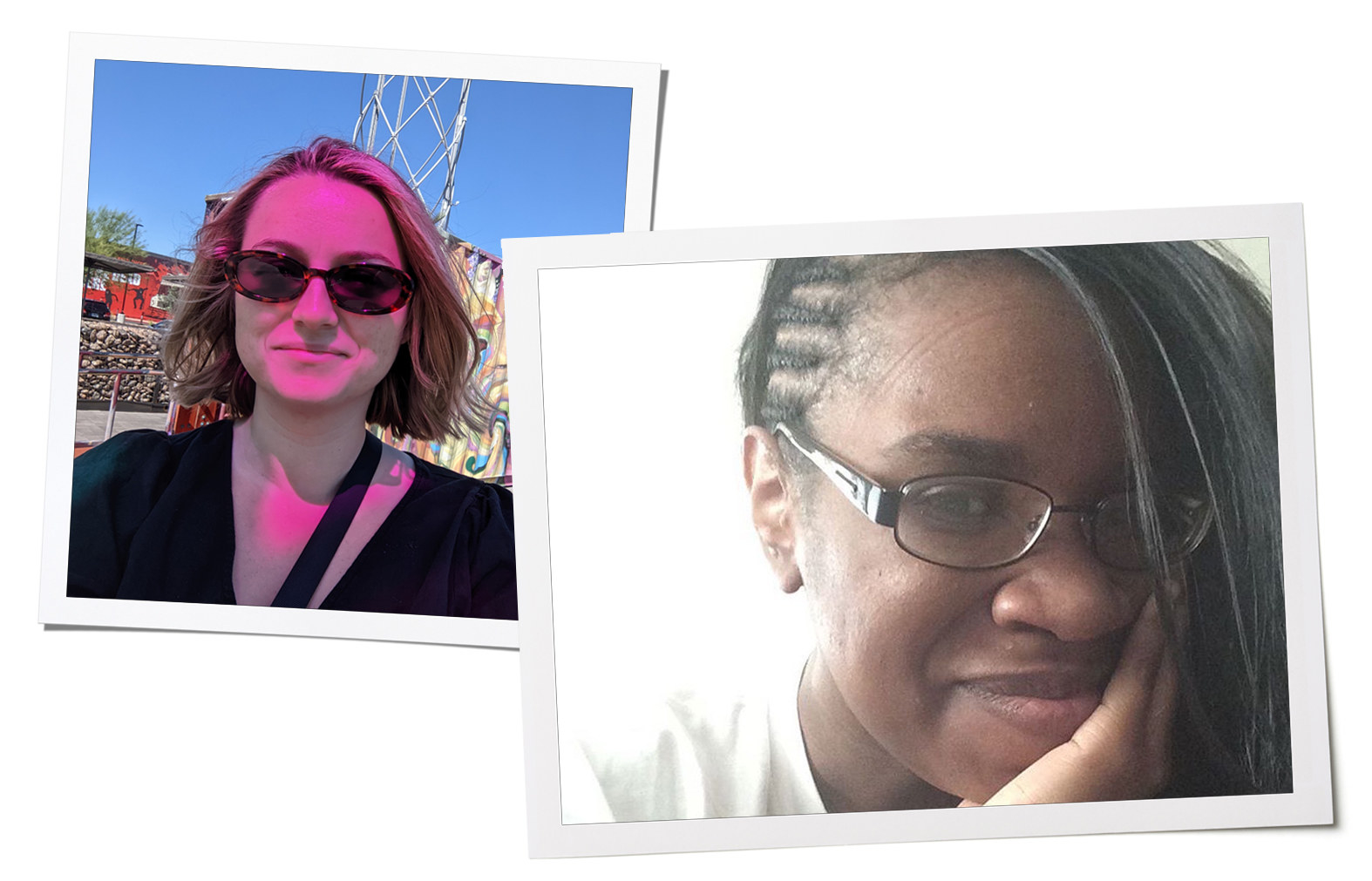

Some like Kirsten Short, 30, from Gilbert, Arizona, told us how they feel like they’ve finally found their feet after years of living paycheck to paycheck.

“I am pretty damn happy,” Short said. “It took a while, but now I’m finally in a position where my savings are accumulating at a comfortable rate.”

Others like Kimberley Hill, 30, in the Bronx, shared how they had to recover from financial trauma they experienced growing up.

“I am in the best financial shape that I have ever been in,” Hill said. “With a little bit of patience, equal parts hard and smart work, I hope to be able to help heal at least a tiny portion of the generational financial wounds that have been suffered by my family. I do believe that this is possible.”

To try to get some big-picture expert advice that could serve as a guide, we also spoke with Berna Anat, a self-described “financial hype woman” and author of Money Out Loud: All the Financial Stuff No One Taught Us, and with Catie Hogan, head of curriculum and founding coach at the financial education app Parthean.

Of course, different things may (or may not) work for different people, and there’s no guarantee of success when it comes to investing.

But, as Hogan told us, assuming that this world isn’t open to you because you’re not an old, rich white guy is defeatist — and exactly what those with lots of money and power probably want you to think.

“I think there’s real rebellion in learning how to invest in learning how to be great with money,” Hogan said. “Whether you have $1 or a million dollars, I think it’s a rebellious act to say, ‘No, screw you. I’m going to learn how to do this and you can’t stop me.’”

After all, as Kayleigh Miles, a 31-year-old in Chino Hills, California, told us, everyone is already on a different financial journey, so we may as well try to study the road map and choose our route.

“I am optimistic about my future because I am finally taking it seriously,” Miles said. “Your money journey is one you’re already on, so you may as well make the best of it if you can.”

Young People Should Start Thinking About Money As A Tool

No one is born or raised in a vacuum, so it would be silly to think that young people haven’t already started developing a preconceived understanding of money that is tailored to their circumstances.

According to Anat, we first begin forming financial habits and perceptions in our preteen years. Our social and cultural experiences, as well as things like social media, also then shape what she calls our “financial baggage” and money habits.

Anat’s first piece of advice, then, is to try to step back and get some perspective on how you feel about money given your experiences.

“Think about what you’ve learned about money so far, and from where. Has it been fair? Has it been equitable?” Anat said. “And think about how you want money to feel in your life, what you want money to help you accomplish or access.”

Hogan, too, recommends we try to strip away the emotion from money and view it as a tool that we can use to unlock new opportunities or experiences for ourselves. It’s not easy, but you should try to be as objective as possible.

“Money is not inherently good. It’s not inherently bad. It has no emotion to it. … It’s a tool,” Hogan said. “The earlier you can recognize that money is a tool to help you achieve whatever it is you want to achieve and to see it very objectively and remove that emotion from it and really examine the things that have happened in your life that have created this emotion around money, the better off you’re going to be.”

Not everyone comes around to this way of thinking so quickly. One 44-year-old man in Los Angeles, who asked, like some in this story, not to be named, told us he didn’t appreciate this until he was well into adulthood, but once he did it changed everything.

“I find it vastly more interesting than I did when I was in my teens or 20s,” he said. “It took until my mid-30s to really learn to use it as a tool.”

Teens Can Set Short-Term Goals And Start Budgeting

Hogan believes human beings aren’t programmed to think long-term, so there’s not much point in telling an 18-year-old they should have clear career goals or start saving for a home or — even worse — be planning for retirement. Those are things they should eventually be considering, she said, but it’s OK to start small.

“Focus on things that are going to impact you now. Learn those first and then start to branch out because it can be really overwhelming,” Hogan said.

This could be as simple as setting up an emergency or rainy day fund in order to have some money on hand should it be needed. In addition to learning about the process of saving, you’ll also avoid getting into credit card debt should something bad happen.

But it doesn’t have to all be about preparing for the worst. Maybe you want to save for a vacation or a new outfit. The mere act of saving — and budgeting — is an important skill to learn.

Anat said that when she was young, she started treating budgeting like it’s a game: Open three bank accounts for your bills, your fun, and your savings, and then practice dividing your income. For young people who are still at home or not yet swamped by the significant bills or expenses that come with adulthood, it’s a little easier to practice and experiment with less risk, but you’re still developing what Anat called “the knee-jerk habit of budgeting.”

“You’re the CEO of your life, and every dollar should have a job,” Anat said. “That’s the muscle I’d want them to develop.”

This budgeting skill is a critical one, a 55-year-old reader in Portland, Maine, told us. As you get older, she believes it’s important to keep a running list of monthly expenses so you’re not surprised at the end of each month.

“Budget, budget, budget,” she said. “Even if you aren’t able to stick to it every week, it is a great starting place for taking control of your finances.”

It’s OK To Be Scared In Your 20s, So Start With The Basics

As you leave school and enter the workforce, it can be easy to feel like an imposter. Sometimes it might seem like everyone has their shit together but you.

Don’t fear, though. Everyone entering “adulthood” is just as scared as you are — especially when it comes to money.

“Everyone around you is financially terrified, too. They’re just not talking about it,” Anat said. “No one has their money life together. No one at any age ever has it 100% together. Whoever is trying to convince you they do is either extremely privileged, lying, or trying to sell you something.”

For that reason, start with the basics — and we mean the basics.

Hogan says the first thing she teaches people to do is how to study their paycheck so you can fully understand the deductions coming out for taxes, health insurance, or retirement contributions, and then build a budget around what’s actually hitting your bank account and not the gross overall number.

Miles, the Chino Hills resident, has applied this meticulous study to her paychecks, but also to her bank statements and expenses — including her credit card bills.

“Get familiar with how much money you make and how much you spend each month,” she advised. “If you’re using a credit card for most of your purchases, review your bank statement. It is so easy to swipe your card and to put off thinking of that cost until a later date.”

Miles said she used to be surprised by credit card debt that she couldn’t account for, but by reviewing her statements and tracking her spending she was able to rein in her impulse purchases and the ensuing interest she was paying.

Jennifer Graham, a 34-year-old in Cincinnati, also warned against the dangers of credit cards that may at first seem enticing as you enter adulthood. Having such easy access to credit will give you a false impression of your finances that will eventually be met with cold, hard reality.

“Just because you can get a credit card with some introductory ‘deal’ doesn’t mean you should. Avoid the temptation and stick to one credit card maximum — or none,” Graham said. “It is so easy to rack up credit card debt, and that is a difficult hole to dig out of even once you start making more money.”

How To Think About Student Loans (And Paying Them Off)

Taking out a student loan will likely be the biggest financial decision you make in your youth, so it’s an important one to get right. While college definitely isn’t for everyone, many people see it as an investment in their future — so treat it with the same level of financial scrutiny you would for any other investment.

One 29-year-old reader in Burlington, Vermont, shared her regret at not better studying her options prior to taking out $90,000 in private loans. She’s now $155,000 in debt.

“Learn how student loans work: I didn’t know anything about interest rates and signed up blindly with private companies,” she advised. “I wish I would have taken the time to look into it more.”

Hogan, too, said she spent much of her 20s drowning in student debt after graduating college in 2009 during the recession. But she believes that while it’s important to settle on a consistent repayment strategy, you shouldn’t beat yourself up for enjoying your 20s.

“I really let my student loan debt consume my every waking thought,” Hogan said. “I did a good job at paying it off. But at the same time, I really deprived myself of a lot of living, and I think I could have done a better job at balancing paying them off, but also not being all consumed by it.”

As You Get Older And Wiser, Set Life Goals (Then Work Out What They’ll Cost)

As you start to get more settled with age, try to envisage what you want your life to look like in the years ahead, Hogan advised. It’s totally OK if this vision looks different as the years change. What’s important is having a sense of clarity and purpose.

For some people, it might be starting a family or purchasing a home. But for others, it could be as simple as taking a yearly vacation or being able to support an aging parent.

Whatever it is, think about money as the tool you’ll need to help you live the life you want. That will then help you to develop a financial strategy, Hogan said.

“I used to talk a lot about how I was an aimless wanderer with money, like I don’t know, throw some in the bank, throw some at loans, throw some in the market when you can. That’s just generally not a great way to go about it,” she said.

“What would make your life really exciting and worth living and would increase the quality of your life, increase your life satisfaction? Let’s get clear on those and work towards those and then quantify them,” she said. “How much is it going to cost to go on a family vacation every year? How much is it going to cost to eventually buy a home or to go work part time or start a business? Once you can kind of figure that out, it’s a lot easier.”

For Short, the Arizona resident, a trip to Germany was what was going to bring her joy. To help her save, she turned to technology.

“There are now plenty of great apps that will pull money from your checking account after it analyzes your spending and allocates that money to savings accounts when it thinks you won’t spend it,” Short said. “I was able to save $1,500 for an Oktoberfest trip without missing any of the money an app took from my checking account.”

Graduating From Saving To Investing

Inherent in the idea of thinking about money as a tool to build your future is the notion of no longer living simply in the present. Part of that shift in thought has to do with aging — nothing makes you start thinking about getting older like back or knee pain! — but part of it is also financial.

At some point, you want to start thinking beyond money simply coming in and going out, and start thinking strategically about different ways to grow it. If money is a tool, it’s got more uses than a Swiss Army knife, and it’s up to you how you wield it.

“I put off any thought of investing until I was ‘older,’” said Miles in Chino Hills. “Did I have a number for when I would feel older? No, of course not, although I knew for certain it wasn’t when I was a fresh college graduate. But investing doesn’t have to mean a starchy suit and millions of dollars, it can also mean setting aside $10 each month and placing it into a retirement account. Do some research and start small.”

For those starting out as investors, Anat said you shouldn’t feel pressure to gravitate toward whatever new thing is currently getting a lot of attention. Instead, keep it simple.

“Put down the crypto; I’m talking about boring-level, baby-bite investing,” Anat said. “I don’t care that much about how you do it, whether it’s through your employer with a 401(k) or a self-funded Roth situation. Start small and start now.”

Soon, you can start shifting some of your income to these investments, just as you did with your savings. You can study the market yourself, pay someone to help you, or use an investing app that will redirect money from your bank into the market.

For the 44-year-old man in Los Angeles, what has mattered most is giving his investments time to grow in the market and being consistent in his contributions to savings across different types of investments. “Doesn’t matter how much, doesn't matter how much time you want to spend on it,” he said. “This is the easiest it’s been to spend very little time and get a diversified stock portfolio that will match the average market returns with very little to no cost. Just start and automate.”

It can feel overwhelming to begin to contemplate an investing strategy, especially if you’re someone who isn’t financially minded or if you don’t come from that world.

But Hogan believes that those in finance try to make it seem more complicated than it actually is in order to keep others out. “The traditional gatekeeping is to make it seem complex and to make it seem really like, ‘Oh no, this is not for you. This is for us, not for you.’ You know, the old white guys of the world, like, telling everyone else that they can’t play ball,” Hogan said. “That’s simply not true. Investing can be very simple.”

Hogan advised that new investors take the time to learn the basics, like how an index fund operates or what the S&P 500 is. And most importantly, there’s no shame in asking for help.

“There’s plenty of sources out there and the financial industry itself is incentivized to keep you in the dark and if you know that, then you can kind of find the right resources for you,” she said.

Learning how to invest in the market can feel empowering, especially as a woman, one 37-year-old reader in Chicago told us. “It can be done passively, like getting an ETF or an Acorns account or just contributing to a 401(k). But that’s the best way to make your money actually grow,” she said. “Men take advantage of the stock market more frequently than women do, which is a big contributor to the wealth inequality between the genders. Same with white people versus many people of color.

“The stock market and investments are available to everyone, don’t let old white male assholes intimidate you from making use of it,” she said.

Automate, Automate, Automate (Especially As You Plan For Retirement)

It might not always seem like it, but we are very lucky to be alive right now. That’s because it’s never been easier to make use of technology both to save and to make your money grow.

Whether you’re investing or saving for retirement, experts and readers stressed to us how essential it is to start automating your finances. This might involve having your company automatically set aside a part of your paycheck to go into a 401(k) or IRA, or it might involve you using an app to analyze and edit your finances.

The key, for those who can afford it, is to get things going so you don’t have to think about it.

“We’re so lucky to live in a day and age where we can automate things,” Hogan said. “What I tell people is: ‘Yeah, I don’t know what my life is gonna look like in my 60s or when I want to retire, but I can kind of automate my investing and saving so I’m doing the right thing without having to think about it, without sabotaging my future self.’”

Short in Arizona works as a general manager; when she meets new hires, she is an evangelist for convincing those who can to set up automatic pay deductions into a 401(k) account and watch the compounding interest accrue.

“It’s silly how much of an impact setting this up early will have on your ability to retire in the future,” she said. “You may notice that small chunk of your paycheck missing the first few paychecks, but after a while you will forget about it, and the money saved will start accumulating without it being a burden.”

Everyone Is Different

Both experts we spoke to for this story said that some of the worst financial advice they hear is that what worked for one person will work for another. Everyone comes with a unique set of baggage and everyone wants different things, so always take financial advice with a grain of salt before applying it to your life.

This is particularly true for people of color, according to Anat. “Get your advice from people who look, live, and think like you,” she said. “I like to say that the money world is hella male, hella pale, and hella stale. This system was created specifically for white, cis, hetero men to succeed, so trying to get our money right by taking their advice is gonna get us — has gotten us — nowhere.”

In this spirit, Anat believes we should also be skeptical of people who try to convince us that money is a “mindset,” because this belies deep, structural inequalities that are rooted in our financial system, like the racial wage gap or rising costs of living. “There are things we can control to fix that, and things we need to put pressure on those in power to make right for us,” she said.

For some, that means acknowledging that the best financial opportunity in their life is the privilege they were born with. Indeed, the 37-year-old reader in Chicago told us how fortunate she feels to have been born into an upper-middle-class white family whom she could turn to occasionally when she needed financial assistance. “Honestly nothing I could do is going to erase or beat the natural advantage I was given by the circumstances of my birth,” she said. “But having that safety net has made my life much easier. It sucks that it's not the same for everyone.”

Hill in the Bronx has lived the other experience. Coming from a family with a low income, she said she’s had to escape past financial trauma that colored her perception of credit and banking as an adult.

She feels cheated, for example, that she listened to advice from a family member against opening a savings account in her 20s because of her low income. “I was in fact poor, but there were a handful of occasions over the years in which I did receive funds that I easily could have saved for an eventual rainy day if I had a fee-free checking account to place said funds,” Hill said.

But little by little, Hill is now saving and building credit. In doing so, she’s also building the financial future she wants for herself.

“Money, debt, and credit does not have to hang such a dark shadow over my family anymore,” she said. “The light finally has room to come in, and it’s going to start with the match that I am holding.” ●