The liberal-leaning Economic Policy Institute (EPI) has released new research suggesting that raising the federal minimum wage to $12 is economically feasible, sustainable, and has a historical precedent.

Essentially, it's been done before — back in 1968.

The proposed increase would roughly return the purchasing power of the minimum wage, and its value relative to average wages, to levels reached at its peak that year.

The report from the EPI was released to coincide with the introduction of a new bill to raise the minimum wage, and says the increase would likely cause little to no job loss, as opponents of wage hikes have claimed. Instead, it says there's likely even more "room to maneuver" than in the 1960s, thanks to converging median wages across states, as well as increased worker productivity and education.

The Raise the Wage Act, set to be introduced Thursday by Sen. Patty Murray (D-Washington) and Rep. Robert Scott (D-Va.), would raise the federal minimum wage for nearly 38 million workers. It would also eliminate an exemption for restaurants and other businesses that are currently permitted to pay tipped workers less than the federal minimum.

The act would affect 32% of wage-earning women (21.1 million women), 37% of African-American workers, and 40% of Hispanic workers, according to a fact sheet released by the EPI and National Employment Law Project.

The bill has no realistic chance of becoming law in a Republican-controlled Congress. In 2014, Democrats often used Republican opposition to minimum wage hikes as a line of attack during congressional election campaigning, a tactic that may have appealed to many in the Democratic base but was less effective in winning races.

But the introduction of the bill comes as presidential candidates, in the early stages of their campaigns, are staking out their positions on income inequality. A Pew Research Center poll from January 2014 put support for raising the minimum wage to $10.10 at 73%, including 53% of Republicans.

We have to take on broader inequities in society—you can’t separate unrest in the streets from cycles of poverty & despair in communities.

After raising the minimum wage regularly throughout the 1960s and '70s, the government then "essentially stopped," said David Cooper, an analyst with EPI and one of the study's authors. And the modest increases of the '90s and 2000s did not keep pace with inflation.

"We went through too many periods where we either weren't raising it frequently enough or we weren't raising it adequately enough," said Cooper. "The bill they're introducing would fix this problem by indexing growth to growth in median wages."

The Economic Policy Institute, founded in 1986, receives the majority of its funding from foundations and about a quarter from unions. It bills itself as a nonpartisan think tank created "to include the needs of low- and middle-income workers in economic policy discussions."

A Gallup poll released Wednesday reveals the number of Americans describing themselves as lower class has risen to 15%, from 3% in 2000. Americans are also less likely now to describe themselves as middle class or upper-middle class than in 2008 and previous years.

One possible explanation for the shift focuses on the job market, according to Gallup. "A big downshift in middle-class identification is found among those with less than a college education, suggesting that increasingly fewer 'middle-class' jobs may be available for those without college educations," the study states.

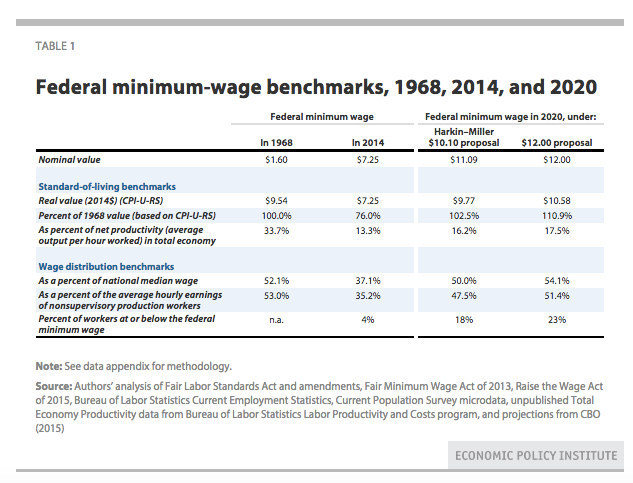

By each benchmark used in the EPI study, the standard of living for minimum wage workers today is worse than it has been historically.

The current federal minimum wage of $7.25 is well below the historical peak reached in 1968. If the minimum wage had kept pace with price increases since then, by 2014 it would have reached $9.54 — more than 30% higher than its actual level.

In inflation-adjusted terms, the federal minimum wage in 2014 had only 76% of its 1968 purchasing power.

Since the start of the year, companies including Wal-Mart, T.J. Maxx, Target, and McDonald's have increased their internal minimum wage to near or above $10 per hour — though McDonald's raise only applies to company-owned locations. Last year Seattle passed a law that would eventually bring minimum wages in the city to $15 an hour, although the rise will happen gradually and won't apply to all businesses until 2021.

But this isn't only about the buying power of the minimum wage over time.

Despite the fact that overall economic productivity has doubled over the last half century, this proposed increase would only return minimum wage workers to a standard of living comparable to that of workers 50 years ago — with a wage bump of approximately 10%.

According to the report, the economy is better able to support the raise than it was in 1968, thanks to increases in worker productivity and education levels.

In the period between World War II through the late 1970s, the wages of most U.S. workers tracked average productivity growth. Since then, however, the gap between productivity and compensation has increased.

Furthermore, low-wage workers of today are better educated, older, and more likely to have work experience than their 1968 equivalents. In 2012, 46% of workers in the bottom fifth of wage distribution have at least some college education, compared to 17% in 1968.

To the extent that more productive, better educated, and more experienced workers typically earn more than the less productive, educated, and experienced, "we would expect that low-wage workers would earn more, not less, than what they earned in 1968," the report states.

"Wages should rise with growth of average productivity if it's a well-functioning, equitable system," said Cooper.